Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

Equatorial Guinea Industrial 5G Market (2025-2031) | Trends,

6Wresearch actively monitors the Equatorial Guinea Industrial 5G Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Enabling Ubiquitous Global Communications in Equatorial Guinea

The Swap from 2G to 3G is at 89% with 134 modernized base station while the Roll-Out of 4G is at 94% with 87 LTE base stations implemented. The modernization project has transformed

Enabling Ubiquitous Global Communications in

Jul 5, 2022 · The Swap from 2G to 3G is at 89% with 134 modernized base station while the Roll-Out of 4G is at 94% with 87 LTE base stations implemented. The modernization project has

Base Station Antennas for the 5G Mobile System

Dec 19, 2018 · The fifth-generation (5G) mobile communication system will require the multi-beam base station. By taking into account millimeter wave use, any antenna types such as an array,

Enabling Ubiquitous Global Communications in Equatorial Guinea

Dec 28, 2022 · The Swap from 2G to 3G is at 89% with 134 modernized base station while the Roll-Out of 4G is at 94% with 87 LTE base stations implemented. The modernization project

Optimal Slicing of mmWave Micro Base Stations for 5G

Oct 11, 2023 · Network op-erators have taken proactive steps to address these dificulties by gradually adopting the deployment of micro base stations (μBS). Integrating these μBS

Tender for Equatorial Guinea energy storage station

Tendering will open this week for a 20MW battery energy storage system (BESS) pilot project in Pakistan could help shape the creation of an ancillary services market. The tender has been

Equatorial Guinea Telecom Tenders, Bids and RFP

Latest Equatorial Guinea Telecom Tenders, Government Bids, RFP and other public procurement notices related to Telecom from Equatorial Guinea. Users can register and get updated

Equatorial Guinea 5G Antennas Market (2024-2030) | Trends,

Historical Data and Forecast of Equatorial Guinea 5G Antennas Market Revenues & Volume By Base Station for the Period 2020-2030 Historical Data and Forecast of Equatorial Guinea 5G

Enabling Ubiquitous Global Communications in

Jul 5, 2022 · In addition to network evolution, a single RAN provides a simplified network topology, deployment, operation, and maintenance: one base station and one controller for multiple

Equatorial Guinea: Communications Change Lives

Mar 19, 2014 · With these services, Equatorial Guinea is now recognized internationally and regionally. Close cooperation between ZTE and our Ministry of Telecommunications has

Enabling Ubiquitous Global Communications in

Jul 5, 2022 · Abstract: This paper focuses on the modernization of the first national Mobile Network of Equatorial Guinea, called GETESA. The government''s decision to invest and take

East China province sees steady progress in 5G base

Source:xinhua 2022-11-04 The number of 5G base stations in east China''s Jiangsu Province registered stable growth amid the province''s efforts to foster 5G development in recent years,

Nokia and Elisa modernize network for Advanced 5G era

It utilizes Nokia''s advanced AirScale base station portfolio, baseband and radio hardware and software to enhance Nokia''s massive MIMO capabilities further by providing a significant leap

Equatorial Guinea 5G Substrate Materials Market (2025-2031

Historical Data and Forecast of Equatorial Guinea 5G Substrate Materials Market Revenues & Volume By Base Station Antennas for the Period 2021-2031 Equatorial Guinea 5G Substrate

Government tenders from Equatorial Guinea

Aug 14, 2025 · Discover 41+ Equatorial Guinea Government tenders - Get latest tenders, RFP, eProcurement from government of Equatorial Guinea. Explore opportunities and start bidding

Equatorial Guinea Tenders

5 days ago · Find relevant Equatorial Guinea tenders on official and local websites, journals, newspapers or on aggregator portals like Global tenders. Check Eligibility to bid for the

Report | 5G Base Station Construction Market-Global

The global 5G Base Station Construction market was valued at xx million in 2020 and is projected to reach US$ xx million by 2027, at a CAGR of xx% during the forecast period. Research has

Low-Carbon Sustainable Development of 5G Base Stations in

May 4, 2024 · As 5G serves as the foundation for the construction of new infrastructure, China, as the world leader in 5G base station construction, has already built over 1.4 million 5G base

Global 5G Base Station Construction Market 2021 by Key

The 5G Base Station Construction market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share,

Global 5G Base Station Construction Market 2020 by Key

Competitive Landscape and 5G Base Station Construction Market Share Analysis 5G Base Station Construction competitive landscape provides details by vendors, including company

6 FAQs about [Equatorial Guinea Communications 5g Micro Base Station Construction Tendering Company]

What are Equatorial Guinea government tenders?

