Hungary Energy Storage Market (2025-2031) | Trends & Size

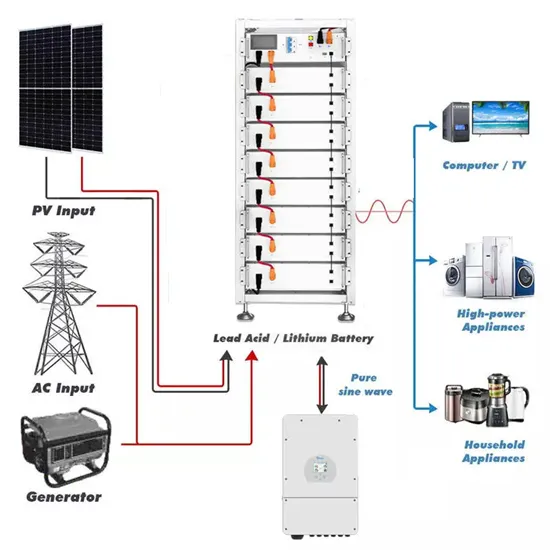

Key trends include the adoption of advanced battery storage technologies, such as lithium-ion batteries, for both utility-scale and residential applications. Energy storage projects are also

Industrial and commercial energy storage vs

6 days ago · The article first introduces the concept of industrial and commercial energy storage and energy storage power stations, outlining their respective

MET Group Inaugurates Hungary''s Largest Battery Energy Storage

Jun 23, 2025 · Hungary''s largest operating standalone battery energy storage system (BESS) has been inaugurated on June 19. MET Group put into operation a battery electricity storage plant

Energy Storage Projects in Pécs Power Grid Innovations and

Summary: Explore how Pécs, Hungary, is leveraging cutting-edge energy storage systems to stabilize its power grid and integrate renewable energy. This article dives into key projects,

The perspectives for a high-tech battery industry in

Apr 15, 2025 · EV and battery industries are priorities for Hungarian economic development policy Battery cell production capacity outlook for Hungary, GWh/year Source: HIPA, 2024 The

2022 Grid Energy Storage Technology Cost and

Sep 23, 2022 · The second edition of the Cost and Performance Assessment continues ESGC''s efforts of providing a standardized approach to analyzing the cost elements of storage

National Battery Industry Strategy 2030

Jan 31, 2024 · Hungary is ideally located on the European battery map, thanks to its central geographical location, investments in cell and battery production facilities, the presence of

Energy storage cost – analysis and key factors to

4 days ago · This article provides an analysis of energy storage cost and key factors to consider. It discusses the importance of energy storage costs in the

Investigating the role of nuclear power and

May 15, 2024 · The Section covers Hungary''s import/export position, the structure of the energy mix of Hungarian electricity generation, the performance of the

The Real Cost of Commercial Battery Energy Storage in 2025 | GSL Energy

Jun 9, 2025 · Discover the true cost of commercial battery energy storage systems (ESS) in 2025. GSL Energy breaks down average prices, key cost factors, and why now is the best time for

Hungary powers up largest battery storage system near Budapest

Jun 20, 2025 · Battery storage is increasingly seen as a cornerstone of the energy transition, offering grid stability and flexibility as renewables surge. The new facility features 48 battery

National Battery Industry Strategy 2030

Jan 31, 2024 · Currently, the total capacity of the storage units applied in the primary Hungarian regulatory market is 28 MW. MVM plans to install 5 MW of capacity by 2022, which intends to

6 FAQs about [Hungary Pécs Industrial and Commercial Energy Storage Battery Cost Performance]

How much does Hungarian government spend on energy storage projects?

The Hungarian government has allocated HUF 62 billion (EUR 158 million) for energy storage projects with an overall 440 MW in operating power. Hungarian authorities launched the tender for grid-scale batteries on January 15 and received offers until February 5. The winning bidders were selected a few days ago.

Will Hungary's new battery energy storage system help Green the grid?

The new facility supports a growing push to green Hungary’s power grid. Hungary has just switched on its largest battery energy storage system (BESS) to date, stepping up its role in Central Europe’s growing grid-scale energy transition.

Who manufactures Car batteries in Hungary?

GS Yuasa also produces automotive lithium-ion starter batteries, while Inzi Control also manufactures battery modules. Many of the significant suppliers of the battery industry in Hungary are located directly near the main car manufacturing plants.

Is Hungary stocking up on battery backup?

Hungary isn’t alone in stocking up on battery backup as it charts its green energy path. In neighbouring Bulgaria, a massive 124 MW/496 MWh battery energy storage system went live in Lovech earlier this year.

Where is the battery industry located in Hungary?

Many of the significant suppliers of the battery industry in Hungary are located directly near the main car manufacturing plants. Since 2016, a total of HUF 1,903.8 billion (EUR 5.29 billion) and approximately 13,757 jobs have been created as a result of working capital investments in the battery industry.

What is the capacity of a network storage facility in Hungary?

The first network storage facility in Hungary was installed by E.On in 2018 followed shortly by Alteo with 3.92 MWh and ELMŰ (Innogy) with 6 MWh (6 MW + 8 MW capacity). Currently, the total capacity of the storage units applied in the primary Hungarian regulatory market is 28 MW.

Learn More

- ASEAN Industrial and Commercial Energy Storage Cabinet Cost

- High-end industrial and commercial energy storage battery

- Industrial and commercial energy storage battery stack

- Nanya Industrial and Commercial Energy Storage Battery Model

- Minsk special energy storage battery cost performance

- Moroni energy storage lithium battery cost performance

- Industrial and commercial energy storage battery cabinet structure

- Auckland New Zealand Industrial and Commercial Energy Storage Battery

- Iranian Industrial and Commercial Energy Storage Cabinets

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.