What Are the Best Lithium Batteries for Base Stations?

The answer lies in lithium batteries for base stations, but not all solutions are created equal. With 42% of tower downtime attributed to power failures (GSMA 2023), choosing the right battery

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Lithium Battery for Communication Base Stations Market

The global Lithium Battery for Communication Base Stations market is poised to experience significant growth, with the market size expected to expand from USD 3.5 billion in 2023 to an

Environmental feasibility of secondary use of electric vehicle lithium

May 1, 2020 · Abstract Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles

Lithium Iron Batteries for Telecommunications Base Stations

REVOV''s lithium iron phosphate (LiFePO4) batteries are ideal telecom base station batteries. These batteries offer reliable, cost-effective backup power for communication networks. They

The majority of lithium batteries used in communication base stations

Feb 24, 2025 · With the arrival of the information age, people around use mobile phones more and more frequently, and communication base stations are particularly important for people.

Battery for base stations of mobile operators

The company "ADS" is the best manufacturer of lithium iron phosphate batteries for base stations of cellular communication in Ukraine Our company specializes in innovative energy storage

Base Station Lithium: The Backbone of Modern

Why Are Traditional Power Solutions Failing Mobile Networks? As 5G deployment accelerates globally, over 68% of telecom operators report base station lithium battery failures during peak

Global Battery Market | Size, Share, Trends and

2 days ago · <p>The global battery market report by Blackridge Research and Consulting provides a comprehensive analysis of the industry''s dynamics,

What are the characteristics of communication base stations and lithium

For non-user replaceable lithium ion batteries, they can be placed in electronic products as a whole sample, or the lithium ion battery can be taken out separately for the environmental

Lithium battery is the magic weapon for

Jan 13, 2021 · Intelligent energy storage lithium battery can effectively protect the base station battery in the event of the accidental short circuit, lightning shock,

Why Lithium Batteries for Base Stations? | HuiJue Group E-Site

Traditional lead-acid batteries—still powering 68% of global base stations—struggle with three critical flaws. First, their 500-800 cycle lifespan pales against lithium''s 3,000+ cycles. Second,

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In the future, especially after the 5G upgrade, lithium battery companies will no longer simply focus on communication base stations, but on how the communication network

Environmental feasibility of secondary use of electric vehicle

Jan 22, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Use of Batteries in the Telecommunications Industry

Mar 18, 2025 · The Alliance for Telecommunications Industry Solutions is an organization that develops standards and solutions for the ICT (Information and Communications Technology)

Environmental-economic analysis of the secondary use of

Nov 30, 2022 · This study examines the environmental and economic feasibility of using repurposed spent electric vehicle (EV) lithium-ion batteries (LIBs) in the ESS of

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize overall

Lithium-ion Battery Safety

Jan 13, 2025 · The hazards and controls described below are important in facilities that manufacture lithium-ion batteries, items that include installation of lithium-ion batteries, energy

What is the purpose of batteries at telecom base

Feb 10, 2025 · Telecom batteries usually use different types of batteries such as lead-acid batteries, Ni-MH batteries, lithium-ion batteries, etc., and their

The Role of Telecom Lithium Batteries in Modern

Jun 19, 2025 · Lithium-ion batteries have become an integral part of modern life, powering a wide range of devices from smartphones and laptops to electric

5G base station application of lithium iron phosphate battery

Jan 19, 2021 5G base station application of lithium iron phosphate battery advantages rolling lead-acid batteries With the pilot and commercial use of 5G systems, the large power consumption

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Lithium Battery For Communication Base Stations Market By

Jun 25, 2025 · The growth trajectory of the Lithium Battery For Communication Base Stations Market is underpinned by increasing adoption across diverse verticals, rising automation, and

Learn More

- What are the manufacturers of lithium-ion batteries for Berlin communication base stations

- What are the lithium-ion battery manufacturers for Bangi communication base stations

- Newly added lithium-ion batteries for communication base stations

- How can lithium-ion batteries in communication base stations achieve Internet access

- The upper floor can be used to install lithium-ion batteries for communication base stations

- What types of batteries are there for communication base stations

- VAT rate for lithium-ion batteries for communication base stations

- What are the lead-acid batteries for Guinea-Bissau border communication base stations

- What are the energy management systems for green communication base stations in China

Industrial & Commercial Energy Storage Market Growth

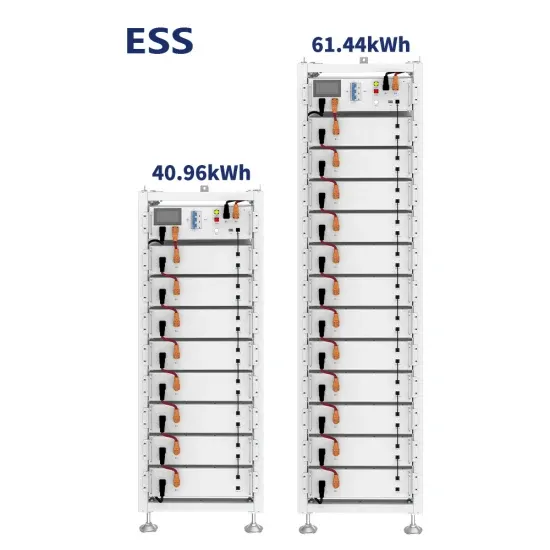

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.