Smart rollout of 5G tech key to promoting economic growth

Jul 15, 2025 · Second, 5G network construction still faces problems like the difficulty in selecting sites for base stations. The costs of network construction, operation and maintenance are

China''s 5G subscriptions surpass 1 billion amid strong uptake

Dec 24, 2024 · This second "Set Sail" action plan since 2021 emphasizes strengthening 5G applications, particularly in consumer-oriented sectors. It sets 2027 targets, including 38 5G

Construction Steps of the 5G Base Station Will Be

The 5G mobile communication base station is going to march into the era of accelerated deployment. By 2020, the estimated number of deployments should reach nearly 1.5 million

China''s regulator pushes 5G network construction amid virus

Feb 24, 2020 · Leading telecom operator China Unicom said on Feb 23 it will work with China Telecom to finish the construction of 250,000 5G base stations across the country by the end

China has more than 3.8 million 5G base stations

Jun 28, 2024 · There were more than 3.8 million 5G base stations in China by the end of May 2024, the latest data from the Ministry of Industry and Information Technology (MIIT) has

Competition in mobile base station market to intensify as global 5G

Aug 5, 2020 · According to the GSM Association''s forecasts, by 2025, more than a quarter of cellular devices in China will operate on 5G networks, occupying one-third of all global 5G

Competition on the mobile base station market

Aug 13, 2020 · As such, Huawei is expected to focus its base station construction this year primarily in domestic China. By the end of 1H20, the three major

Construction Steps of the 5G Base Station Will Be

The 5G mobile communication base station is going to march into the era of accelerated deployment. By 2020, the estimated number of deployments should reach nearly 1.5 million

5G accelerates again, and the three major components of the base

According to the new plan, the construction period of the previous four quarters will be reduced to three quarters, so for 5G upstream suppliers, the density of Q1-Q3 orders will increase

China has more than 3.8 mln 5G base stations

Jun 26, 2024 · GSMA, an international operator association, has forecast that China''s number of 5G connections will hit 1.6 billion by the end of 2030 -- nearly a third of the global total. GSMA

China sees steady progress in 5G base station construction

Sep 22, 2022 · China had over 2.1 million 5G base stations by the end of August, accounting for 19.8 percent of its mobile base stations, up 5.5 percentage points from the end of 2021,

China Mobile activates the 3rd phrase 4G stations construction

Insiders say that China Mobile will activate the third phrase TD-LTE network base station construction in advance and plans to establish 700,000 4G stations, more than 500,000 as

Optimizing the ultra-dense 5G base stations in urban

Dec 1, 2020 · The developed model can facilitate the rollout of 5G technology. Due to the high propagation loss and blockage-sensitive characteristics of millimeter waves (mmWaves),

Ambitious 5G base station plan for 2025

Aug 17, 2025 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

China''s 5G construction turns to lithium-ion batteries for

With China ramping up spending on infrastructure construction to revive its economy, industry observers expect the country''s demand for lithium-iron-phosphate batteries for use in energy

Global 5G Progress-Europe, USA, China, Japan, South Korea

Latest 5G Progress In The World According to the data released by GSA, as of December 2020, 140 operators in 59 countries and regions around the world have opened 5G base stations

5G network construction gathers speed

"5G networks include two parts, namely core networks and base stations. Chinese telecom carriers are aiming to upgrade their 5G core networks into stand-alone architecture by the end

Ambitious 5G base station plan for 2025

Dec 28, 2024 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

As the leader in new infrastructure construction, what is the

In order to speed up the construction of 5G "new infrastructure", on March 12, Telecom announced that it will complete the joint construction of 250,000 5G base stations across the

China has a total of 3.189 million 5G base stations

The number of 5G base stations per 10,000 people has reached 22.6. Over 90% of 5G base stations are built and shared, and the 5G network is accelerating towards intensive, efficient,

China''s regulator pushes 5G network construction amid virus

Feb 25, 2020 · Leading telecom operator China Unicom said on Feb 23 it will work with China Telecom to finish the construction of 250,000 5G base stations across the country by the end

China Telecom to Open More than 300,000 5G Base Stations

It is expected that by the end of the third quarter, more than 300,000 5G base stations will be opened, covering all urban areas, some county owns and developed townships in the country.

Construction of the world''s largest 5G network has begun,

Domestic 5G construction is also in full swing. At the end of last year, the three major operators proposed the goal of completing the construction of 550,000 5G base stations in 2020. Mobile

6 FAQs about [Communications 5g base station construction in the third quarter]

How many 5G base stations will China build in 2025?

China plans to construct over 4.5 million 5G base stations in 2025 while introducing additional policy and financial incentives to support industries expected to shape the next decade, the country’s Ministry of Industry and Information Technology (MIIT) announced during its annual work conference.

Who are 5G base stations suppliers?

Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market. China has installed around 12 times as many 5G base stations as the United States.

What are the prospects of the 5G base station market?

Because of the increased need for high-speed data with low latency, the 5G base station market is likely to develop significantly throughout the forecast period. Furthermore, the growth of the 5G IoT ecosystem and vital communication services is expected to provide lucrative prospects for the 5G base station market to expand.

Which countries dominated the 5G base station market in 2024?

Asia Pacific dominated the global 5G base station market in 2024. Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market.

Will 5G Revolution & 6G innovation be a priority next year?

The move comes as the country charted its vision for industrial growth during a two-day work conference of the Ministry of Industry and Information Technology. With 4.19 million 5G base stations already in operation, the industry regulator said that "promoting 5G revolution and 6G innovation will be one of the priorities" next year.

Where is the first 5G base station made?

Back in July of last year, Verizon received the first U.S. manufactured 5G base station from a facility in Texas. Pictured is Verizon's CTO Kyle Malady holding some of the hardware. Image used courtesy of Ericsson

Learn More

- Khartoum Communications 5G Base Station Construction Greenland

- Equatorial Guinea Communications 5g Micro Base Station Construction Tendering Company

- China Communications 5g Base Station 2MWH

- Avaru Communications earliest 5g base station deployment

- Belize Communications 5G Base Station Progress

- Saudi Arabia Communications 5G Base Station Hybrid Power Supply

- Jakarta 5g communication base station inverter construction project

- 5g communication base station super capacitor construction hybrid power supply

- Tripoli Communications Photovoltaic Base Station Construction Tender

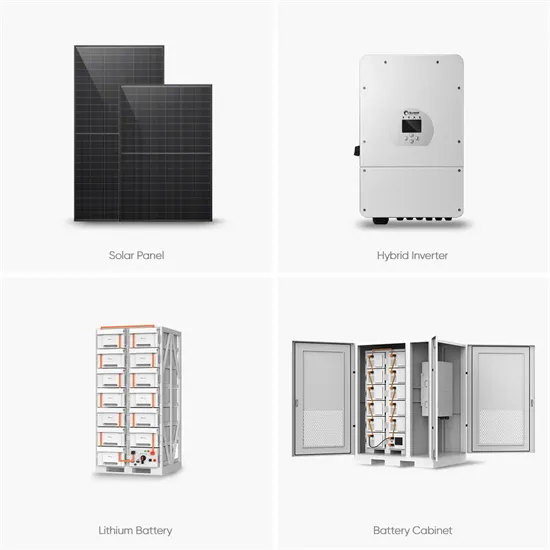

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.