China''s solar PV module exports hit 236 GW in 2024, with

Feb 4, 2025 · China''s solar PV module exports hit 236 GW in 2024, with growth in all regions except Europe China exported 16.63 GW of modules in December 2024, up 9% MoM from

How do local policies and trade barriers reshape the export

Jan 1, 2021 · Policy incentives are essential in stimulating PV exports by compensating for the shortage of industrial bases in the central and western regions. Trade protectionism has

How Does Photovoltaic Export Agency Operate? These 10

Jul 4, 2025 · This article provides a detailed analysis of the core processes involved in the export agency of photovoltaic products, covering key aspects such as qualification requirements,

Five Points of Impact! China''s PV cuts 4% export tax rebate

Nov 18, 2024 · This represents a 4% decrease in the rebate rate for photovoltaic exports, significantly impacting China''s PV market, which heavily relies on exports. Export tax rebates

Research on the policy route of China''s distributed photovoltaic

Nov 1, 2020 · The distributed photovoltaic power generation is an important way to make use of solar energy in cities. China issues a series of policies to support

China adjusts its export policies with a 9% tax discount for

Jun 14, 2025 · China has announced significant changes to its export tax rebate policies, effective from December 1, impacting various industries, including photovoltaic (PV) products. In a joint

Introduction to Photovoltaic Solar Energy

Jan 1, 2025 · Photovoltaic (PV) solar cells transform solar irradiance into electricity. Solar cells, primarily made of crystalline silicon, are assembled in arrays to produce PV modules. PV

Photovoltaic panels – transportation and

Aug 8, 2025 · Photovoltaic panels – specifications Over the decades, the prices of solar panels have dropped drastically. Between 2008 and 2012, module prices

Export Trade Process of Photovoltaic Products | Shanghai Import/Export

Oct 28, 2024 · The export trade process of photovoltaic products generally includes the following steps: Sign a contract. The exporter signs a sales contract with the importer to determine the

Top Solar & Wind Power Exports 2022

Solar vs wind Which countries earns the most from solar power or wind power exports? This analysis will answer that question plus other renewable energy queries. Exports of solar power

What categories does photovoltaic panel export belong to

Executive summary – Solar PV Global Supply Chains Solar PV products are a significant export for China. In 2021, the value of China''''s solar PV exports was over USD 30 billion, almost 7%

A Brief Analysis Of The Reduction In China''s Photovoltaic Export

Nov 18, 2024 · The Ministry of Finance and the State Administration of Taxation issued the "Announcement on Adjusting the Export Tax Rebate Policy", proposing to reduce the export

Monthly Solar Photovoltaic Module Shipments Report

Source and disposition of photovoltaic module shipments U.S. shipments and sales to the original equipment manufacturer (OEM) for resale and export shipments are not published for certain

Photovoltaic modules and laminates: Measures in force

Dec 5, 2014 · "Photovoltaic modules and laminates consisting of crystalline silicon photovoltaic cells, including laminates shipped or packaged with other components of photovoltaic

Photovoltaics: Basic Principles and Components

Oct 14, 2013 · The decreasing cost of PV systems and the increasing number of manufacturers and dealers for PV equipment have con-tributed to widespread use of the technol-ogy. In PV''s

Can reshoring policies hinder China''s photovoltaic module exports

Jul 1, 2025 · This paper employs a two-pronged approach, utilizing a generalized Bass diffusion model to analyze the diffusion of global new photovoltaic installations facing energy transition

Annual Solar Photovoltaic Module Shipments Report

Overview This report includes summary data for the photovoltaic industry from annual and monthly respondents. Data include manufacturing, imports, and exports of modules in the

6 FAQs about [Which mode does the export of photovoltaic modules belong to ]

Why did China Export more solar modules in 2021?

The rapidly growing demand overseas bolstered the export of Chinese modules. According to data compiled by InfoLink, China exported 88.8 GW of modules in 2021, a 35.3% increase that is chiefly attributed to major PV markets, such as Europe, Brazil, and India. The chart shows China exporting more modules to the world in 2021 than in 2020.

