Nanya Industrial and Commercial Energy Storage Battery Model

In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management contracts, and financial

What is Commercial and Industrial Energy Storage?

Jun 12, 2025 · Commercial and industrial energy storage systems (C&I ESS) refer to large-scale battery solutions designed to store electricity for businesses, manufacturing plants, and

nanya port backup energy storage battery factory

Wholesale Battery Storage Systems Manufacturer and Supplier, Factory Center Power Technology Co., Ltd. is a China-based manufacturer and supplier of battery storage systems

How Nanya Port''s Energy Storage Battery Components Are

With round-the-clock operations and megawatt-scale equipment, facilities like Nanya Port consume enough electricity daily to power small cities. But here''s the kicker: traditional diesel

Three Investment Models for Industrial and

Sep 30, 2023 · In this article, we''ll take a closer look at three different commercial and industrial battery energy storage investment models and how they play a

Nanya port energy storage container

The framework of intelligent operation and energy interaction system of container port constructed in this paper can realize the cooperative scheduling of operation equipment and energy in the

Nanya Energy Storage Container Industry and Commerce

In 2017, the National Energy Administration, along with four other ministries, issued the "Guiding Opinions on Promoting the Development of Energy Storage Technology and Industry in China"

nanya port industrial and commercial energy storage ems

About nanya port industrial and commercial energy storage ems manufacturer As the photovoltaic (PV) industry continues to evolve, advancements in nanya port industrial and commercial

Energy Storage Industry Trends: C&I Energy Storage Market

Feb 6, 2025 · With the transformation of the global energy structure and the rapid development of renewable energy, the commercial and industrial energy storage (C&I ESS) market will see

Energy storage in China: Development progress and business model

Nov 15, 2023 · According to the different investors, beneficiaries and profit models, the business models of energy storage are temporarily classified into six types, namely the ancillary service

Nanya Outdoor Energy Storage Battery Exports Trends

Outdoor energy storage solutions are reshaping how industries and households access reliable power. This article explores the booming market for Nanya outdoor energy storage battery

Nanya port energy storage power station

When an EV requests power from a battery-buffered direct current fast charging (DCFC) station, the battery energy storage system can discharge stored energy rapidly, providing Energy

Nanya energy storage project factory operation

Feb 7, 2025 · Another such model is the leasing model for front-of-the-meter energy storage projects adopted by Hunan province in 2018, and the subsequent 2020 upgraded version of

China Industrial and Commercial Energy Storage System

What are the characteristics of energy storage industry development in China? Throughout 2020, energy storage industry development in China displayed five major characteristics: 1. New

Nanya energy storage project factory operation

Just as planned in the Guiding Opinions on Promoting Energy Storage Technology and Industry Development, energy storage has now stepped out of the stage of early commercialization

6 FAQs about [Nanya Industrial and Commercial Energy Storage Battery Model]

How to develop energy storage business model in China?

In order to guide the development of energy storage business model, it is recommended to improve policy formulation in terms of planning, technical standards, market and regulatory mechanisms. In the planning stage of the power system, the Chinese government should consider the safety, economic and social benefits of energy storage.

What are ancillary service business models for energy storage in China?

There are three types of ancillary service business models for energy storage in China. As shown in Fig. 2, the first is the power generation company investment model. Power generation companies use existing funds or bank loans to build and operate energy storage through energy storage operating companies.

What are the emerging energy storage business models?

The independent energy storage model under the spot power market and the shared energy storage model are emerging energy storage business models. They emphasized the independent status of energy storage. The energy storage has truly been upgraded from an auxiliary industry to the main industry.

What is Haiyang 101 mw/202 MWh energy storage power station?

In December 2021, the Haiyang 101 MW/202MWh energy storage power station project putted into operation, and energy storage participated in the market model of peak regulation application ancillary services. In February 2022, it officially became the first independent energy storage power station in Shandong province to pass the market registration.

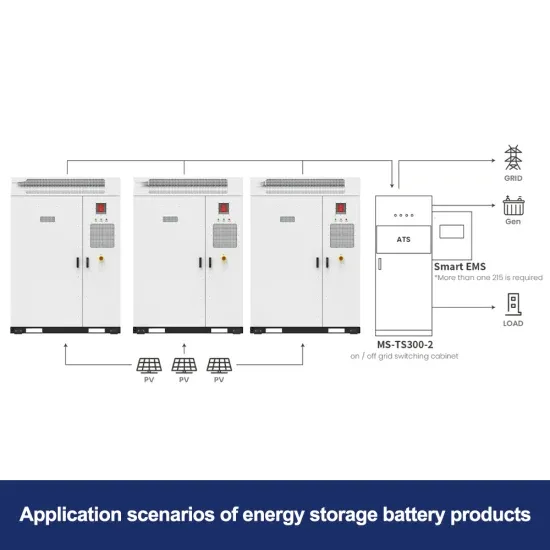

What are the application scenarios of energy storage in China?

It also introduces the application scenarios of energy storage on the power generation side, transmission and distribution side, user side and microgrid of the power system in detail. Section 3 introduces six business models of energy storage in China and analyzes their practical applications.

What is the business model of energy storage in Germany?

The business model in the United States is developing rapidly in a mature electricity market environment. In Germany, the development of distributed energy storage is very rapid. About 52,000 residential energy storage systems in Germany serve photovoltaic power generation installations. The scale of energy storage capacity exceeds 300MWh .

Learn More

- High-end industrial and commercial energy storage battery

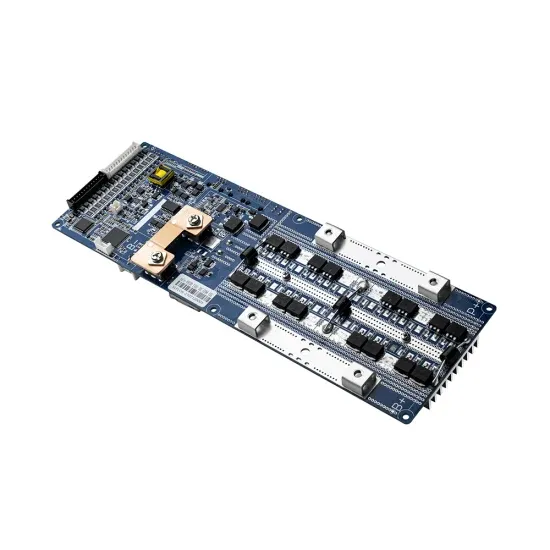

- Industrial and commercial energy storage battery cabinet structure

- Auckland New Zealand Industrial and Commercial Energy Storage Battery

- Hungary Pécs Industrial and Commercial Energy Storage Battery Cost Performance

- Industrial and commercial energy storage battery stack

- Photovoltaic Industrial and Commercial Energy Storage

- Tokyo Industrial and Commercial Energy Storage Cabinet Manufacturer

- El Salvador Industrial and Commercial Energy Storage Cabinet Enterprise

- Asmara Industrial and Commercial Energy Storage Equipment Manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.