6 Top Lithium Ion Battery Companies in Germany · August

Aug 1, 2025 · Detailed info and reviews on 6 top Lithium Ion Battery companies and startups in Germany in 2025. Get the latest updates on their products, jobs, funding, investors, founders

25 Lithium Ion Battery Manufacturers in 2025

This section provides an overview for lithium ion batteries as well as their applications and principles. Also, please take a look at the list of 25 lithium ion battery manufacturers and their

PI Berlin Introduces Deep Dive Quality Assessment for Lithium-Ion

Jun 23, 2020 · The number of solar energy storage projects is rising rapidly around the world, with international growth rates for photovoltaic storage reaching between 70 and 150 percent in

Preparing for the battery revolution

May 11, 2021 · Preparing for the battery revolution Berlin startup Theion launches the first solid-state lithium-sulfur battery on the market. Theion is the ancient Greek word for sulfur as well as

Issue 08/2024 | Battery Technology from Berlin-Brandenburg

Berlin-Brandenburg is increasingly becoming a center for innovative battery technologies that drives electromobility and energy transformation. Two outstanding examples illustrate the

German lithium-ion battery Companies | Market Research

Top listed companies in the Germany lithium-ion battery industry are: A123 Systems LLC, AT and T Inc., BAK Power, BYD Co. Ltd., Clarios, Envision Group, Exide Industries Ltd., GS Yuasa

Lithium‐based batteries, history, current status,

Oct 7, 2023 · The high energy/capacity anodes and cathodes needed for these applications are hindered by challenges like: (1) aging and degradation; (2)

"Batteries made in Germany, made in Berlin" | Brain City Berlin

Mr. Schaupp, last year theion opened a new battery research centre in Adlershof to bring its sulphur-lithium battery to market maturity. How does it work? Every battery needs an anode

Top 21 Lithium Ion Battery Manufacturing Companies

Aug 18, 2025 · Explore innovations from lithium ion battery manufacturing companies like Northvolt and Clarios, shaping the future of energy storage solutions.

Environmental feasibility of secondary use of electric vehicle lithium

May 1, 2020 · Abstract Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles

Lithium Ion Battery Manufacturers in Germany

Bender GmbH Business type: manufacturer, exporter Product types: lithium polymer batteries, lithium ion batteries, silver zinc batteries, medical equipment batteries, rechargeable batteries,

Top 10 lithium battery manufacturers in Germany

6 days ago · This article will explore the top 10 leading lithium battery manufacturers in Germany, analyzing their technological advantages, market positioning, and performance in various

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Lithium-Ion Battery Systems | IEEE Journals & Magazine

May 16, 2014 · The production of lithium-ion (Li-ion) batteries has been continually increasing since their first introduction into the market in 1991 because of their excellent performance,

6 FAQs about [What are the manufacturers of lithium-ion batteries for Berlin communication base stations ]

What are the top 10 lithium battery manufacturers in Germany?

This article will briefly introduce top 10 lithium battery manufacturers in Germany: they are Varta, BMZ Group, Akasol, Tesvolt, Voltabox, Sonnen, EAS Batteries, LION Smart, CustomCells, E3/DC. Industry status: One of the leading custom lithium battery manufacturersres in Europe.

Where are lithium ion batteries made?

Dresden is another key player in the German lithium ion battery scene, particularly noted for its focus on the development of lifepo4 batteries and other lithium cell manufacturers in Germany. The city has developed a niche in high-quality lithium battery production, supported by its strong semiconductor and electronics sectors.

Why is Germany a leader in the lithium battery industry?

Germany, with its exceptional engineering technology, stringent quality management, and strong innovative capabilities, holds a significant position in the global lithium battery industry.

Where does BMW manufacture lithium ion batteries?

BMW, headquartered in Munich, has become a significant player in lithium ion battery manufacturing in Germany, primarily focusing on EV lithium battery manufacturers.

What is the battery industry like in Germany?

For Germany, the battery industry has a variety of connotations. Lithium battery, a vital part of electric vehicles, are still largely dependent on Asian businesses. The top 10 lithium battery manufacturers in Germany are currently working to establish a more complete lithium battery production chain in their home country.

Why is Stuttgart a good place to buy a lithium ion battery?

Stuttgart stands as a pivotal center for lithium battery production in Germany, home to several leading lithium ion battery pack manufacturers. The city’s strong automotive industry background provides a robust foundation for lithium battery makers, fostering extensive R&D facilities and skilled labor.

Learn More

- What are the lithium-ion battery manufacturers for Bangi communication base stations

- What are the lithium-ion batteries for Niger communication base stations

- Construction standards and requirements for lithium-ion batteries for communication base stations

- Lithium-ion batteries for three communication base stations in Baghdad

- What types of batteries are there for communication base stations

- What are the manufacturers of battery energy storage systems for Manila communication base stations

- What are the EMS equipment manufacturers for communication base stations

- What are the lead-acid batteries for Guinea-Bissau border communication base stations

- The upper floor can be used to install lithium-ion batteries for communication base stations

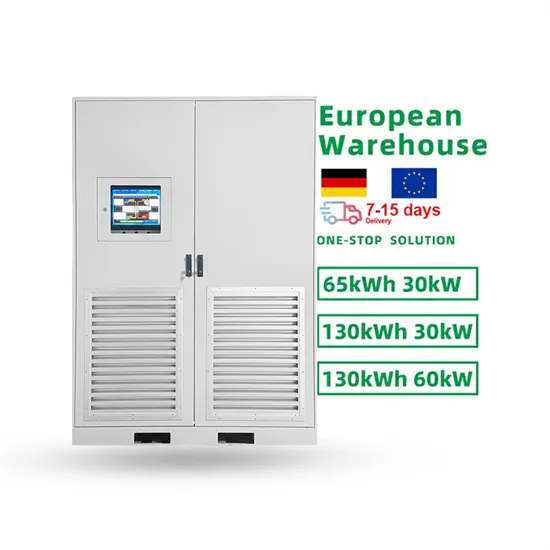

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.