Top 15 Lithium-ion Battery Manufacturers: A Global Review

Jun 26, 2025 · Discover the top 15 lithium-ion battery manufacturers for 2025 in our global guide. We compare the best companies for EV, industrial, and custom lithium batteries to find your

Top 10 Lithium ion Battery Manufacturers In Usa

2 days ago · Lithium-ion batteries have become an integral part of our daily lives, powering everything from smartphones to electric vehicles. As the demand for these batteries continues

Top 10 Lithium Battery Manufacturers in China

Dec 18, 2024 · China dominates the global lithium battery industry with top manufacturers like CATL, BYD, and Ganfeng setting benchmarks in innovation and production. Discover how

Lithium Battery for Communication and Energy Storage:

The Triple Threat: Capacity, Safety, and Cost Dynamics 2023 market analysis shows communication base stations require 18% more energy density than commercial batteries

Bangi lithium battery energy storage equipment

Lithium-ion batteries (LIBs) have nowadays become outstanding rechargeable energy storage devices with rapidly expanding fields of applications due to convenient features like high

Best 10 Lithium Ion Battery Manufacturers in China 2025

Aug 3, 2025 · Shenzhen Huanduy Technology Co., Ltd is an accredited lithium ion battery supplier in engineering, fabrication, supplies, and services of lithium iron phosphate batteries.

Lithium Battery for 5G Base Stations Market

Feb 9, 2025 · Energy Consumption Intensity of 5G Infrastructure The transition to 5G networks requires base stations to handle exponentially higher data throughput and lower latency,

LI-ION BATTERY SOLUTION FOR TELECOM BASE STATION

Jan 29, 2016 · LI-ION BATTERY SOLUTION FOR TELECOM BASE STATION Samsung SDI''s safe, proven and the most reliable solution for telecom industry Meet Samsung SDI''s newest

BESS (Battery Energy Storage Systems)

Boost energy storage with Industrial/Commercial & Home BESS, powered by lithium batteries. Ensure grid stability, savings, & backups. Plus, power base stations with Huijue Energy

25 Lithium Ion Battery Manufacturers in 2025

This section provides an overview for lithium ion batteries as well as their applications and principles. Also, please take a look at the list of 25 lithium ion battery manufacturers and their

Who Are the Top 10 Lithium-Ion Battery Manufacturers

Feb 26, 2025 · Who dominates the lithium-ion battery market? The top manufacturers include CATL (China), LG Energy Solution (South Korea), Panasonic (Japan), BYD (China), and

Top 10 Lithium Battery Manufacturers in China (2024 List)

Jun 5, 2024 · This article will introduce the top 10 lithium battery manufacturers in China, analyzing each company''s background, core products, and technical advantages in detail,

6 FAQs about [What are the lithium-ion battery manufacturers for Bangi communication base stations ]

Who makes lithium batteries in China?

China dominates the global lithium battery industry with top manufacturers like CATL, BYD, and Ganfeng setting benchmarks in innovation and production. Discover how these companies are revolutionizing energy storage and leading advancements in electric vehicles and renewable energy technologies. 1. CATL (Contemporary Amperex Technology Co. Limited)

Who makes lithium ion batteries?

Farasis Energy produces lithium-ion batteries for electric vehicles (EVs) and hybrid vehicles, contributing to the electrification of the automotive industry. Energy Storage Systems (ESS): The company manufactures lithium-ion batteries for energy storage applications, supporting the efficient storage and utilization of renewable energy.

Who is China Aviation lithium battery?

CALB (China Aviation Lithium Battery Co., Ltd.) Headquarters: Nanjing, Jiangsu Overview: China Aviation Lithium Battery is a high-tech enterprise that integrates the research, production, and sale of new energy batteries.

Is China a leader in lithium-ion battery energy storage?

China, as one of the leaders in the world’s new energy industry, has gathered many companies that are deeply engaged in the field of lithium-ion battery energy storage and have advanced technology.

Who are the top 10 battery energy storage manufacturers in China?

This article will focus on top 10 battery energy storage manufacturers in China including SUNWODA, CATL, GOTION HIGH TECH, EVE, Svolt, FEB, Long T Tech, DYNAVOLT, Guo Chuang, CORNEX, explore how they stand out in the fierce market competition and lead the industry forward. SUNWODA, founded in 1997, is a global leader in lithium-ion batteries.

Where are CATL batteries made?

Headquarters: Ningde, Fujian Overview: CATL is one of China’s largest lithium-ion battery manufacturers and a global leader in battery manufacturing. Key Products A leading manufacturer focuses on high-performance EV batteries with continuous innovations for enhanced energy density, longevity, and safety.

Learn More

- What are the manufacturers of lithium-ion batteries for Berlin communication base stations

- What are the manufacturers of battery energy storage systems for Manila communication base stations

- What are the EMS equipment manufacturers for communication base stations

- Lithium-ion battery manufacturer for wireless communication base stations in Tunisia

- Battery data analysis of communication base stations

- Why is the battery energy storage system for communication base stations equipped

- Battery regulations for battery energy storage systems in communication base stations

- Protection clauses for battery energy storage systems in communication base stations

- Does the battery energy storage system for communication base stations require approval now

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

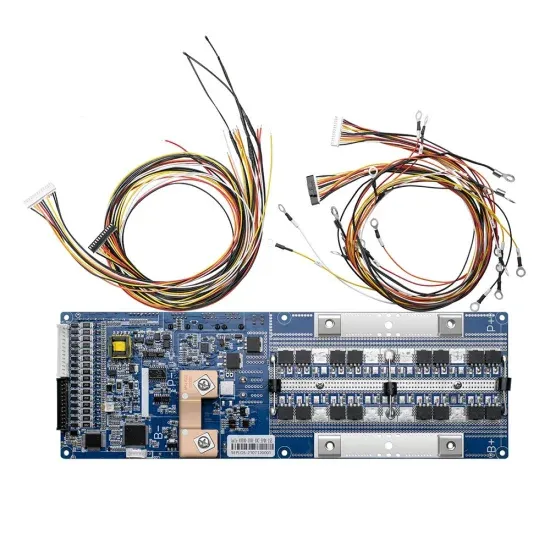

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.