Optimal fast charging strategy for series-parallel configured lithium

Jan 1, 2025 · The limited charging performance of lithium-ion battery (LIB) packs has hindered the widespread adoption of electric vehicles (EVs), due to the complex arrangement of numerous

New EU Rules Revamp Battery Safety, Recycling,

Jul 8, 2024 · These regulations, effective on January 1, 2025, limit the state of charge for all lithium-ion batteries transported by air, land, or sea to 30%. It

Lithium Battery Regulations and Standards in the EU: An

May 27, 2024 · For LMT batteries, batteries and individual cells within the battery pack must be readily removable and replaceable by a professional at any time

Powering the Future Smart Mobility: A European

May 7, 2025 · Unlike lithium-ion batteries, which primarily rely on the intercalation of lithium ions into electrode materials, zinc-based batteries often operate

Technical specifications and test protocols for the battery

Mar 29, 2021 · 1. Introduction The objective of this deliverable is to document the system specifications, based on the requirements gathered and documented D1.1 Consolidated

Commission Notice Commission guidelines to facilitate

Jan 10, 2025 · Commission guidelines to facilitate the harmonised application of provisions on the removability and replaceability of portable batteries and LMT batteries in Regulation (EU)

Capacity estimation of retired lithium-ion

Feb 19, 2025 · Capacity estimation for lithium-ion batteries is a key aspect for potentially repurposing retired electric vehicle batteries. Here, Zhou et al. use

Regulation (EU) 2023/ of the European Parliament and of

Jul 28, 2023 · (20) For the safety of electric vehicle batteries and starting, lighting and ignition batteries (SLI batteries), the continued validity of the EU type-approval for vehicles of

Capacity estimation of retired lithium-ion batteries using

Feb 11, 2025 · In brief Capacity estimation for lithium-ion batteries is a key aspect for potentially repurposing retired electric vehicle batteries. Here, Zhou et al. use real-world data from retired

An Overview of EU Bat ery Regulation

Oct 30, 2024 · 01 Opportunities and risks drive the evolution of quality and challenges The European Union Batery Regulation (EU) 2023/1542 has entered into force as of August 17,

A novel active lithium-ion cell balancing method based on charging

May 6, 2025 · In series and parallel strings connected Lithium-ion (Li-ion) battery modules or packs, it is essential to equalise each Li-ion cell to enhance the power delivery performance

New EU regulatory framework for batteries

Sep 19, 2024 · OVERVIEW Batteries are a crucial element in the EU''s transition to a climate-neutral economy. On 10 December 2020, the European Commission presented a proposal

6 FAQs about [European Union lithium battery pack series charging]

What is EU Battery regulation 2023/1542?

Key Provisions and Impact of the New EU Battery Regulatory Explained In July 2023, a new EU battery regulation (Regulation 2023/1542) was approved by the EU. The aim of the regulation is to create a harmonized legislation for the sustainability and safety of batteries.

What is the new EU Battery regulation?

The new EU Battery Regulation entered into force on 17 August 2023 and brings with it increasingly strict targets on recycling.

What is the largest rechargeable battery in the EU?

This includes Excell Batteries as their largest rechargeable battery in 540Wh, and the largest primary stick packs are approximately 2kWh. As part of the Regulation, the EU will require all portable devices sold within the bloc to have replaceable batteries by 2027.

Are lithium batteries covered by the general product safety regulation?

The General Product Safety Regulation covers safety aspects of a product, including lithium batteries, which are not covered by other regulations. Although there are harmonised standards under the regulation, we could not find any that specifically relate to batteries.

What is the EU batery regulation?

torage systemsAs previous contents mentioned, the EU Batery Regulation has oficially entered into force from A gust 17, 2023. The purpose of this Regulation is to prevent and reduce the adverse efects of bateries on the environment, and to ensure sustainability and safety o all bateries.Safety forms the basis for the existen

Who is covered by the EU batery regulation?

the EU market.Refers to any natural or legal person in the supply chain other than the manufacturer or importer, who places bateries nomic operatorEU Batery Regulation covers electric vehicle bateries, LMT bateries, SLI bateries, industrial bateries, portable bateries, and stationary batery energy s tric vehicles L category (Regulation (EU)

Learn More

- Lithium battery pack series discharge

- Lithium battery pack 1000V high voltage charging and discharging

- Charging management of lithium battery pack

- Lithium battery pack charging times

- Lithium battery pack fast charging voltage

- Lithium battery pack split charging

- Lithium battery pack charging and discharging balancing machine

- 60v lithium iron phosphate battery pack charging current

- Maximum charging power of lithium battery pack

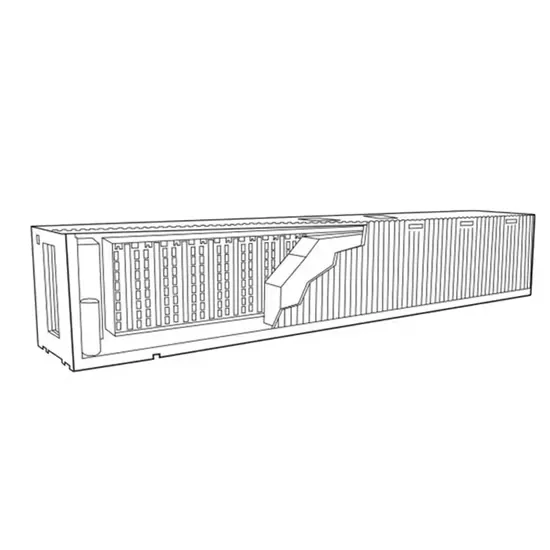

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.