Democratic Republic of Congo lithium battery charging

The mineral-rich Democratic Republic of the Congo (DRC) is often portrayed as a victim of exploitation by China, the US and Europe in their competition Today, DRC cobalt is shipped to

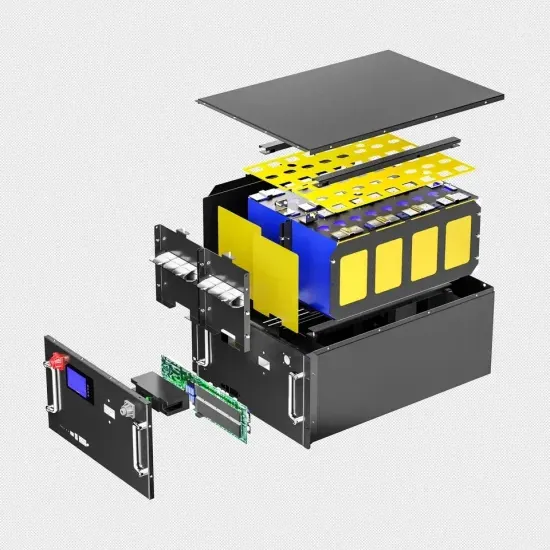

72v150ah Democratic Republic of Congo lithium battery pack

Zijin plans lithium production in Congo from early 2026 China''''s Zijin Mining Group aims to start producing lithium in the Democratic Republic of Congo early next year from one of the world''''s

Rechargeable battery prices in Democratic Republic of Congo

Can the Democratic Republic of the Congo produce lithium-ion battery cathode precursor materials? London and Kinshasa, November 24, 2021 – The Democratic Republic of the

Lithium battery storage cabinets in the Republic of Congo

Chinese Battery Giant CATL Buys Stake in Congo''''s Manono Lithium Project (Yicai Global) Sept. 29 -- Contemporary Amperex Technology is snapping up a 24 percent stake in one of the

Democratic Republic of Congo: Gates and Bezos invest in Manono lithium

Jul 29, 2025 · Two of the world''s wealthiest figures, Bill Gates and Jeff Bezos, are making a high-profile move into Africa''s critical minerals sector, backing a major lithium venture at the

Cobalt mining for lithium ion batteries has a high human

Sep 30, 2016 · Mobile power, human toll The world has grown reliant on lithium-ion batteries that power smartphones, laptops and electric cars. But the desperate search for the ingredients

Congo: Zijin Mining to launch lithium production in early 2026

Jan 7, 2025 · Chinese mining group Zijin Mining Group Co. is preparing to start producing lithium in the first quarter of 2026 in the Manono region in the south-east of the Democratic Republic

72v150ah Democratic Republic of Congo lithium battery pack

About 72v150ah Democratic Republic of Congo lithium battery pack With the rapid advancement in the solar energy sector, the demand for efficient energy storage systems has skyrocketed.

New lithium battery in the Republic of Congo

In battery boom cobalt-supply chain, Democratic Republic of Congo As a result, demand is surging for lithium-ion batteries and the materials needed to make them – including cobalt, a

Lithium battery assembly company in the Democratic Republic of Congo

The Democratic Republic of Congo (DRC) could build its own factory for the local manufacture of batteries for electric vehicles, thanks to its natural resources, notably cobalt and lithium.

Democratic Republic of Congo lithium battery filling system

The Democratic Republic of Congo (DRC) could become a major low-cost and low-emission producer of lithium-ion (Li-ion) battery precursors, says research company BloombergNEF in a

The United States plans to build a lithium-sulphur battery

Kinshasa, April 30th, 2025 (CPA) - The construction of a lithium-sulphur battery factory in the Democratic Republic of Congo to speed up industrialization was advocated during a visit by

Major lithium battery manufacturer in the Democratic

Democratic Republic of the Congo. its application in lithium-ion batteries for smartphones, laptops, and electric vehicles. In the medical industry, chains of major electronics and

