BESS in North America_Whitepaper_Final Draft

Apr 23, 2021 · This whitepaper reflects on available opportunities across the battery energy storage industry focusing on the market development in the United States and Canada.

Energy Storage Financing: Project and Portfolio Valuation

Jan 27, 2021 · ABSTRACT This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the

Enabling renewable energy with battery energy storage

Feb 10, 2025 · Enabling renewable energy with battery energy storage systems The market for battery energy storage systems is growing rapidly. Here are the key questions for those who

Study on the Profit Model of Power Battery Enterprises

In order to meet the energy and transportation reform, the investment of CATL has involved power batteries, energy storage, lithium battery materials, lithium battery intelligent equipment

5 Steps to Maximize the Value of Battery Energy Storage

6 days ago · This article walks you through some of the most common steps when considering the deployment and operation of a battery storage system, and shows you the power of data

An introduction: Revenue streams for battery storage

Sep 16, 2020 · To optimise asset returns, investors need to understand how to monetise multiple potential sources of revenues. Overview of the business models and revenue sources for

Microsoft Word

Oct 1, 2020 · Unlike Li-ion and other solid-state batteries which store electricity or charge in electrodes made from active solid materials, Redox Flow Batteries (RFB) work like a reversible

Technoeconomic Modeling of Battery Energy Storage in

Sep 24, 2015 · Executive Summary Comprehensive lead-acid and lithium-ion battery models have been integrated with photovoltaic models giving System Advisor Model (SAM) the ability to

Energy Storage System Modeling

Apr 26, 2011 · 4.4.2.2 Energy storage system and energy balance models Energy storage system model comprises of equations that describe the charging/ discharging processes of energy

Economic Analysis Case Studies of Battery Energy

Nov 4, 2015 · SAM links a high temporal resolution PV-coupled battery energy storage performance model to detailed financial models to predict the economic benefit of a system.

Lithium battery energy storage profit analysis method

Several authors,,,, enhance a simplistic Power-Energy Model with the functional dependencies between energy efficiency, maximum charging/discharging power and state-of-energy to better

Energy Storage Grand Challenge Energy Storage Market

Dec 18, 2020 · This report covers the following energy storage technologies: lithium-ion batteries, lead–acid batteries, pumped-storage hydropower, compressed-air energy storage, redox flow

Business models in energy storage

4 days ago · The revenue models are dependent on regulation of the energy sector, the prices and pricing models for grid access and retail en-ergy, and the evolution of the technology,

Stacked revenues for energy storage participating in energy

Nov 15, 2023 · Moreover, providing multiple services maximizes the battery''s revenues, for example, participating in joint energy and reserve markets showed a 76% increase in annual

How much profit do energy storage batteries

Mar 15, 2024 · Energy storage batteries present lucrative opportunities for profit generation across various sectors, 1. driven by increasing energy demand, 2.

How is the profit of energy storage battery cells? | NenPower

Mar 4, 2024 · Energy storage battery cells generate profits through 1. increasing demand for renewable energy solutions, 2. advancements in technology enhancing efficiency, and 3. the

A comprehensive review of battery modeling and state

Oct 1, 2020 · With the rapid development of new energy electric vehicles and smart grids, the demand for batteries is increasing. The battery management system (BMS) plays a crucial role

Increasing the lifetime profitability of battery energy storage

Oct 15, 2023 · Recent electricity price volatility caused substantial increase in lifetime profit. Lithium-ion cells are subject to degradation due to a multitude of cell-internal aging effects,

Utility-Scale Portable Energy Storage Systems

Feb 13, 2021 · SUMMARY Battery storage is expected to play a crucial role in the low-carbon transformation of energy systems. The deployment of battery stor-age in the power grid,

Modelling and optimal energy management for battery energy storage

Oct 1, 2022 · Incorporating Battery Energy Storage Systems (BESS) into renewable energy systems offers clear potential benefits, but management approaches that opti

6 FAQs about [Energy storage product battery cell profit model]

What is the financial model for the battery energy storage system?

Our financial model for the Battery Energy Storage System (BESS) plant was meticulously designed to meet the client’s objectives. It provided a thorough analysis of production costs, including raw materials, manufacturing processes, capital expenditure, and operational expenses.

Is energy storage a profitable business model?

Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage. We find that all of these business models can be served

How profitable is battery energy storage system (BESS)?

Profitability Analysis Year on Year Basis: The proposed Battery Energy Storage System (BESS) plant, with an annual installed capacity of 1 GWh per year, achieved an impressive revenue of US$ 192.50 million in its first year.

What is a battery energy storage system (BESS) model?

Tailored to the specific requirement of setting up a Battery Energy Storage System (BESS) plant in Texas, United States, the model highlights key cost drivers and forecasts profitability, considering market trends, inflation, and potential fluctuations in raw material prices.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

What are the raw materials used in battery energy storage system?

