Business Models and Profitability of Energy Storage

Oct 22, 2020 · SUMMARY Rapid growth of intermittent renewable power generation makes the identifica-tion of investment opportunities in energy storage and the establishment of their

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new

Analysis and Comparison for The Profit Model of Energy Storage

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power sys

What is the profit model of independent energy storage

The demand for flexibility regulation resources in the new power system is becoming increasingly urgent, with frequency regulation being particularly prominent. Energy storage has excellent

Hierarchical game optimization of independent shared energy storage

Apr 15, 2025 · With the rapid development of renewable energy, independent energy storage systems have garnered increasing attention. However, challenges such as limited revenue

Analysis of various types of new energy storage revenue models

May 28, 2024 · In the current environment of China''s vigorous development of energy storage, it is essential to carry out research on the benefits and economic evaluation of new energy

Shared Energy Storage Business and Profit Models: A Review

Dec 18, 2023 · As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability and safety

Emergence of 2.0 Profit Models for Industrial and Commercial Energy

May 26, 2025 · Policy Withdrawal ≠ Market Retreat! The Era of Profit Model 2.0 for Commercial and Industrial Storage Investment in Jiangsu Has Arrived As the policy landscape changes,

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

Frontiers | Multi-time scale trading profit model

Aug 25, 2022 · 3.1 Profit of pumped storage power plant taking part in the spot market In this article, the profit of PSPP included electric energy spot market

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their

Profit model of new energy storage

Are energy storage products more profitable? The model found that one company''s products were more economic than the other''s in 86 percent of the sites because of the product''s ability to

Study on profit model and operation strategy optimization of energy

Sep 25, 2023 · With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absorption, frequency

浙江新型储能收益模式及经济性实证分析

Feb 27, 2025 · 为此,本文以浙江省内某50 MW/100 MWh电化学储能站示范项目作为典型案例,首先分析了其技术条件和投资情况,进一步计算了其在电力市场、中长期合约和容量租赁服务等方

Shared energy storage-assisted and tolerance-based alliance

Jan 1, 2024 · Given this background, a shared energy storage (SES)-assisted and tolerance-based alliance strategy based on cooperative game and resource dependence theories is

Analysis of various types of new energy storage revenue

This paper establishes a framework for analyzing the revenue models of various types of energy storage under different scenarios. The framework complements the lack of previous studies on

6 FAQs about [Profit model of new energy storage]

What is a profit model for energy storage?

Operational Models: From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new models not only provide investors and users with more choices and opportunities but also drive the continuous development of energy storage technology.

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Learn More

- Profit model of centralized energy storage power station

- New energy storage power station operation model

- Electric energy storage equipment profit model

- New business model for energy storage

- Bhutan energy storage power station profit model

- Czech Electric s new energy storage model

- Huawei s new energy storage power station accessories

- Belize New Energy Storage Enterprise

- New intelligent energy storage generator

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

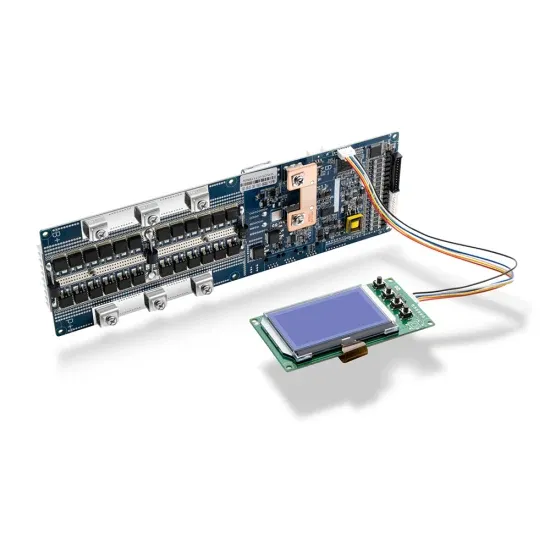

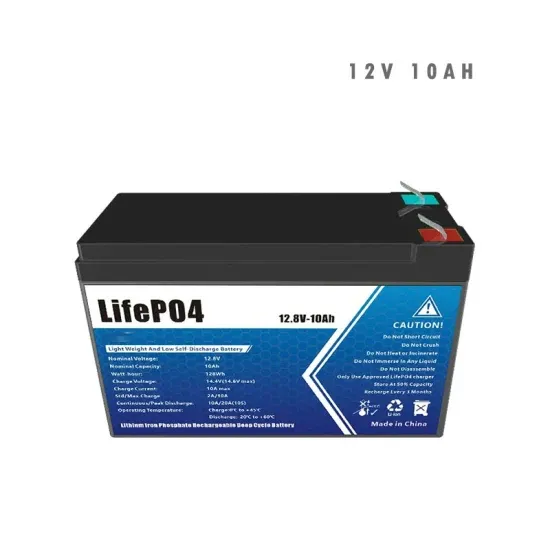

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.