China''s Zijin Plans Lithium Production in DR Congo From 2026

Jan 8, 2025 · China''s Zijin Mining Group plans to begin lithium production in early 2026 at the Manono project in the Democratic Republic of Congo, one of the world''s largest deposits of the

Lithium battery factory opens in the Republic of Congo

Can the Democratic Republic of the Congo produce lithium-ion battery cathode precursor materials? London and Kinshasa, November 24, 2021 – The Democratic Republic of the

ELECTRIC BATTERIES IN DEMOCRATIC REPUBLIC OF THE CONGO

Democratic Republic of Congo battery export companies list This list includes notable companies with primary headquarters located in the country. The industry and sector follow the Industry

Lithium battery assembly company in the Democratic

The Democratic Republic of the Congo could leverage its abundant cobalt resources and hydroelectric power to become a low-cost, low-emissions producer of lithium-ion battery

Lithium battery prices in the Republic of Congo

The Democratic Republic of Congo (DRC) could become a major low-cost and low-emission producer of lithium-ion (Li-ion) battery precursors, says research company BloombergNEF in a

6 FAQs about [Democratic Republic of Congo Electric Stacker Lithium Battery Pack]

Can the Democratic Republic of the Congo produce lithium-ion battery cathode precursor materials?

London and Kinshasa, November 24, 2021 – The Democratic Republic of the Congo (DRC) can leverage its abundant cobalt resources and hydroelectric power to become a low-cost and low-emissions producer of lithium-ion battery cathode precursor materials.

Why does the DRC rely on hydroelectric power plants?

This is due to the DRC’s proximity to cathode raw materials and heavy reliance on hydroelectric power plants.

How much cobalt does the DRC produce?

“The DRC produces about 70 per cent of global cobalt but captures just 3 percent of the battery and electric vehicle value chain.

How much would a DRC plant cost?

This is three times cheaper than what a similar plant in the U.S. would cost. A similar plant in China and Poland would cost an estimated $112 million and $65 million, respectively. Precursor material produced at plants in the DRC could be cost competitive with material produced in China and Poland but with a lower environmental footprint.

Does Zijin Mining have a lithium project in Congo?

Zijin Mining plans lithium production in Congo by 2026, leveraging one of the world’s largest lithium deposits. Legal disputes between AVZ Minerals and the Congolese government complicate development of the Manono lithium project.

How can Africa extend its access to the battery industry?

In so doing, the country and the rest of Africa can extend their access from the USD271 billion battery precursor segment to the more lucrative USD1.4 trillion combined battery cell production and cell assembly segments of the battery minerals global value chain.

Learn More

- Democratic Republic of Congo lithium battery station cabinet manufacturers ranked top ten

- Specialized in 60v lithium battery pack for electric tools

- Vilnius electric forklift lithium battery pack

- Electric flat car lithium battery pack

- Liberia electric storage vehicle lithium battery pack

- Saudi Arabia Electric Forklift Lithium Battery Pack

- Electric forklift lithium battery pack

- Copenhagen electric storage vehicle lithium battery pack

- Ulaanbaatar ups power lithium battery pack

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

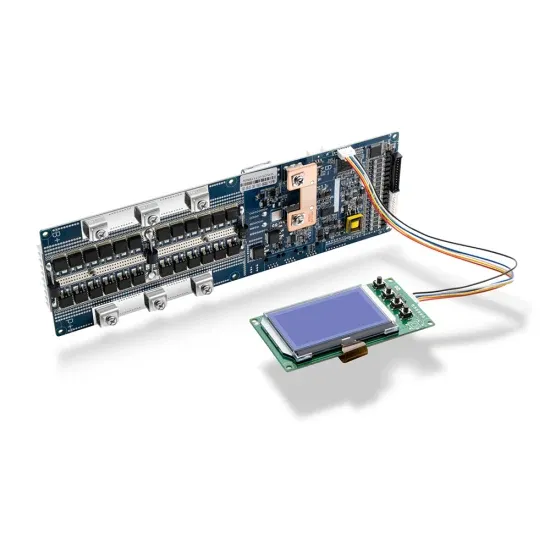

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.