Government of Equatorial Guinea tenders are covered from all departments including - Equatorial Guinea government awards contracts for goods and services across all industries. The most popular categories for Equatorial Guinea government procurement are - Equatorial Guinea Government releases various kinds of tenders -

Does Equatorial Guinea have a government procurement system?

Equatorial Guinea's government procurement, despite recent improvements. The national eGP platform lists tenders and contracts. In 2023, 547 tenders were awarded, a fraction of published bids. With a new focus on efficiency and international standards, Equatorial Guinea aims to attract wider participation and ensure resources benefit the nation.

What is Equatorial Guinea RFP & RFQ?

Equatorial Guinea RFP - A document outlining the Equatorial Guinea government's requirements for a proposed project or service, inviting vendors to submit detailed proposals. Equatorial Guinea RFQ - An RFQ is sent to potential suppliers to solicit specific pricing for goods or services by the Equatorial Guinea's government.

What is Equatorial Guinea RFQ and EOI?

Equatorial Guinea RFQ - An RFQ is sent to potential suppliers to solicit specific pricing for goods or services by the Equatorial Guinea's government. Equatorial Guinea EOI - An EOI is published by Equatorial Guinea's authorities as a preliminary inquiry to gauge interest and capability before issuing a formal tender.

How many telecommunication companies are in Equatorial Guinea?

Equatorial Guinea has three telecommunication companies: GETESA, Muni and Gecomsa. Getesa is the largest and the historical Equatorial Guinea telecommunication company established in 1987. The Government of Equatorial Guinea holds 60% of the company whereas France Cable held 40% until it transferred its shares to Orange in 2010.

What was the first national mobile network of Equatorial Guinea?

This paper focuses on the modernization of the first national Mobile Network of Equatorial Guinea, called GETESA. Equatorial Guinea has three telecommunication companies: GETESA, Muni and Gecomsa. Getesa is the largest and the historical Equatorial Guinea telecommunication company established in 1987.

Learn More

- Equatorial Guinea 5G network base station hybrid energy

- 5g base station construction communication company

- Israel Communications 5g base station main construction

- Yemen Communications Company 5G Base Station Bidding

- Khartoum Communications 5G Base Station Construction Greenland

- Communications 5g base station construction in the third quarter

- Kigali Communications 5G Base Station News

- Gitega Communications 5G base station density

- Riga Communications 5G base station to be built in 2025

Industrial & Commercial Energy Storage Market Growth

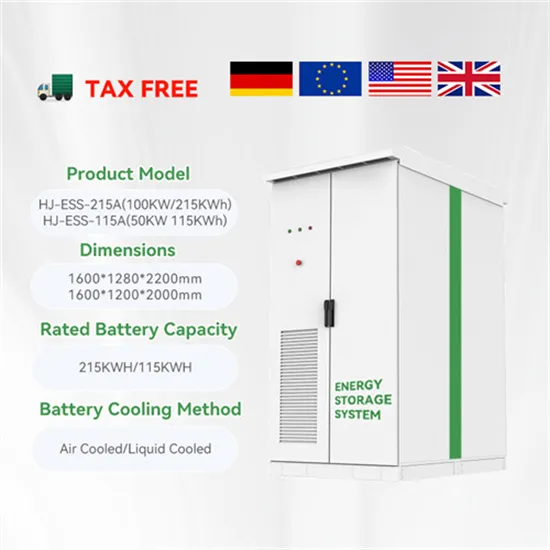

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

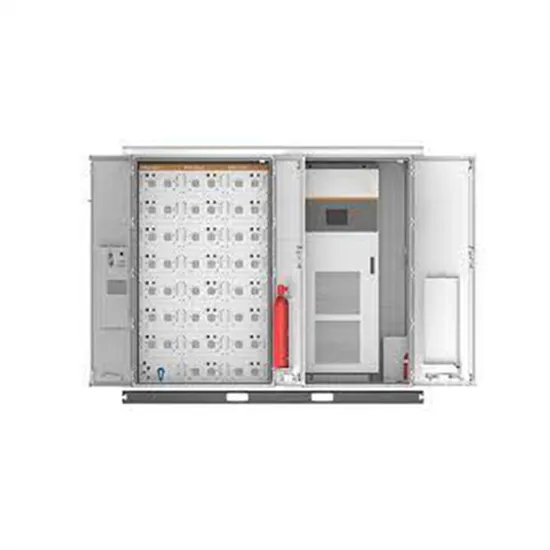

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.