Base station interoperability testing for the post

Jul 12, 2023 · As part of the "Research and Development Project of the Enhanced Infrastructures for Post-5G Information and Communication Systems" under

北美 5G 基地台市場預測至 2030 年

Jun 4, 2024 · The North America 5G base station market was valued at US$ 4,501.44 million in 2022 and is expected to reach US$ 13,246.30 million by 2030; it is estimated to register a

5G Base Station Construction Market Report: Trends,

Mar 13, 2025 · These emerging trends are transforming the base station construction market by driving innovation and improving the efficiency of 5G networks. With the combination of small

How Baseband Boards Contribute to 5G and Beyond

Aug 15, 2025 · The transition from 4G to 5G base stations has been driven by significant advancements in hardware and software technologies. 5G base stations incorporate cutting

Fujitsu and NEC significantly improve efficiency

Jul 12, 2023 · Fujitsu and NEC significantly improve efficiency of base station interoperability testing for the post-5G era Time for testing reduced by nearly

North America 5G Base Station Market Forecast to 2030

Jun 4, 2024 · North America 5G Base Station Market Forecast to 2030 - Regional Analysis - by Component, Frequency Band, Cell Type, and End User - The North America 5G base station

North America 5G Base Station Equipment Market: Market

Jun 28, 2025 · The North America 5G base station equipment market has witnessed significant growth driven by increased demand for high-speed wireless communication infrastructure.

The State of 5G Deployment Around the World (2024)

Sep 19, 2024 · This growth is driven by regions like Asia and the Pacific, North America, and Europe, where countries are intensively investing in 5G networks to support advances such as

Renewable energy powered sustainable 5G network

Feb 1, 2021 · A massive increase in the amount of data traffic over mobile wireless communication has been observed in recent years, while further rapid growth is expected in

5G Base Station Construction Market Report: Industry Drivers

Jun 22, 2025 · In summary, the 5G Base Station Construction Market is influenced by regional nuances, with North America and Asia-Pacific demonstrating robust growth, while Europe and

5G Base Station Market is estimated to record a CAGR of

Dec 12, 2024 · The leading 5G base station market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new

5G Base Station Market By Share, Size and Forecast 2028

North America dominates the Global 5G Base Station Market in 2022. North America, particularly the United States, was among the first regions to roll out commercial 5G networks.

North America AFU of 5G Base Station Market By Application

Aug 11, 2024 · The North America market for 5G base stations, focusing on application-specific deployment units (AFU), shows significant segmentation across various industries. In the

5G in the North America region – Ericsson Mobility Report

Aug 15, 2025 · The North America region has made impressive progress in deploying 5G. Discover the latest subscription and data trends for the US and Canada in our forecast.

The rise of 5G technologies and systems: A quantitative

May 1, 2022 · That early evolution is explored here in the case of "5G", the fifth generation of wireless communication devices and systems. The 5G technology is a landmark for new

5G Base Station Market Size to Hit US$ 468.9 Billion by 2032

Jul 28, 2024 · According to the 5G base station industry analysis, North America has emerged as a leading and rapidly growing region in the 5G base station market. The United States, in

North America 5G Communication Base Station Backup

Jul 17, 2024 · With estimates to reach USD xx.x billion by 2031, the "North America 5G Communication Base Station Backup Power Supply Market " is expected to reach a valuation

6 FAQs about [North America Communications 5G Base Station Project]

How big is the 5G base station market?

5G Base Station Market size was valued at USD 11.20 Billion in 2021 and is projected to reach USD 194.26 Billion by 2030, growing at a CAGR of 37.3% from 2022 to 2030. Because of the increased need for high-speed data with low latency, the 5G base station market is likely to develop significantly throughout the forecast period.

Where is the first 5G base station made?

Back in July of last year, Verizon received the first U.S. manufactured 5G base station from a facility in Texas. Pictured is Verizon's CTO Kyle Malady holding some of the hardware. Image used courtesy of Ericsson

Why do we need 5G base stations?

Moreover, the proliferation of IoT devices and the increasing interconnectivity of smart cities, autonomous vehicles, and industrial automation further contribute to the demand for high-speed data connectivity. 5G base stations play a pivotal role in delivering the required network capacity and performance to support these emerging applications.

How will 5G networks contribute to the revitalization of telecommunications infrastructure?

