Enabling renewable energy with battery energy storage

Feb 10, 2025 · These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable-energy generation, helping

Top 10 Global BESS Manufacturers – BESSfinder

May 19, 2025 · Introduction The Battery Energy Storage System (BESS) industry has experienced remarkable growth in recent years, driven by the global shift toward renewable energy and the

Which are the top manufacturing Companies of Battery Energy Storage

Dec 10, 2024 · Introduction to the Battery Energy Storage Systems Market/Industry: The battery energy storage systems (BESS) market is poised for transformative growth, driven by the

Top 13 Battery Storage Companies in Philippines (2025)

Equilast Inc. specializes in energy solutions, offering a diverse range of batteries, including lithium-ion options, which are essential for applications like telecom base sites and standby

Battery Energy Storage System (BESS) Vendors [2025 List

A comprehensive up-to-date list of all battery energy storage systems (BESS) for grid/utility, commercial/industria, and residential applications. Here are the largest largest BESS

10 Energy Storage Companies to Know in 2025

Jan 21, 2025 · The race to develop efficient and scalable energy storage systems has never been more crucial. These technologies underpin the transition to a low-carbon future by ensuring

Top 10 Global Power & Storage Battery Manufacturers 2024

Apr 2, 2025 · Among the top 10 global battery manufacturers (power + energy storage) in 2024, six are Chinese companies: CATL, BYD, EVE Energy, CALB, Gotion High-Tech, and

A review of battery energy storage systems and advanced battery

May 1, 2024 · This review highlights the significance of battery management systems (BMSs) in EVs and renewable energy storage systems, with detailed insights into voltage and current

Battery storage power station – a comprehensive

2 days ago · Battery storage power stations store electrical energy in various types of batteries such as lithium-ion, lead-acid, and flow cell batteries. These

Manila Energy Storage Battery Suppliers: Powering the

Jun 2, 2023 · As the Philippines races to meet its renewable energy goals, Manila has become the epicenter of Southeast Asia''s battery energy storage system (BESS) boom. Companies

6 FAQs about [What are the manufacturers of battery energy storage systems for Manila communication base stations ]

What makes PBI the best battery company in the Philippines?

Moreover, PBI has established strong partnerships with local and international firms, enhancing their capability to innovate and stay ahead in the market. Located in Davao, Mindanao Energy Systems Inc. is another top contender in the Philippines’ battery market, specializing particularly in lithium ion batteries and solar battery systems.

What is Masinloc battery energy storage?

We started our venture into battery energy storage technology in 2018 when we acquired the 10 MW Masinloc Battery Energy Storage System (BESS) of the Masinloc Power Plant from AES Philippines. The Masinloc BESS is the first battery energy storage facility in the Philippines and one of the first in Southeast Asia.

Why should you choose a battery company in Manila?

Companies in Manila are well-placed to manage imports of raw materials such as lithium, necessary for the production of lithium ion batteries, and to export finished products globally. Founded in the early 2000s, Philippine Battery Incorporated has grown to become one of the leading battery manufacturers in the Philippines.

Why is Manila a key hub for battery supply in the Philippines?

As the capital and one of the largest cities in the Philippines, Manila stands as a central hub for the battery supplier Philippines industry. The city’s extensive port facilities and well-developed logistics infrastructures serve as the backbone for the distribution and supply chains of battery manufacturers.

What is a battery energy storage system?

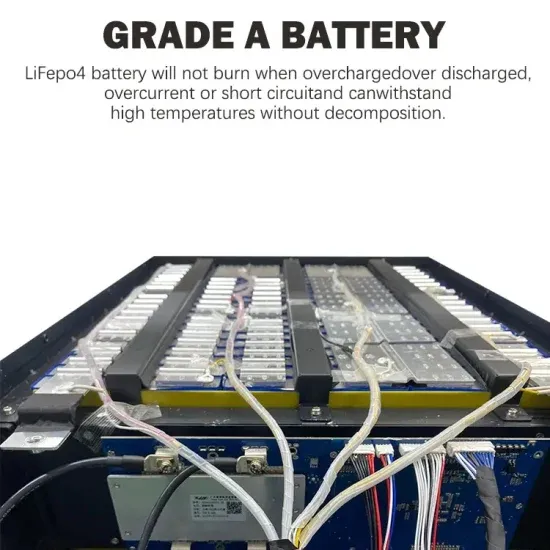

(Source) Battery Energy Storage System (BESS) uses specifically built batteries to store electric charge that can be used later. Much research has resulted in battery advancements, transforming the notion of a BESS into a commercial reality.

Which country has the best battery industry in the Philippines?

Cebu is another significant player in the Philippines’ battery industry. Known for its robust manufacturing sector, Cebu has attracted numerous battery suppliers, including specialists in lead acid battery supplier Philippines and lithium ion battery suppliers Philippines.

Learn More

- What are the battery energy storage systems for communication base stations

- What are the three types of grounding for battery energy storage systems in communication base stations

- Construction standards for battery energy storage systems at Vatican communication base stations

- Record filing system for construction of battery energy storage systems for communication base stations

- What qualifications are required for communication base station battery energy storage systems

- Battery regulations for battery energy storage systems in communication base stations

- Battery energy storage system for communication base stations in South Africa

- Work on designing battery energy storage system for communication base stations

- Lithium battery energy storage for communication base stations

Industrial & Commercial Energy Storage Market Growth

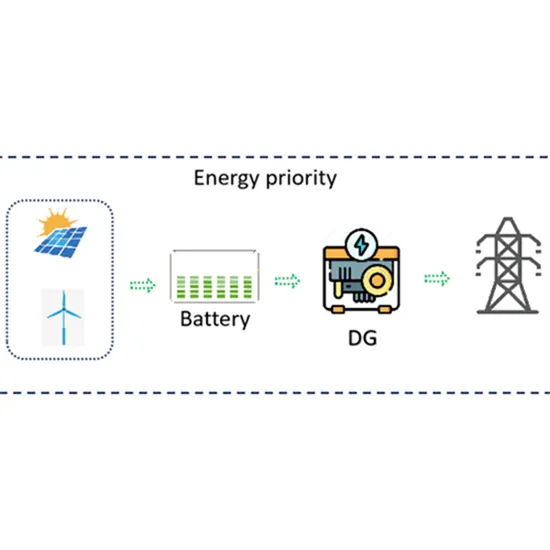

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.