The 9 largest solar panel manufacturers in the world [2025]

Jun 6, 2025 · Discover which companies produce the highest number of solar panels around the world. What kind of home do you live in? Solar power is currently the world''s third largest

Top 10 photovoltaic panel exporting enterprises

Finlay Colville, head of market research at Solar Media, reveals the top ten PV module suppliers last year in the first of a two-part blog, exploring not just shipment volumes but also the...

How Trade Policies Are Reshaping Global Solar

Jan 28, 2025 · International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral

The trend of "volume increase and price decrease" in PV module exports

Jun 26, 2024 · Recently, China''s General Administration of Customs released the import and export data of photovoltaic modules in May 2024, which showed that the export amount of

Export volume of photovoltaic module industry companies

What are China''s solar PV exports? In 2021, the value of China''s solar PV exports was over USD 30 billion, almost 7% of China''s trade surplus over the last five years. In addition, Chinese

India''s PV module exports hit $1.9 billion in fiscal

May 28, 2024 · India''s solar module exports hit $1.9 billion in fiscal 2023-24, with shipments to the US market accounting for the lion''s share of the total.

Global Module Shipments of 20+ Major Chinese

Jan 31, 2025 · PVTIME – The year 2024 is poised to be a transformative year for the global photovoltaic industry, characterised by substantial innovation and

India''s solar photovoltaic (PV) module exports have seen a

Jun 29, 2025 · Three major Indian companies—Waaree Energies, Adani Solar, and Vikram Solar—dominated the export market, driving India''s rapid growth as a solar supplier. The

Chinese Solar Exports: What''s Driving the Growth? | MSC

Dec 19, 2023 · As such, there has been a major rise in solar exports, with commodities like solar batteries, PV modules, panels, and silicon Wafers being shipped globally. One of the major

Top 10 Solar Panel Manufacturers and Suppliers

Aug 17, 2024 · China, being a global leader in solar panel manufacturing, offers a wide range of high-quality products that cater to various markets worldwide.

Domestic support, diversified overseas strategies underlined for PV

Aug 8, 2025 · Asia surpassed Europe as the largest export market for Chinese solar products in the first half of this year, the China Photovoltaic Industry Association said on Thursday. Solar

Five Points of Impact! China''s PV cuts 4% export tax rebate

Nov 18, 2024 · On November 15, China''s Ministry of Finance and the State Administration of Taxation announced a reduction in the export tax rebate rate for certain products, including

6 FAQs about [Major export companies of photovoltaic modules]

Who are China's top PV module manufacturers?

China’s top PV module manufacturers Overseas revenue is critical for China’s top PV module manufacturers, which are also the world’s top seven, including LONGi Green Energy, JinkoSolar, Trina Solar, JA Solar, Risen Energy, Astronergy (Chint) and TW Solar.

What is the export volume of solar PV products?

From January to November, the export volume of solar PV products hit USD 47.75 billion. Except for the top 4 manufacturers, Canadian Solar and Risen Energy have shipped over 60% of their modules overseas.

Who makes photovoltaic modules in South Korea?

3. Analysis of the Top 10 Global Photovoltaic Module Manufacturers in 2025 Hanwha Q CELLS, the core energy enterprise of South Korea’s Hanwha Group—one of the country’s top ten conglomerates—has a well-established presence in module manufacturing, R&D, and global market operations.

What are the top 5 solar module manufacturers in 2023?

The total module shipments of the top 5 manufacturers nearly reached 300GW in 2023. The major players maintained their leading positions throughout the list. The top four were LONGi, Jinko, Trina and JA Solar, the same order as last year.

How big is China's photovoltaic module exports?

In addition, China’s cumulative photovoltaic module exports have exceeded $200 billion in the past decade, while the cumulative exports volume of module have exceeded 575GW, Mr. Zhang Sen added. China’s top PV module manufacturers

Who will dominate the global PV module market in 2023?

A total of 18 Chinese companies were selected in the top 20 list, with a total output of more than 440GW in 2023, gradually taking over the global PV module market with their unique advantages. LONGi, the king of the PV industry, will supply 66.44GW of modules in 2023, up 42% year on year.

Learn More

- Companies exporting photovoltaic modules from Belize

- Two major solar photovoltaic panel companies

- How many photovoltaic curtain wall companies are there in Kabul

- Chromium telluride thin film photovoltaic modules

- Austria s photovoltaic energy storage companies

- Irish solar photovoltaic energy storage companies

- Famous photovoltaic inverter companies

- Structure of flat-plate solar photovoltaic modules

- Ultra-high voltage energy storage photovoltaic companies

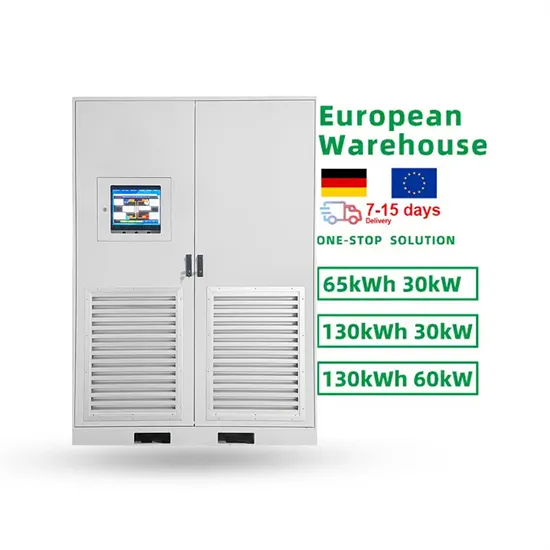

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.