Understanding Battery Labels: A Quick Reference Guide

Apr 11, 2025 · What do battery labels mean? Battery labels provide critical information about chemistry (e.g., alkaline, lithium), voltage, capacity, safety certifications, and disposal

Use of the New Hazard Class 9 Lithium Battery Label

Nov 23, 2017 · One significant change to the hazard communication regulations for lithium batteries or cells is the phase in of the new Hazard Class 9 Lithium Battery label to replace the

2020 Lithium Battery Guidance Document

Jan 8, 2020 · Lithium-ion batteries (sometimes abbreviated Li-ion batteries) are a secondary (rechargeable) battery where the lithium is only present in an ionic form in the electrolyte. Also

UN 3090: Lithium metal batteries including lithium alloy batteries

Substance information for UN 3090 - Lithium metal batteries including lithium alloy batteries based on the Hazardous Materials Table (Title 49 CFR 172.101) to assist in preparing a risk

How to Identify a Lithium Battery: A Complete Guide

Codes such as CR (coin cells) or IATA Class 9 labels indicate lithium chemistry. Rechargeable variants may include "R" prefixes (e.g., RCR123A). Regulatory marks like UN38.3 certification

What Hazard Class Are Lithium Batteries?

Aug 8, 2025 · Specific Lithium Battery Classifications Within Class 9, lithium batteries are further differentiated by chemical composition and configuration, each assigned a specific UN

Understanding Lithium Battery Hazards: A Guide to Class 9

Feb 13, 2025 · This article explores the Class 9 hazard label associated with lithium batteries, what it signifies, and crucial safety tips for handling these powerhouses. What

LITHIUM BATTERIES

2 days ago · Lithium batteries not shipped in same package as Class Y N 1.4, 2.1, 3, 4.1, 4.2, 4.3, 5.1, 5.2 and 8 and 2.2 with Cargo Aircraft Only label, including All Packed in One and Overpack.

Un 3480 lithium ion batteries class 9

Lithium batteries are classified in Class 9 - Miscellaneous dangerous goods as: UN 3090, Lithium metal batteries; or; UN 3480, Lithium-ion batteries; or, if inside a piece of equipment or packed

Understanding Lithium Battery Hazards: A Guide to Class 9

Feb 13, 2025 · Lithium batteries are integral to our modern world, powering everything from smartphones to electric vehicles. However, with their increasing ubiquity comes the need for

How to Decode a Lithium-ion Battery Data Plate?

Mar 3, 2025 · What Information Is Found on a Lithium-ion Battery Data Plate? A lithium-ion battery data plate provides critical specifications, including voltage (V), capacity (Ah or Wh),

LITHIUM METAL BATTERIES

3 days ago · All Lithium Batteries (Section I/IA/IB and Section II) in all packing instructions must not be shipped in the same package with the following Hazard Classes/Divisions: 1.4, 2.1, 3,

Class 9 Hazardous Goods and Lithium Battery Labeling Guide

May 14, 2025 · Use the right lithium battery labels to follow safety rules. Correct labels keep people and nature safe. Show UN numbers on packages to name dangerous items. This helps

6 FAQs about [Class 9 lithium battery pack identification]

Are lithium batteries class 9?

Lithium batteries are articles and are now assigned their own UN numbers: UN 3536 — lithium batteries installed in cargo transport unit lithium ion batteries or lithium metal batteries. All lithium batteries are Class 9 — miscellaneous dangerous substances and articles.

What does a class 9 Battery label mean?

The Class 9 label serves as a warning to those who handle these batteries. It indicates that the package contains lithium batteries which can potentially short-circuit, overheat, or catch fire, particularly if subjected to external pressure or piercing.

What are the New Hazard Communication Regulations for lithium batteries?

One significant change to the hazard communication regulations for lithium batteries or cells is the phase in of the new Hazard Class 9 Lithium Battery label to replace the currently used Class 9 Miscellaneous label. This short Power Point presentation will summarize these changes and the deadlines for compliance.

When is the New Hazard Class 9 lithium battery label acceptable?

The new Hazard Class 9 Lithium Battery Label is acceptable as of January 1, 2017 and mandatory as of January 1, 2019.

Are Li-ion batteries class 9 hazardous material?

All Li-ion batteries shipped under Class 9 hazardous material designation must meet the UN Manual of Test and Criteria, Part III, subsection 38.3. (This addresses safety.) Number of packages and gross weight per package. With PI 968 to PI 970, cells and battery packs must be packed in a rigid outer packaging.

What text should be included on a lithium battery label?

NOTE: No text other than the Class “9” must be included in the bottom part of the Lithium Battery Class 9 label. IATA 7.2.2.4 * Shipper must add UN number(s). It should be 12 mm high AND ** The phone number is optional. Printed or other static representations of this document are considered uncontrolled and for reference-only.

Learn More

- 12v41ah lithium battery pack production

- Energy-enabling lithium battery pack

- What equipment is needed to make lithium battery pack

- Reference price of Ethiopian quality lithium battery pack

- Kuwait low temperature lithium battery pack manufacturer

- Five parallel four series lithium battery pack

- Bhutan lithium battery pack factory

- Lithium battery PACK new nickel sheet

- Lithium battery pack and lead-acid battery pack

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

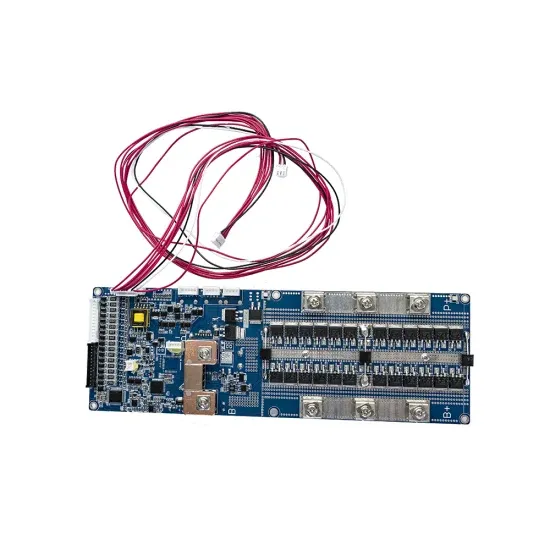

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.