Wave of Decline Sweeps Lithium-Ion Battery Pack Pricing, in

Mar 6, 2025 · Lithium-ion battery pack prices dropped 20% in 2024, reaching $115/kWh. EV battery prices dip below $100/kWh—explore the trends behind this decline.

Status and prospects of lithium iron phosphate

Sep 23, 2024 · Lithium iron phosphate (LiFePO 4, LFP) has long been a key player in the lithium battery industry for its exceptional stability, safety, and cost-effectiveness as a cathode

Rising Prices in the Lithium Iron Phosphate (LFP) Battery

Apr 8, 2025 · The lithium iron phosphate (LFP) battery market has experienced significant price hikes in 2025, influenced by various factors, including production difficulties and escalating raw

What Are The Implications Of $66/kWh Battery Packs In China?

Dec 26, 2024 · Assuming they get to $80 per kWh for EV LFP battery packs, then the US tariff of 25% makes them about $100 per kWh. That''s below Tesla''s US cost of $100–$120 per kWh

What Is the LiFePO4 Battery Price?

Nov 20, 2024 · LiFePO4 battery combines lithium materials like lithium, cobalt, nickel, and graphite. The prices of materials like lithium cobalt oxide (LCO) are around $50 to $60 per kg,

Lithium Iron Phosphate batteries – Pros and

Mar 25, 2021 · Introduction: Offgrid Tech has been selling Lithium batteries since 2016. LFP (Lithium Ferrophosphate or Lithium Iron Phosphate) is currently our

Understanding Lithium Iron Phosphate Batteries:

Feb 21, 2025 · In recent years, lithium iron phosphate (LiFePO4) batteries have gained significant attention as a viable energy storage solution across various

Visualized: What is the Cost of Electric Vehicle

Oct 14, 2023 · At a lower cost are lithium iron phosphate (LFP) batteries, which are cheaper to make than cobalt and nickel-based variants. LFP battery cells

The Cost of Lithium Iron Phosphate Energy Storage: What

Oct 26, 2022 · Why LFP Batteries Are Stealing the Spotlight Let''s face it: lithium iron phosphate (LFP) batteries are the "reliable best friend" of the energy storage world. While they might not

How Much Do Lithium Iron Phosphate Batteries Cost?

Mar 9, 2023 · Several factors contribute to the overall cost of lithium iron phosphate batteries: 1. Capacity and Voltage. The capacity (measured in amp-hours, Ah) and voltage requirements

CATL, BYD To Slash Battery Prices By 50% In 2024. BOOM!

Feb 26, 2024 · CATL and BYD are both on a path to decrease battery prices this year by as much as 50%, meaning battery packs at the end of 2024 could cost half what they did at the end of

How Much Does a Lithium-Ion Battery Cost in 2025?

Nov 30, 2024 · Lithium Iron Phosphate (LFP) batteries are often used as a power source in RVs, boats, and electric scooters. Most LFP batteries cost $120 to $1,950 and the average LFP

Why China Leads in LFP Batteries: Key Factors

Apr 3, 2025 · Over the past decade, lithium iron phosphate (LFP) batteries have quietly taken over the global energy storage and electric vehicle (EV) markets.

Lithium Battery Price Trends & Comparisons

Apr 22, 2024 · Explore the latest trends and comparisons in lithium battery prices for 2024. Get insights on cost-effective lithium battery solutions in India.

6 FAQs about [What is the price of lithium iron phosphate battery pack]

How much does a lithium iron phosphate battery cost?

Generally, the lithium iron phosphate battery price stands between $600 to $800. The price bracket of a 24V LiFePO4 battery is not different from a 12V battery. However, an increase or decrease in capacity can differentiate the price. It also ranges between $600 to $900, in 200AH capacity.

How much does a LiFePO4 battery cost?

Raw Material LiFePO4 battery combines lithium materials like lithium, cobalt, nickel, and graphite. The prices of materials like lithium cobalt oxide (LCO) are around $50 to $60 per kg, lithium iron phosphate (LFP) costs around $15 to $20 per kg, and lithium nickel manganese cobalt oxide (NMC) costs $25 to $35 per kg.

Is lithium iron phosphate a good battery?

Lithium iron phosphate, commonly known as LiFePO4, is becoming increasingly popular due to its safety, long lifespan, and durability. It can be a positive change for your electric devices as it does not need maintenance and frequent change. However, lithium iron phosphate battery price is 3 to 4 times higher than traditional batteries.

What is a lithium ion battery?

Lithium iron phosphate (LFP) and lithium nickel manganese cobalt oxide (NCM) are two types of rechargeable batteries commonly used in electric vehicles and renewable energy storage. with minor processing Historic prices on lithium ion battery cells.

Are lithium iron phosphate batteries the future of EV batteries?

Lithium iron phosphate (LFP) batteries now comprise nearly half of the global EV battery market, with China leading adoption, where they met nearly three-quarters of domestic battery demand in 2024. The report states that LFP batteries reached 80% of the batteries sold in China during November and December.

How much does a lithium ion battery cost?

The electric vehicle market, the primary driver for lithium-ion batteries, grew more slowly than in previous years but still showed the lowest price at $97 per kWh. Meanwhile, the stationary storage market has surged, with intense competition among cell and system suppliers, particularly in China.

Learn More

- Price of No 9 lithium iron phosphate battery pack

- 60kwh lithium iron phosphate battery pack price

- What is the actual life of a 60v lithium iron phosphate battery pack

- New 60v lithium iron phosphate battery pack

- Minimum allowable voltage of lithium iron phosphate battery pack

- Zhongya lithium iron phosphate battery pack customization

- 48v 10a lithium iron phosphate battery pack

- How much does a 80KWh lithium iron phosphate battery pack cost

- What is the voltage difference of lithium iron phosphate battery station cabinet

Industrial & Commercial Energy Storage Market Growth

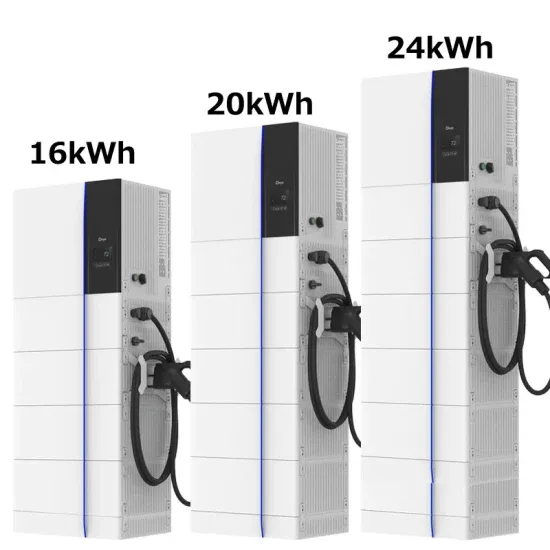

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.