A novel business model and charging and discharging

Jun 27, 2025 · Four scenarios are set up for case analysis. The conclusions indicate that under the novel business model for centralized energy storage presented in this paper, optimized

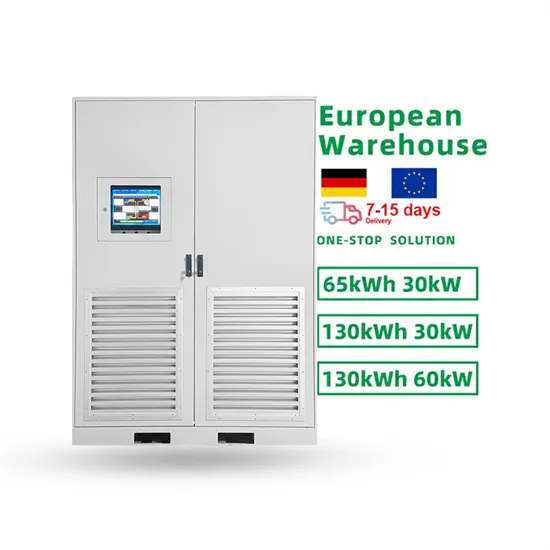

Price of centralized energy storage power station

In order to alleviate the pressure of electricity supply on the power grid,China has implemented peak-valley price policy,where electricity prices are often higher during peak demand periods.

Operation strategy and capacity configuration of digital

Aug 15, 2024 · Sensitivity analysis was conducted to assess the impact of variations in both the rated power and maximum continuous energy storage duration of the BESS. Base on the

Research on the optimization strategy for shared energy storage

Feb 20, 2025 · A cooperative investment model accommodates various energy storage technologies, reducing costs and enhancing efficiency. Case studies show the model

Optimal Operation with Dynamic Partitioning Strategy for

Jan 1, 2024 · As renewable energy continues to be integrated into the grid, energy storage has become a vital technique supporting power system development. To effectively promote the

Planning shared energy storage systems for the spatio

Nov 1, 2023 · The centralized multi-objective model allows renewable energy generators to make cost-optimal planning decisions for connecting to the shared energy storage station, while also

A study on the energy storage scenarios design and the business model

Sep 1, 2023 · Energy storage is an important link for the grid to efficiently accept new energy, which can significantly improve the consumption of new energy electricity such as wind and

Profit model of liquid-cooled energy storage power station

The First 100MW Liquid Cooling Energy Storage Project in China Meanwhile, the nuclear-grade 1500V 3.2MW centralized energy storage converter integration system and the

The economic use of centralized photovoltaic power

Jan 15, 2025 · Abstract Photovoltaic energy is the highest proportion of renewable energy in China, but its scientific utilization has great room for improvement. This study established a

Optimal Operation with Dynamic Partitioning Strategy for Centralized

Jan 3, 2024 · As renewable energy continues to be integrated into the grid, energy storage has become a vital technique supporting power system development. To effectively promote the

How is the profit model of energy storage power station

Jan 27, 2024 · The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Competitive model of pumped storage power plants

Aug 1, 2021 · The calculation example analysis shows that compared with the traditional model, the "three-stage" model can bring better benefits to the pumped storage power station, and

Hour-Ahead Optimization Strategy for Shared Energy Storage

Jul 29, 2022 · With the rapid growth of intermittent renewable energy sources, it is critical to ensure that renewable power generators have the capability to perform primary frequency

The Economic Value of Independent Energy Storage

Aug 12, 2023 · This article establishes a full life cycle cost and benefit model for independent energy storage power stations based on relevant policies, current status of the power system,

How much is the actual profit of energy storage power station?

Feb 12, 2024 · 1. Energy storage power stations generate profits through diverse revenue streams, including ancillary services and capacity payments. 2. Their profitability is also

profit model of large-scale energy storage power stations

Competitive model of pumped storage power plants participating The calculation example analysis shows that compared with the traditional model, the "three-stage" model can bring

Study on profit model and operation strategy optimization of energy

Sep 25, 2023 · With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absor

Competitive model of pumped storage power plants participating

Aug 1, 2021 · The calculation example analysis shows that compared with the traditional model, the "three-stage" model can bring better benefits to the pumped storage power station, and

Optimal Operation with Dynamic Partitioning Strategy for Centralized

In this paper, we propose the optimal operation with dynamic partitioning strategy for the centralized SES station, considering the day-ahead demands of large-scale renewable energy

A novel business model and charging and discharging

Jun 27, 2025 · To enhance the local consumption of photovoltaic (PV) energy in distribution substations and increase the revenue of centralized energy storage service providers, this

Several profit models of energy storage stations

The CES business model allows multiple renewable power plants to share energy storage resources located in different places based on the transportability of the power grid. the

Analysis of energy storage power station investment and

Nov 9, 2020 · In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

6 FAQs about [Profit model of centralized energy storage power station]

Does energy storage configuration maximize total profits?

On this basis, an optimal energy storage configuration model that maximizes total profits was established, and financial evaluation methods were used to analyze the corresponding business models.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How much does a power grid centric scenario cost?

The investment cost of the three application scenarios is related to the capacity configuration of energy storage. The maximum cost of the power grid-centric scenario application scenario is 32.87 million yuan.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Learn More

- Bhutan energy storage power station profit model

- Operational model of energy storage power station in Milan Italy

- Ulaanbaatar Centralized Energy Storage Power Station

- Business model of industrial and commercial energy storage power station

- Central Asia Company s own power station energy storage

- Base station lithium battery energy storage 15kw inverter power supply

- Global Compressed Air Energy Storage Power Station

- Malawi Wind and Solar Energy Storage Power Station

- Solar Energy Storage Power Station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.