Bolivian Salt Flats Lithium Extraction Bidding

Sep 3, 2024 · YLB (YLB) has announced that four companies are advancing in the bid to develop pilot lithium extraction plants in Bolivia''s salt flats. China''s

India''s lithium-ion cell supply chain – Leading

Apr 18, 2023 · To ensure a steady supply of raw materials for Lithium-ion battery production in the country, India will be obtaining lithium and cobalt in countries

Bolivians Push Back on ''Worst Possible'' Lithium Deal With

Feb 23, 2025 · Widespread outrage has erupted in Bolivia over the details of contracts officials signed with Chinese and Russian companies to exploit the country''s vast lithium reserves.

Case Study Monitoring of Lithium Accumulators Using

The replacement of lead batteries with LiFePO4 technology with a capacity of 266.2 KWh that supports the energy supply of an important telecom in Bolivia that provides data and Internet

Quantum Motors Opens Lithium Battery Factory

Jul 6, 2025 · The CEO of Quantum Motors, José Carlos Márquez, explained that the factory is an industry that was born as a vertical integration for the

Bolivia takes a key step on long road to tapping

Dec 15, 2023 · Bolivia cut the ribbon on its first industrial-scale lithium plant, the dawn of what it hopes will be an export boom of the battery metal that could

CATL''s $1.4 Billion Investment: A New Chapter For The Bolivian Lithium

Jun 19, 2023 · Chinese battery giant CATL, a global leader in electric vehicle batteries, has confirmed a $1.4 billion investment. This investment aims to develop Bolivia''s untapped lithium

Jinko, SMA, Cegasa work on largest lithium-ion

Jan 17, 2023 · The largest lithium-ion battery storage system in Bolivia is nearing completion at a co-located solar PV site, with project partners including Jinko,

Bolivia: Court orders suspension of Chinese and Russian lithium

Jun 2, 2025 · "Bolivian court pauses Chinese, Russian lithium deals", 02 June 2025Bolivia''s plans to emerge as a major lithium producer have hit an impasse after a local court ordered

Bolivia step closer to full lithium potential as

Jan 18, 2024 · Bolivia finalised a major deal this week with China''s largest battery producer CATL and largest cobalt miner CMOC in a move that could finally

6 FAQs about [Major lithium battery pack companies in Bolivia]

Where is the largest lithium-ion battery storage system in Bolivia?

The site in the municipality of Baures, Bolivia. Image: Cegasa. The largest lithium-ion battery storage system in Bolivia is nearing completion at a co-located solar PV site, with project partners including Jinko, SMA and battery storage provider Cegasa.

Could Bolivia finally untap its lithium resources?

Credit: Courtesy of psyberartist. Bolivia finalised a major deal this week with China’s largest battery producer CATL and largest cobalt miner CMOC in a move that could finally see the South American country untap the full potential of its huge lithium resources.

Does Bolivia have a lithium plant?

This follows a deal between Bolivia’s state-run lithium company, Yacimientos del Litio Bolivianos (YLB), and a Chinese consortium. CATL agreed to invest over $1 billion in the project’s first stage for rights to develop the two lithium plants. Despite being a global leader in electric vehicle batteries, CATL does not currently produce any lithium.

How can Bolivia leverage its lithium resources?

Bolivia can leverage its lithium resources by collaborating with international companies and governments with expertise in lithium production. Joint ventures and partnerships can provide access to capital, technology, and knowledge, accelerating the development of Bolivia’s lithium industry. Sustainable Practices to Develop Lithium in Bolivia

Will Bolivia develop a lithium extraction plant in its salt flats?

Bolivia aims to develop plants in seven of its 28 salt flats. (Image courtesy of YLB.) Bolivia state-owned Yacimientos de Litio Boliviano (YLB) has shortlisted four companies to advance into the next phase of a bid to develop pilot lithium extraction plants in the country’s salt flats.

Can Bolivia become a major player in lithium production?

Bolivia, known for its vast lithium deposits in the Salar de Uyuni, has garnered significant attention for its potential to become a major player in lithium production. This blog post explores lithium production in Bolivia, highlighting the opportunities it presents and the challenges that must be overcome to harness this valuable resource.

Learn More

- Lithium battery pack electric wheel

- Lithium battery pack fast charging voltage

- 72v lithium battery pack frequently loses power

- Reference price of Ethiopian quality lithium battery pack

- Kuwait low temperature lithium battery pack manufacturer

- No 9 lithium battery pack

- Five parallel four series lithium battery pack

- Bhutan lithium battery pack factory

- Lithium battery PACK new nickel sheet

Industrial & Commercial Energy Storage Market Growth

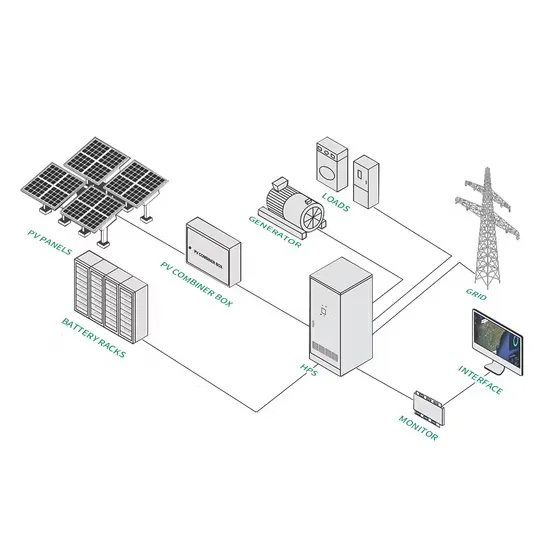

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.