Somaliland Among Few in Africa with 5G Network – SII

Somtel Rolls out 5G Network in Somaliland. As the first operator to roll out a 5G network, Somtel, a telecoms firm based in Somalia and the supplier of the eDahab mobile payment service, has

Mobile Communication Network Base Station Deployment Under 5G

Apr 13, 2025 · This paper discusses the site optimization technology of mobile communication network, especially in the aspects of enhancing coverage and optimizing base station layout.

MCMC MTSFB TC T017_2021

Sep 1, 2021 · This Technical Code applies to IMT-2020 (Fifth Generation) Base Station (5G BS) based on the technologies as specified in applicable Malaysian Standards, technical codes,

Telesom switches on 5G in twelve Somaliland locations

Jan 10, 2024 · Telesom, a Somaliland-based telecom operator, has launched a commercial 5G network offering mobile and fixed wireless access services in various urban and rural areas,

Installation of Base Stations and Radiation Safety

Jul 21, 2025 · The rollout of 5G services needs the establishment of an extensive network of radio base stations and small cells to support very high-speed data transmission and ubiquitous

4.5G Base Station – Ulak Haberleşme

Jan 16, 2025 · With 4.5G connectivity technologies, the aim is to provide the public with fast and uninterrupted communication services for safety and emergencies through mobile network

DBS5900 Distributed Base Stations — Huawei Enterprise

Aug 13, 2025 · The DBS5900 is a wireless access device for the eLTE wireless broadband private network solution. It provides wireless access functions, including air interface management,

New Technology Allows Satellites to Act as Base

Apr 10, 2025 · In the future, however, not all satellites will be powerful enough to act as complete base stations. As part of the TRANTOR project funded by the

Quick guide: components for 5G base stations and antennas

Mar 12, 2021 · 5G technology manufacturers face a challenge. With the demand for 5G coverage accelerating, it''s a race to build and deploy base-station components and antenna mast

Somaliland Aspires to Lead Africa in 5G Development

Oct 28, 2024 · Somtel introduced 5G in Somaliland''s capital, Hargeisa, in partnership with eDahab, the leading mobile payments provider in January 2024. The company claims to be

What is 5G base station architecture?

Dec 1, 2021 · The higher the frequency, the more data it transmits. 5G core network architecture operates on different frequency bands, but it''s the higher frequencies that deliver the most

Which RF Technologies Are Shaping 5G Base Stations?

Apr 24, 2025 · At the heart of this revolution lies a complex infrastructure powered by advanced radio frequency (RF) technologies. Among all the components that build a 5G network, RF

6 FAQs about [Somaliland Communications 5g base station universal]

Does Somaliland have a 5G network?

Somaliland, a self-declared independent nation-state located in the North-West region of Somalia has long been known for its resilience in the face of adversity. Now the small nation is taking a bold step towards the future with the recent launch of its first 5G network.

Why is Telesom launching 5G in Somaliland?

Telesom, on its part, will need to secure its new network since the decentralised nature of 5G networks, with more data being processed at the edge, opens up new points of vulnerability. However, the launch of 5G in Somaliland represents a powerful symbol of the country's unwavering spirit amidst existential challenges.

Is Somtel launching a 5G network?

Somtel team during the launch of the 5G network. PHOTO: COURTESY Somtel, the leading Somali telecommunications company, and the eDahab mobile payment provider have launched a new product that will revolutionize the region’s digital landscape by becoming the first operator to launch a 5G network.

Is 5G affordable in Somalia?

However, challenges remain. Infrastructure rollout is in its early stages, currently limited to major cities. While affordability will also be a crucial factor for mass 5G mobile adoption, Somalia already ranks in the top five African countries with the most affordable mobile internet.

What is Telesom's 5G mobile service?

“Telesom's 5G mobile service represents a quantum leap in wireless technology, offering unparalleled speed, reliability, and connectivity,” the company said in a statement. “This next-generation service is set to revolutionise the way people communicate, work, and experience the digital world.”

Why is Telesom launching 5G & FWA services?

Telesom’s commitment to technological advancement aligns with the national vision for a digitally connected and empowered Somaliland. The company believes that the introduction of 5G and FWA services will not only enrich the lives of individuals but also catalyze economic growth and innovation across various sectors.

Learn More

- Peru HJ Communications 5g base station bidding

- Gitega Communications 5G base station density

- North America Communications 5G Base Station Project

- Mali Communications sets up 5g base station

- Communications 5g base station construction in the third quarter

- Slovenia Communications 5g base station room

- Riga Communications 5G base station to be built in 2025

- North America Communications 5G Pilot Base Station

- Seychelles Communications 5g signal base station

Industrial & Commercial Energy Storage Market Growth

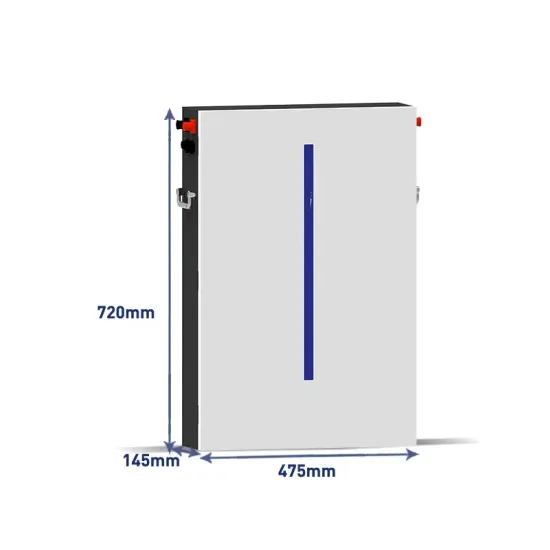

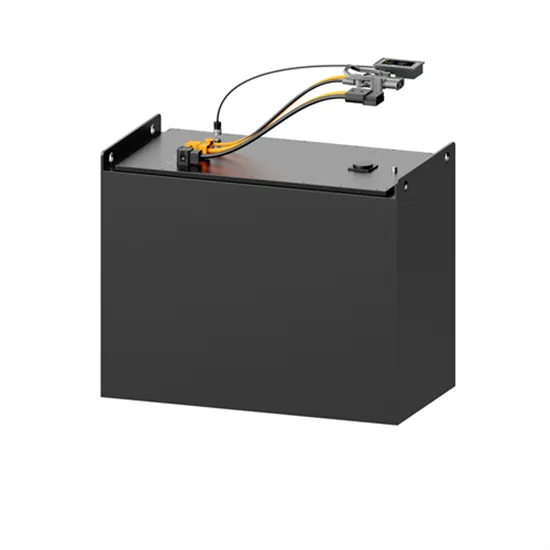

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.