Energy storage integration profit analysis code

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three

Shared Energy Storage Business and Profit Models: A Review

Dec 18, 2023 · As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability and safety

energy storage system integration profit analysis

Energy model optimization for thermal energy storage system integration This paper presents a dynamic energy model to study the implementation of thermal energy storage (TES) systems

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new

How do energy storage system integration companies

Why should you invest in energy storage? ity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when Is energy

Techno-economic optimization of utility-scale battery storage

Mar 15, 2025 · Integrating energy storage into renewable generation systems offers significant potential for enhancing revenue streams. This study conducts a comprehensive long-term

Optimizing Energy Storage Systems. A Dynamic

Apr 4, 2025 · Abstract This paper presents an algorithmic approach for optimizing energy storage system (ESS) capacity allocation across multiple electricity markets to maximize profits. The

Energy storage system integration profit analysis

Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is globally on the rise (IEA,2020). One

Energy storage in China: Development progress and business model

Nov 15, 2023 · Even though several reviews of energy storage technologies have been published, there are still some gaps that need to be filled, including: a) the development of energy storage

Shared Energy Storage Business and Profit Models: A Review

Dec 18, 2023 · As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability

Energy storage system integration profit analysis

About Energy storage system integration profit analysis As the photovoltaic (PV) industry continues to evolve, advancements in Energy storage system integration profit analysis have

A comprehensive review of the impacts of energy storage on

Jun 30, 2024 · As the utilization of energy storage investments expands, their influence on power markets becomes increasingly noteworthy. This review aims to summarize the current

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Energy-Storage Modeling: State-of-the-Art and Future

Aug 13, 2021 · Existing models that represent energy storage differ in fidelity of representing the balance of the power system and energy-storage applications. Modeling results are sensitive

Modelling and optimal energy management for battery energy storage

Oct 1, 2022 · Battery energy storage systems (BESS) have been playing an increasingly important role in modern power systems due to their ability to directly address renewable

Energy storage system integration profit analysis

Optimal sizing and economic analysis of Photovoltaic distributed Optimal sizing and economic analysis of Photovoltaic distributed generation with Battery Energy Storage System

Energy storage system integration profit

The bidding strategies of large-scale battery storage in 100 Then, the IDA energy system under the MED-level uncertainty of battery is used to show the primary results and corresponding

Grid-connected battery energy storage system: a review on

Aug 1, 2023 · Battery energy storage system (BESS) has been applied extensively to provide grid services such as frequency regulation, voltage support, energy arbit

Empowering smart grid: A comprehensive review of energy storage

Jul 1, 2021 · The rapid growth in the usage and development of renewable energy sources in the present day electrical grid mandates the exploitation of energy storage technologies to

Smart optimization in battery energy storage systems: An

Sep 1, 2024 · As a solution to these challenges, energy storage systems (ESSs) play a crucial role in storing and releasing power as needed. Battery energy storage systems (BESSs)

6 FAQs about [Energy storage system integration profit model]

What is a profit model for energy storage?

Operational Models: From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new models not only provide investors and users with more choices and opportunities but also drive the continuous development of energy storage technology.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Are battery energy storage systems financially viable?

Battery Energy Storage Systems (BESS) have become a crucial element in modern energy markets, providing grid stability, renewable energy integration, and cost optimization. Understanding the financial viability of these systems requires a robust proforma model that accounts for revenue streams, costs, and key financial metrics.

Is energy storage a profitable investment?

profitability of energy storage. eagerly requests technologies providing flexibility. Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Is energy storage a'renewable integration' or 'generation firming'?

The literature on energy storage frequently includes “renewable integration” or “generation firming” as applications for storage (Eyer and Corey, 2010; Zafirakis et al., 2013; Pellow et al., 2020).

Learn More

- Profit model of new energy storage

- Bhutan energy storage power station profit model

- Profit model of centralized energy storage power station

- Electric energy storage equipment profit model

- Kingston large energy storage cabinet model

- Hydropower energy storage profit plan

- Czech distributed energy storage cabinet cooperation model

- Sukhumi Industrial Energy Storage Cabinet Model Specifications

- Energy storage product model

Industrial & Commercial Energy Storage Market Growth

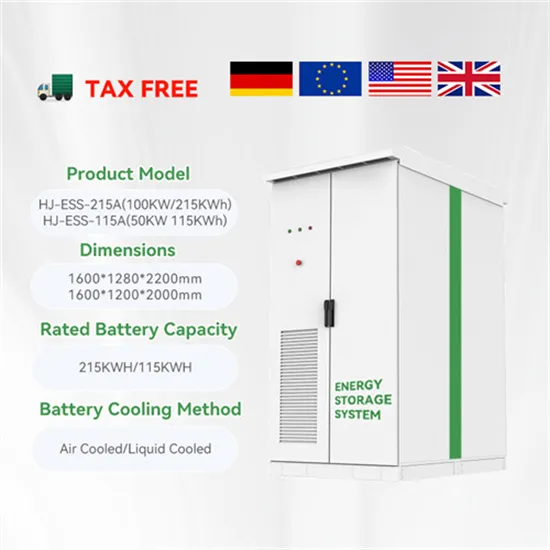

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.