Telecom Tenders 2025: From 5G Infrastructure to Village

May 30, 2025 · With billions of dollars in investment and a clear policy push for digital and rural connectivity, 2025 is set to be a landmark year for telecom tenders in India. Whether it''s 5G

Ambitious 5G base station plan for 2025

Dec 29, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

China to accelerate 5G revolution, 6G innovation

Aug 16, 2025 · China plans to build 4.5 million 5G base stations and develop more future industries in 2025, said the Ministry of Industry and Information

25 crore mobile subscribers using 5G in India as

Mar 22, 2025 · Reliance Jio: It added that telecom operators have cumulatively deployed 4.69 lakh 5G base stations nationwide, as of February 28, 2025, to

Ambitious 5G base station plan for 2025 | GDToday

Dec 28, 2024 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

Ambitious 5G base station plan for 2025_news_english_QiluNet

Dec 30, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

China Mobile Aggregates 480,000 5G Base Stations in

China Mobile Procurement and Bidding Network recently released a single-source procurement announcement for 2024-2025 5G wireless main equipment (2.6GHz/4.9GHz, 700MHz). The

Türkiye plans 5G tender for August, first signals expected in

Jun 22, 2025 · T ürkiye''s Transport and Infrastructure Minister Abdulkadir Uraloglu announced that the country plans to hold its 5G tender in August, with the first 5G signals expected to be

Malaysia Telecommunications bids and eProcurement

Aug 18, 2025 · View Telecommunications government contracts and RFPs from Malaysia. Bid on readily available Telecommunications tenders from Malaysia with the best and oldest online

Ambitious 5G base station plan for 2025

Dec 28, 2024 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

5G mobile communication rollout in Kazakhstan

Jun 18, 2024 · Regarding further development of 5G technology, Kcell and Tele2 operators will continue to expand 5G coverage in the cities of Astana, Almaty,

5G Base Station Chips: Driving Future Connectivity by 2025

Nov 27, 2024 · Analysts predict the 5G base station chip market will grow at a compound annual growth rate (CAGR) of over 13.1 % from 2024 to 2030. Key trends include: AI Integration:

How 5G Base Stations Are Powering the Future of Connectivity

Feb 6, 2025 · The dawn of the 5G era has ushered in unprecedented advancements in connectivity, transforming industries, lifestyles, and global economies. At the heart of this

6 FAQs about [Magadan Communications 5G Base Station Tender 2025]

Will China build a 5G base station next year?

Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the country's top industry regulator said on Friday.

Which telco will supply 5G base stations in 2023 & 2024?

Huawei Technologies has secured a major contract that will see it supply over half of the 5G base stations for telco China Mobile between 2023 and 2024. In total, Huawei has won 52 percent of China Mobile’s 5G base station work, as part of the largest portion of the contracts put out for tender this year, according to Yicai Global.

Which companies have been awarded a 5G contract?

Smaller contracts were also awarded to Datang Mobile Communications Equipment, Ericsson, and Nokia Shanghai Bell. China Mobile plans to operate more than 1.6 million 5G base stations this year, increase its number of cloud servers by more than 240,000 units, and add 40,000 external data center racks.

Who are China's 5G operators?

Chinese main operators are China Mobile, China Telecom and China Unicom. In addition to its expected expansion in the 5G field, China noted that it is also set to begin trials for 10-gigabit optical networks and enhance computing power infrastructure, reflecting the growing demand for artificial intelligence (AI) technologies.

Who won a 5G contract in China?

Huawei wasn't the only Chinese vendor to win a sizeable chunk of the tender, with ZTE the second-largest winner with around 26 percent of the contract, equivalent to 23,227 5G base stations. Smaller contracts were also awarded to Datang Mobile Communications Equipment, Ericsson, and Nokia Shanghai Bell.

Will 5G Revolution & 6G innovation be a priority next year?

The move comes as the country charted its vision for industrial growth during a two-day work conference of the Ministry of Industry and Information Technology. With 4.19 million 5G base stations already in operation, the industry regulator said that "promoting 5G revolution and 6G innovation will be one of the priorities" next year.

Learn More

- Moroni Communications 5G Base Station in 2025

- Riga Communications 5G base station to be built in 2025

- Marshall Islands Communications 5G Base Station Tender Results

- Tripoli Communications Photovoltaic Base Station Construction Tender

- China Communications Domestic 5G Base Station

- Khartoum Communications 5G Base Station Construction Greenland

- North America Communications 5G Pilot Base Station

- Doha Communications 5g base station settings

- China Communications 5G Base Station Energy Method

Industrial & Commercial Energy Storage Market Growth

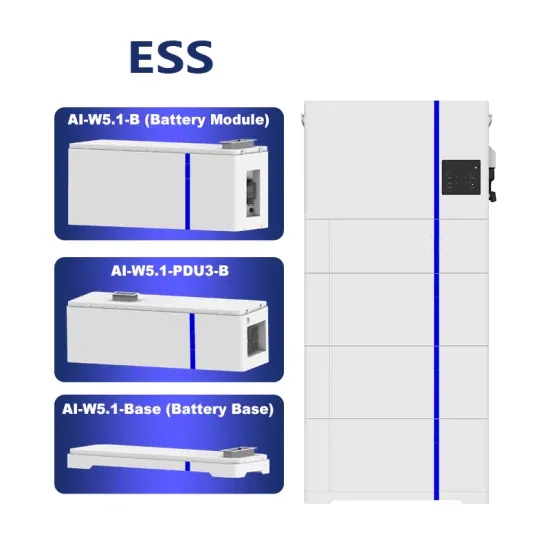

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.