Differences Between P-Type and N-Type Solar Panels

In the vast firmament of the new energy photovoltaic field, each leap in technology is a brave exploration of the boundaries of solar energy utilization efficiency. P-type and N-type solar

Global solar module prices fall amid weak

Aug 16, 2024 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

TaiyangNews PV Price Index – 2025

Jul 17, 2025 · P-type cells remain unlisted for the third consecutive week, indicating a continued phase-out. In the module segment, TOPCon bifacial products rose slightly, by 0.7% (182 mm)

P-type Solar Cells Price Increase as Market Demand Recovers

Feb 20, 2025 · The mainstream concluded price for M10 P-type wafer is RMB 1.10/Pc, while G12 P-type wafer is priced at RMB 1.65/Pc. The mainstream concluded price for M10 N-type wafer

Photovoltaic (PV) Module Technologies: 2020

Nov 2, 2021 · Photovoltaic (PV) module prices are a key metric for PV project development and growth of the PV industry. The general trend of global PV module pricing has been a rapid and

pv dex: n-type module prices continue to fall in

Aug 7, 2024 · The price of n-type solar modules has continued to decline in Europe thanks to oversupply and "fierce competition" amongst manufacturers,

Environmental impact assessment of the manufacture and use of N

Sep 10, 2024 · Carbon emissions for both the P-type and N-type PV modules were lower only during the cell production phase but higher during the other stages when compared to the P

N-Type VS. P-Type Solar Panels: Which One

Jul 8, 2023 · When you start researching the basics of a household solar energy system, one of the initial things you''ll need to learn is the difference between n

TrendForce says, the average bidding price of N-type modules

Oct 14, 2024 · The types of CEEC''s 100MW photovoltaic module are P-type double-sided double-glass 182 size 545W and above, the bidding price was 0.635 yuan/W-0.734 yuan/W, and the

Photovoltaic Module: Definition, Importance, Uses and Types

Jul 5, 2024 · Photovoltaic Module (PV) Definition, Uses, Types including Portable PV, Rooftop PV, and Hybrid PV. Advantages and Disadvantages of Photovoltaic Modules.

6 FAQs about [Price of photovoltaic p-type modules]

How much does a PV module cost in China?

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.” The results of the China Datang Group’s 2025-2026 PV module framework. Image: Datang.

What is the PV module price index?

The PV Module Price Index tracks wholesale pricing and supply of crystalline-silicon modules that have fallen out of traditional distribution channels, and as a result are listed for resale on the EnergyBin exchange.

How much will PV modules cost in 2025?

On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

Do PV modules lose resale value?

For historical secondary market PV module pricing from 2020 through 2023, download the 2023 PV Module Price Index from EnergyBin’s Resources portal. Overall, the price index shows that new PV modules don’t tend to lose resale value in the U.S. secondary market unless their technology is older, such as Legacy POLY modules.

How much does a resale solar module cost?

For example, N-Type modules by REC listed for resale in May and July pushed up weighted average prices to $0.411 and $0.460 respectively. P-Type modules in September increased to $0.311 as modules by Sirius PV, Solar4America, and Panasonic were remarketed. The same price increase was present in P-Type Bifacials for the month of December.

How much does p-type polysilicon cost?

The transaction price for p-type polysilicon was RMB32,000-36,000/ton, with an average of RMB34,000/ton. The Silicon Industry Branch stated that the pace of this round of rush installation has been too fast, with price adjustments mainly reflected in the module sector.

Learn More

- Subsidy price of photovoltaic modules in Hamburg Germany

- Price of local photovoltaic modules in Vietnam

- How is the price of photovoltaic glass

- Price of photovoltaic panels 100 square meters in Malabo

- Cape Verde photovoltaic energy storage lithium battery price

- Can stacked photovoltaic modules be used

- Middle East photovoltaic energy storage 15kw inverter price

- 45kw photovoltaic drip irrigation quality inverter price

- Polycrystalline photovoltaic panel 100w price

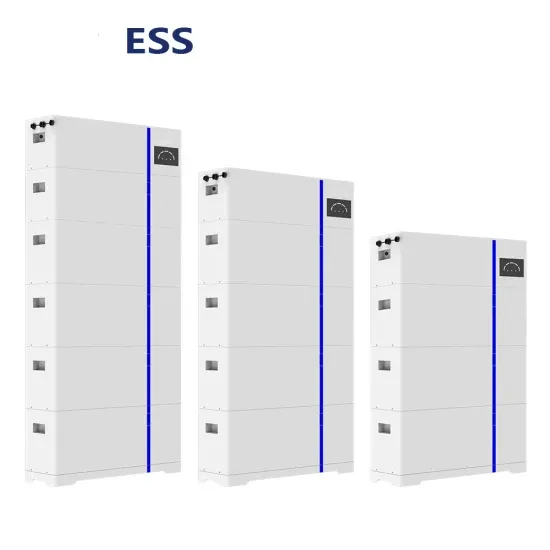

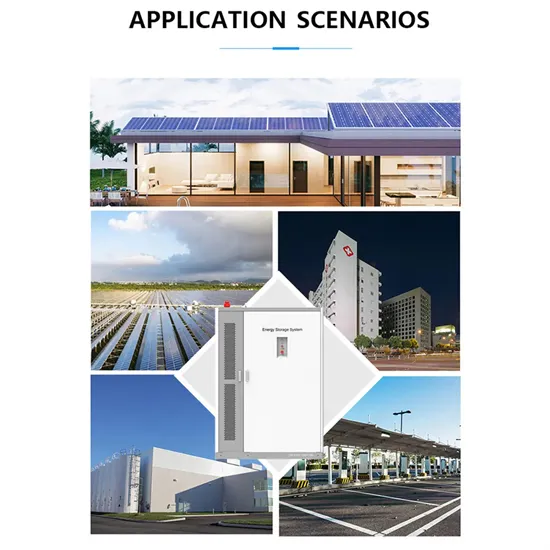

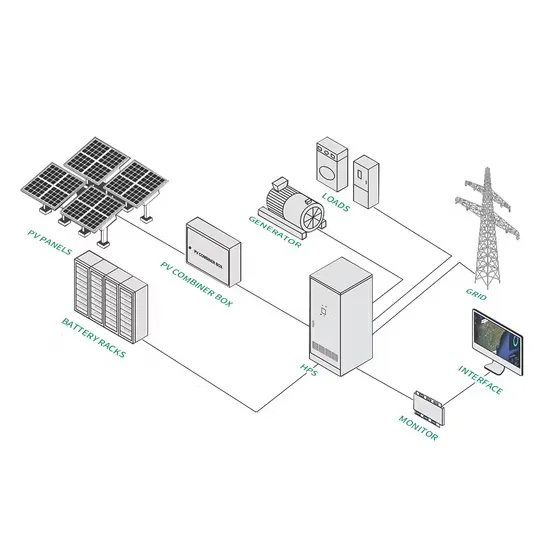

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.