BIPV Photovoltaic Curtain Wall Industry''s Evolution and

Mar 29, 2025 · The Building-Integrated Photovoltaics (BIPV) photovoltaic curtain wall market is experiencing robust growth, driven by increasing demand for sustainable building solutions

Solar Company in Afghanistan | Solar EPC Companies in Afghanistan

Solar Power Solutions Pvt Ltd is the leading solar company in Afghanistan. As one of the best-known solar EPC companies in the country, we specialize in providing comprehensive solar

Curtain walls

Aug 14, 2025 · These PV glasses also allow interesting possibilities for interior design by the selective natural light transmission through the space between the PV cells. Special finishes of

List Of Import export companies in Kabul

May 5, 2025 · There are 34 Import export companies in Kabul as of May 5, 2025; which is an 6.25% increase from 2023. Average age of Import export companies in Kabul is 2 years and 6

List Of Electronics Companies in Kabul

May 5, 2025 · There are 11 Electronics Companies in Kabul as of May 5, 2025; which is an 0.00% increase from 2023. Average age of Electronics Companies in Kabul is 5 years .

Photovoltaic System Businesses in Afghanistan

Afghan Solar is the oldest & largest Solar Company in Afghanistan. With 22 offices throughout the Country, Afghan Solar can supply, install & maintain systems in the most remote areas. Official

Curtain Wall with Photovoltaic Glass Market Dynamics and

Apr 2, 2025 · The curtain wall with photovoltaic glass market is experiencing robust growth, driven by increasing demand for sustainable building solutions and the integration of renewable

List Of Solar energy contractors in Afghanistan

May 5, 2025 · There are 69 Solar energy contractors in Afghanistan as of January 23, 2025; which is an 9.52% increase from 2023. Of these locations, 67 Solar energy contractors which

T/CECS 1582-2024 建筑光伏幕墙及采光顶设计标准

Mar 28, 2024 · 建筑光伏幕墙及采光顶设计标准 Standard for design of solar photovoltaic curtain wall and skylight of building 【标准号】 T/CECS 1582-2024 【发布日期】 2024-03-28 【标准

Photovoltaic curtain wall | DongPengBoDa Steel

Mar 17, 2023 · At present, the annual use area of curtain wall building in China breaks through 70 million square meters. If the pv curtain wall can reach 10

Onyx Solar: the global leader in photovoltaic glass for

Onyx Solar leads in producing innovative transparent photovoltaic (PV) glass for buildings globally. Their PV Glass serves dual purposes: as a building material and as a means to

Learn More

- Photovoltaic glass curtain wall can open windows

- How many photovoltaic curtain walls are there in Pyongyang

- Benefits of Stockholm shopping mall photovoltaic curtain wall

- Photovoltaic curtain wall procurement

- Photovoltaic curtain wall renovation of Greek buildings

- Bangladesh building renovation photovoltaic curtain wall

- 2025 Photovoltaic curtain wall price

- Photovoltaic curtain wall plant

- The best photovoltaic curtain wall

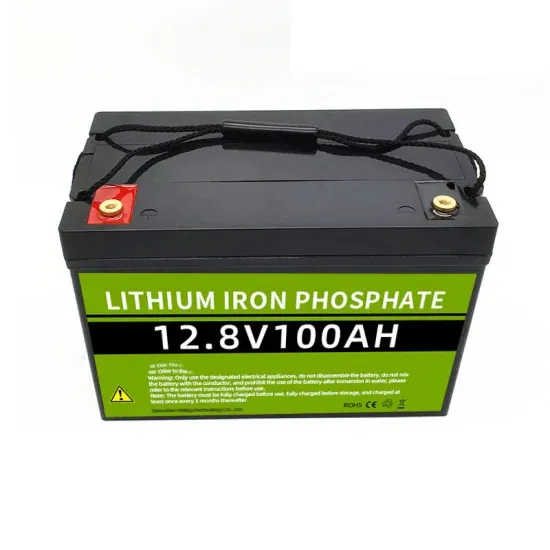

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.