They will aim to contribute to the revitalization of the telecommunications infrastructure market by supporting the global spread and development of open 5G networks. 1.

What is 5G & how does it work?

5G technology addresses these demands by offering significantly faster download and upload speeds compared to previous generations of wireless technology. 5G networks can provide multi-gigabit-per-second data rates, enabling users to access and share large amounts of data quickly and seamlessly.

Is 5G the future of digital transformation?

1. Background As digital transformation (DX) advances in various industries, fifth-generation mobile communications systems (5G) are being deployed globally as the infrastructure for DX. In the post-5G era, ultra-low latency, massive simultaneous connectivity, and other 5G functions will be further enhanced and become more widespread.

Learn More

- North America Communications 5G Pilot Base Station

- Phnom Penh Communications 5G Base Station Project Department

- Seychelles Communications 5g signal base station

- How many hours does it take to build a 5G base station in Astana Communications

- Doha Communications 5g base station settings

- Belize Communications 5G Base Station Progress

- Marshall Islands Communications 5G Base Station Tender Results

- Namibia Communication Network 5G Base Station Upgrade Project

- Equatorial Guinea Communications 5g Micro Base Station Construction Tendering Company

Industrial & Commercial Energy Storage Market Growth

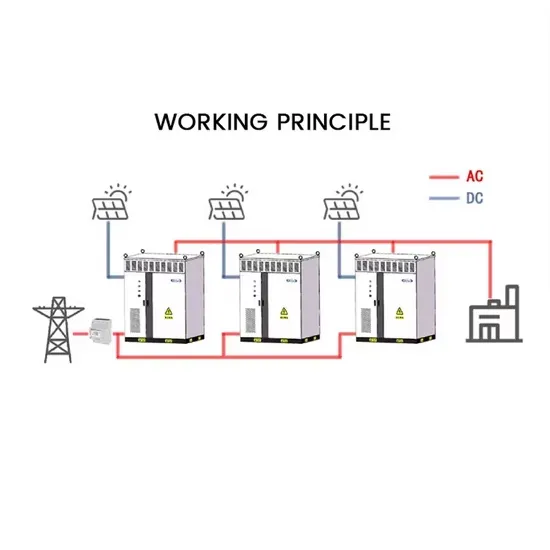

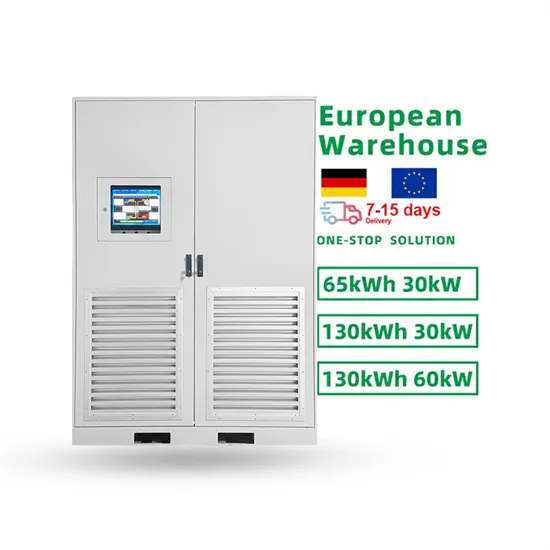

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

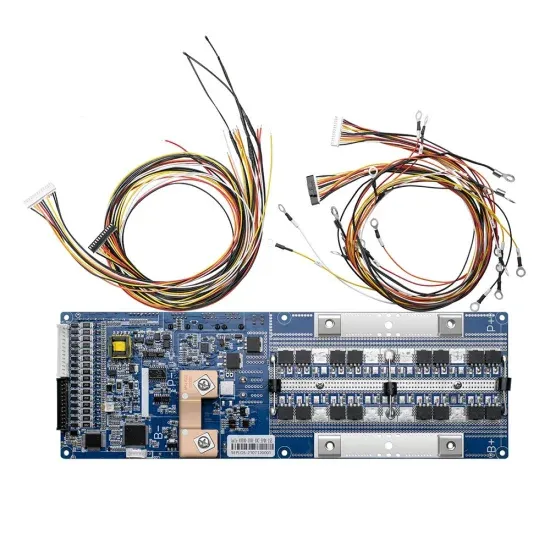

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.