Ericsson Delivers First U.S. Manufactured 5G Base Station to

Jun 10, 2025 · Verizon has become the first U.S. communications service provider to receive a 5G base station manufactured at Ericsson''s new 5G production factory in Texas. Kyle Malady,

China Telecom Opens 5G Pilot Base Stations in Six Cities

Aug 1, 2025 · On December 2, China Telecom opened 5G pilot base stations in Lanzhou. At present, China Telecom has launched 5G pilot base stations in six cities, namely Xiong''an,

5G Base Station Construction Market Report: Trends,

Mar 13, 2025 · 5G Base Station Construction Market Report: Trends, Forecast and Competitive Analysis to 2031 - The future of the global 5G base station construction market looks

5G Base Station Construction Market Report: Trends,

Mar 13, 2025 · Segmentation Analysis: 5G base station construction market size by type, application, and region in terms of value ($B). Regional Analysis: 5G base station construction

North America 5G Base Station Equipment Market: Market

Jun 28, 2025 · The North America 5G base station equipment market has witnessed significant growth driven by increased demand for high-speed wireless communication infrastructure.

5G Base Station Market Trends, Growth & Forecast 2032

Also, North America accounted for a significant share of the 5G base station market. The solid investment by telecommunication operators and a supportive regulatory environment

5G Wireless Base Station Market Growth Research Report

Jul 28, 2025 · 5G Wireless Base Station Market Size The 5G Wireless Base Station Market was valued at USD 21,000 million in 2023 and is expected to decrease to USD 20,769 million in

North America 5G Communication Base Station Body Market

Jul 17, 2024 · The North America 5G Communication Base Station Body Market varies across regions due to differences in offshore exploration activities, regulatory frameworks, and

North America 5G Communication Base Station Backup

Jul 17, 2024 · With estimates to reach USD xx.x billion by 2031, the "North America 5G Communication Base Station Backup Power Supply Market " is expected to reach a valuation

North America AFU of 5G Base Station Market Size,

Jun 29, 2025 · The North America AFU (Active Frequency Unit) of 5G base station market is rapidly growing as the demand for high-speed, low-latency communication networks accelerates.

North America 5G Base Station Market Forecast to 2030

Jun 4, 2024 · North America 5G Base Station Market Forecast to 2030 - Regional Analysis - by Component, Frequency Band, Cell Type, and End User - The North America 5G base station

What will be the future brought with the next generation of

Together with Tokyu Corporation, Sumitomo Corporation will also carry out pilot experiments for sharing 5G base stations among communications companies. By January 2020, experiments

North America 5G Communication Base Station Antenna

Jul 22, 2024 · New Jersey: The North America 5G Communication Base Station Antenna market is poised for unprecedented growth, driven by innovative applications and technological

6 FAQs about [North America Communications 5G Pilot Base Station]

What is 5G base station market report?

5G Base Station Market Report is Segmented by Type (Small Cell and Macro Cell), by End User (Commercial, Residential, Industrial, Government, Smart Cities, and Other End Users), and by Geography (North America, Europe, Asia Pacific, Latin America, Middle East and Africa).

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

What is 5G Americas?

5G Americas provides global, North American and Latin American statistics relating to 5G and LTE networks. The information provided here is based on data provided from Omdia ‘s extensive database of network-related statistics. 5G Americas is an industry trade organization composed of leading telecommunications service providers and manufacturers.

What is a 5G base station?

A 5G network base-station connects other wireless devices to a central hub. A look at 5G base-station architecture includes various equipment, such as a 5G base station power amplifier, which converts signals from RF antennas to BUU cabinets (baseband unit in wireless stations).

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

What is 5G radio access network (ran)?

The deployment of 5G antenna systems and 5G radio access network (RAN) components further underscores these benefits, ensuring comprehensive coverage and connectivity. The 5G small cell segment continues to dominate the global 5G base station market, commanding approximately 60% of the market share in 2024.

Learn More

- North America Communications 5G Base Station Project

- Magadan Communications 5G Base Station Tender 2025

- Communications 5g base station construction in the third quarter

- Kigali Communications 5G Base Station News

- How many communication base station flywheel energy storages are there in North America

- Vaduz Communications Civilian 5G Base Station Installation Progress

- Belize Communications 5G Base Station Progress

- Israel Communications 5g base station main construction

- China Communications 5G Base Station Energy Method

Industrial & Commercial Energy Storage Market Growth

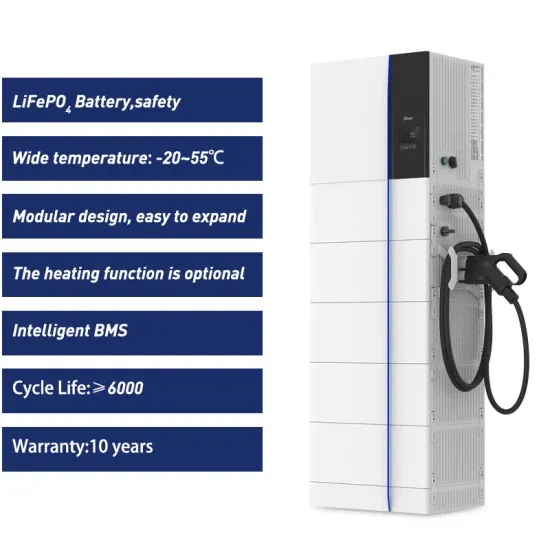

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.