What is solar photovoltaic (PV)?

Solar photovoltaic (PV), typical renewable energy, has the largest potential to provide a considerable amount of energy from abundant sunshine resources. Thus, many countries have established supportive policies to flourish PV industry. The past 20 years have witnessed the dramatic growth of China’s PV production.

Do internal and external forces affect China's solar PV export?

This study examines the impact of both internal and external forces on China’s solar PV export during 2007–2016. The results show that the spatial pattern of PV exports is quite different before and after 2011, with export increasingly concentrated in the Yangtze River Delta.

Is China's PV Manufacturing an export-oriented industry?

Moreover, China’s PV manufacturing is an export-oriented industry since the export market consumes about 95% of China’s total PV production before 2012 and 68% during 2012–2016 (Letcher and Fthenakis, 2018). How China has achieved such a remarkable growth in PV production and export deserves further exploration.

Does trade protectionism impede solar PV trade between China and EU?

On the other hand, solar PV trade between China and the EU is impeded by trade barriers. According to the UN Comtrade database, China’s PV products account for 45.0%, 33.3%, and 25.0% of the EU market in 2011, 2013, and 2015 respectively, verifying the effect of trade protectionism.

Why did China's solar PV market fall after 2011?

After 2011, the global market plummeted and trade protectionism depressed China’s PV trade (Voituriez and Wang, 2015). As an export-oriented emerging industry, China’s solar PV sector is hard to illustrate since its development is always subject to uncertainties caused by external forces.

Learn More

- Botswana export tariffs on photovoltaic modules

- Major export companies of photovoltaic modules

- Bissau import and export of photovoltaic modules

- Photovoltaic n-type modules and n-type cells

- Which photovoltaic glass product is the best

- Failure modes of solar photovoltaic modules

- Which photovoltaic off-grid inverter is better

- Conversion rate of monocrystalline silicon photovoltaic modules

- Price of photovoltaic p-type modules

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

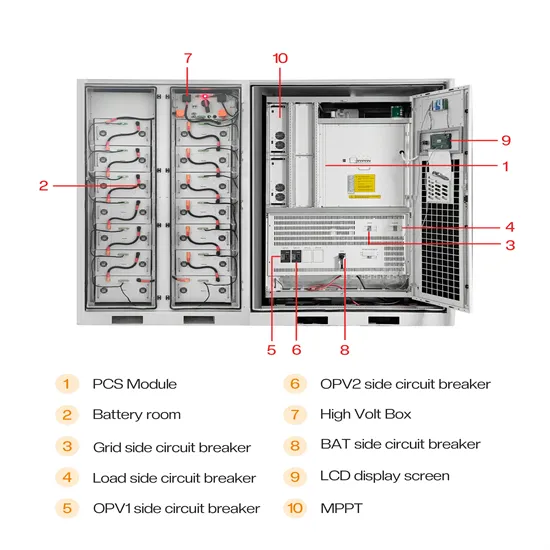

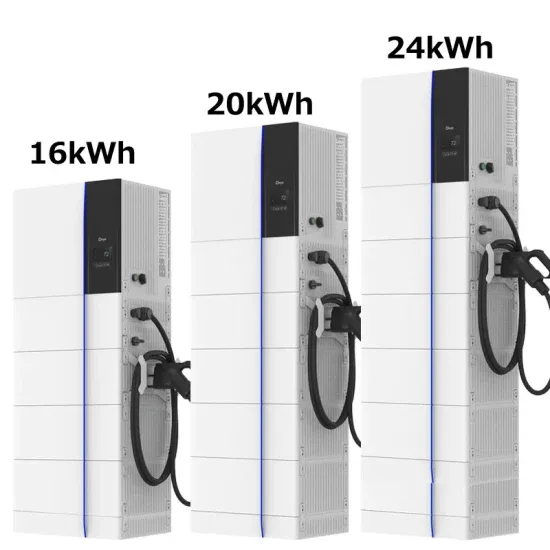

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.