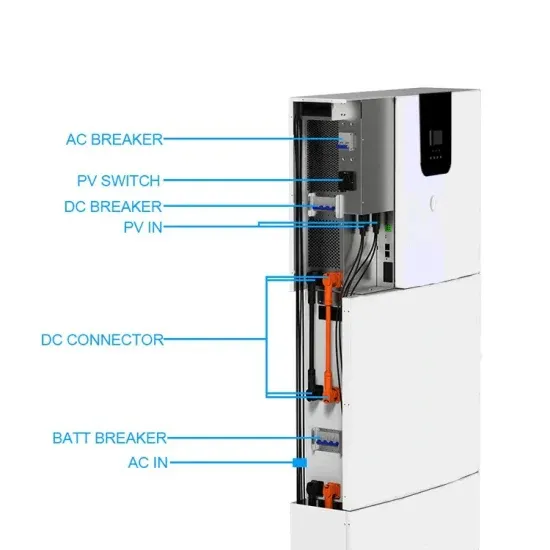

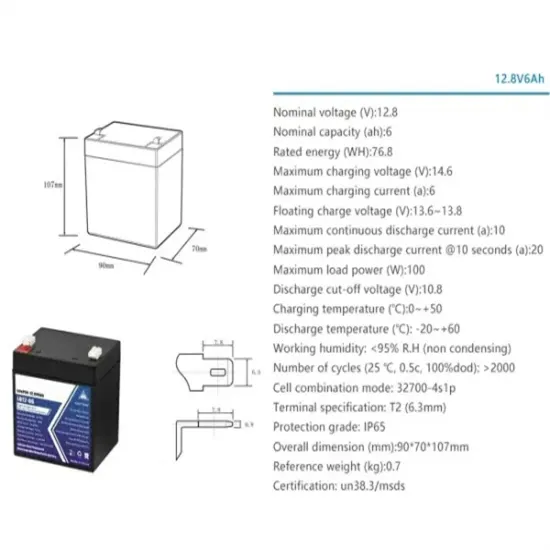

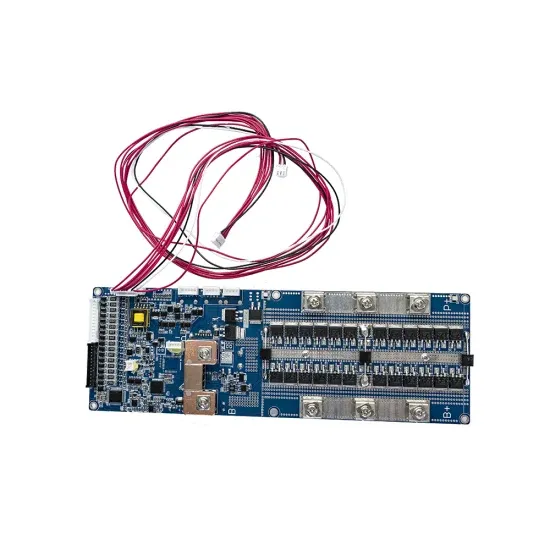

Raw Material Required: The primary raw materials utilized in the Battery Energy Storage System (BESS) manufacturing plant include as lithium-ion battery cells, battery modules and battery management system, power conversion system, cooling and thermal management systems. List of Machinery:

Learn More

- Energy Storage Battery Product Ranking

- Profit model of centralized energy storage power station

- Bhutan energy storage power station profit model

- Profit model of new energy storage

- Energy storage battery product planning and design

- Nanya Industrial and Commercial Energy Storage Battery Model

- Georgia Enterprise Energy Storage Battery Model

- Model of energy storage battery imported from Lome

- Energy storage system integration profit model

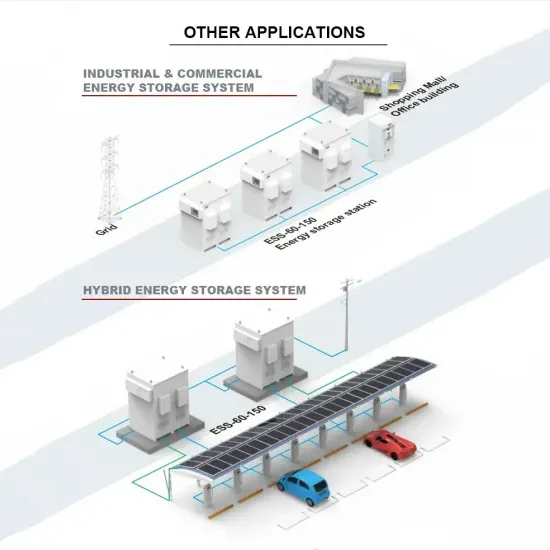

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.