United States 5G Base Station Market to Witness Significant

Dublin, March 11, 2024 (GLOBE NEWSWIRE) -- The "United States 5G Base Station Market: Prospects, Trends Analysis, Market Size and Forecasts up to 2030" report has been added to

5G Communication Base Stations Participating in Demand

Aug 20, 2021 · The 5th generation mobile networks (5G) is in the ascendant. The 5G development needs to deploy millions of 5G base stations, which will become considerable

Global 5G Base Station Construction Supply, Demand and

The global 5G Base Station Construction market size is expected to reach $ million by 2029, rising at a market growth of % CAGR during the forecast period (2023-2029). This report

5G base stations to proliferate widely

2 days ago · A China Mobile employee checks a 5G base station in Xiangyang, Hubei province. [Photo by Yang Tao/For China Daily] Plan is to establish high-speed, smart, green, safe and

Telecom carriers to ramp up work on 5G base stations

Specifically, in the first half of this year, they will build 100,000 5G base stations in total, which can cover 47 cities with 5G signals. In the meantime, China Mobile, the nation''s biggest telecom

5G Mobile Communication Base Station Electromagnetic

Dec 15, 2023 · Abstract. The current national policies and technical requirements related to electromagnetic radiation administration of mobile communication base stations in China are

Mingzhenghong Electronics Assists in 5G Base Station Construction

Mingzhenghong Electronics assists in the construction of 5G base stations and promotes the development of future communication technologies by developing and manufacturing high

Global 5G Base Station Construction Sales Market Report,

Feb 21, 2025 · Chapter 6: Region analysis by company, by Type, by Application, revenue for each segment. Chapter 7: Provides profiles of key manufacturers, introducing the basic situation of

Shanghai Has Built Over 72,000 5G Macro Base Stations

Jul 3, 2023 · Shanghai has accumulated over 72,000 outdoor 5G base stations and 310,000 indoor small stations, promoted about 900 "dual-gigabit" innovative applications, and created

Global 5G Base Station Construction Market 2023 by Company

According to our (Global Info Research) latest study, the global 5G Base Station Construction market size was valued at USD million in 2022 and is forecast to a readjusted size of USD

Global and India 5G Base Station Construction Market

The global 5G Base Station Construction revenue was US$ million in 2022 and is forecast to a readjusted size of US$ million by 2029 with a CAGR of % during the review period (2023-2029).

Coming up next: 5G, digital ''breakthroughs''

Mar 22, 2021 · China''s efforts to quicken the rollout of the fifth-generation or 5G wireless technology will spawn a wide range of new applications in the consumer and industrial sectors,

Shanghai accelerates dual-megabits network construction with 5G

Aug 13, 2024 · Shanghai is set to revolutionize its telecommunications landscape by embarking on an ambitious project to establish a dual-megabits network, with plans to construct a total of

Across China: What 5G telecom towers can offer in China''s

This photo taken on July 25, 2022 shows a 5G base station constructed by China Tower in Suzhou, east China''s Jiangsu Province. With over 3.8 million 5G base stations now

Top 10 global 5G infrastructure companies and

Jul 4, 2023 · As 5G continues to revolutionise the industry, we round up the Top 10 companies shaping the future of the technology - and those at the forefront

China''s strides in advancing 5G development

Jun 6, 2024 · Today, with over 3.7 million 5G base stations installed nationwide, the large-scale application of 5G in China has greatly benefited both individuals and businesses, bringing

Modeling 5G shared base station planning problem using an

Nov 1, 2024 · With the cost of 5G network construction surges, Base Station (BS) sharing is becoming more and more popular among operators nowadays. A typical scenario of 5G

Ericsson, KDDI deploy underground 5G base stations in Japan

May 15, 2023 · Ericsson (NASDAQ: ERIC) was selected by the Japanese communications service provider KDDI as a partner for Japan''s first vault 5G base stations. The company will

5G Base Station Construction Market Report: Industry Drivers

Jun 22, 2025 · Los Angeles, USA - 5G Base Station Construction market is estimated to reach USD xx Billion by 2024. It is anticipated that the revenue will experience a compound annual

6 FAQs about [5g base station construction communication company]

How many 5G base stations are there in China?

With 4.19 million 5G base stations already operational across China, the MIIT emphasized that “promoting 5G revolution and 6G innovation will be one of the priorities” for 2025, according to a report by Chinese newspaper China Daily. Chinese main operators are China Mobile, China Telecom and China Unicom.

Who are 5G base stations suppliers?

Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market. China has installed around 12 times as many 5G base stations as the United States.

Where is the first 5G base station made?

Back in July of last year, Verizon received the first U.S. manufactured 5G base station from a facility in Texas. Pictured is Verizon's CTO Kyle Malady holding some of the hardware. Image used courtesy of Ericsson

What are the prospects of the 5G base station market?

Because of the increased need for high-speed data with low latency, the 5G base station market is likely to develop significantly throughout the forecast period. Furthermore, the growth of the 5G IoT ecosystem and vital communication services is expected to provide lucrative prospects for the 5G base station market to expand.

What is the range of a 5G base station?

5G base stations use millimeter waves that are extremely limited in range. Each 5G base station has a range of between 800–1000 feet, or 0.15–0.19 miles. It makes up for its limited range by surpassing 4G in other key areas: data transfer speeds (bandwidth), latency, and capacity.

Who are the major players in the 5G base station market?

The major players in the market are Airspan Network, Cisco Systems Inc., Ericsson, Huawei technologies co. Ltd., Qualcomm Technologies, Inc., Samsung, Marvell, NEC Corporation, Nokia Corporation, and ZTE corporation amongst others are a few major companies operating in the 5G Base Station Market.

Learn More

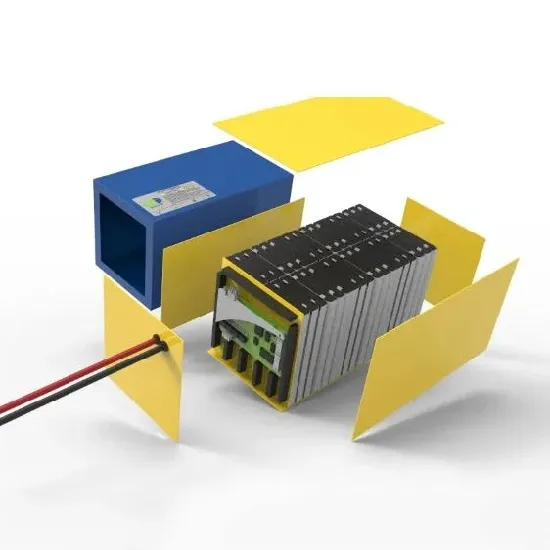

- Communication base station battery energy storage system construction company

- South Tarawa Communication 5G Base Station Construction Project

- Equatorial Guinea Communications 5g Micro Base Station Construction Tendering Company

- Rwanda 5G communication base station wind and solar complementary construction

- 5g communication base station flywheel energy storage construction

- Uzbekistan 5g communication base station wind power construction project

- Jakarta 5g communication base station inverter construction project

- Communication 5g base station construction efficiency

- Timor-Leste 5G communication base station hybrid energy construction project bidding

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.