Southeast Asia''s Solar Industry Development

Feb 28, 2025 · Southeast Asia has solidified its position as a global hub for solar PV production. The International Energy Agency (IEA) notes that the region

Sinovoltaics Predicts 101 GW Southeast Asia Solar Module

Jun 30, 2025 · In the 1st edition of its Southeast Asia Solar Supply Chain Map for 2025, Sinovoltaics expects the nameplate solar PV module manufacturing capacity of Southeast

Sinovoltaics Southeast Asia SEA Solar Energy Supply Chain

Despite strong ambitions, PV module manufacturing in Southeast Asian is currently under pressure. Operational capacities have been significantly reduced or temporarily halted,

Southeast Asia''s PV market to drive global energy transition

Sep 20, 2024 · PV has become a key driver for Southeast Asia''s renewable energy development amid global net-zero emissions trend, due to the region''s abundant sunlight, rapid economic

Progress in Diversifying the Global Solar PV Supply Chain

As of 2023, Southeast Asian countries were active across the whole solar PV supply chain with rather significant manufacturing capacity in each segment, and especially in cells and modules

Leaving Southeast Asia, where should Chinese photovoltaic

Jul 4, 2024 · Southeast Asia has become an important region for Chinese photovoltaic enterprises to export to the US market. According to statistics, as of 2023, the main supply of photovoltaic

Sinovoltaics Southeast Asia SEA Solar Energy Supply Chain

June 2025 The first 2025 edition of the Southeast Asia Solar Supply Chain Map includes significant revisions and additions, driven by valuable market feedback and the region''s

Untapped Potential: Solar PV and battery manufacturing

Oct 9, 2023 · Southeast Asia is a solar PV manufacturing hub with 2 per cent – 3 per cent of the world''s polysilicon and wafer capacity and 9 per cent–10 per cent of the world''s cells and

The United States announced the results of the preliminary

On November 29, 2024 local time, the U.S. Department of Commerce announced its preliminary affirmative ruling on its anti-dumping duty investigation of crystalline photovoltaic cells

Southeast Asia''s green energy transition: 28% PV demand

Feb 7, 2025 · As the global energy transition accelerates, Southeast Asia has become a key market for renewable energy development. According to InfoLink''s latest data, PV demand in

Untapped Potential: Solar PV and battery manufacturing

Oct 9, 2023 · The solar PV module manufacturing value chain comprises four main steps: polysilicon production, wafer production, cell manufacturing, and module assembly. Southeast

Cheaper solar power gains ground in southeast Asia

4 days ago · Southeast Asia''s cumulative solar photovoltaic (PV) capacity could nearly triple to 35.8 gigawatt (GW) in 2024 from an estimated 12.6 GW this year, consultancy Wood

6 FAQs about [Southeast Asia Solar PV Modules]

Does sinovoltaics have a supply chain map in Southeast Asia?

Hong Kong-based compliance and quality assurance company Sinovoltaics has published a new report mapping all solar module factories in Southeast Asia. “The Sinovoltaics Supply Chain Map Southeast Asia for Q2 2024 includes several notable changes since our Q1 report,” said analysts at Sinovoltaics in a statement.

Why is PV module manufacturing under pressure in Southeast Asia?

Despite strong ambitions, PV module manufacturing in Southeast Asian is currently under pressure. Operational capacities have been significantly reduced or temporarily halted, primarily due to U.S. import tariffs. Once a strategic workaround for Chinese manufacturers aiming to access Western markets, Southeast Asia now faces growing constraints.

Is Southeast Asia an exporter of solar PV products?

Southeast Asia is largely an exporter of solar PV products today. Its nameplate capacity of 70 GW dwarfs regional demand of ~3 GW p.a. There are three broad archetypes of producer countries in the region:

Who makes solar panels in Southeast Asia?

According to manufacturers’ present in Southeast Asia today, most manufacturing capacity in the region was established by manufacturers from the People’s Republic of China. Southeast Asia is largely an exporter of solar PV products today.

What is the Southeast Asia Solar supply chain map?

This edition of the Southeast Asia Solar Supply Chain Map provides a detailed snapshot of current realities and future ambitions, as the region navigates complex trade, investment, and production challenges.

What is a solar PV module manufacturing value chain?

The solar PV module manufacturing value chain comprises four main steps: polysilicon production, wafer production, cell manufacturing, and module assembly. Southeast Asia is a solar PV manufacturing hub with 2 per cent – 3 per cent of the world’s polysilicon and wafer capacity and 9 per cent–10 per cent of the world’s cells and modules capacity.

Learn More

- Solar camping rechargeable in Southeast Asia

- How many wind solar and energy storage power stations are there in Southeast Asia

- Solar Cell Energy Storage in Asia

- Failure modes of solar photovoltaic modules

- Tripoli Solar PV Combiner Box

- Solar and PV panel prices

- PVDF film for solar photovoltaic modules

- Ngerulmud Distributed Solar Photovoltaic Modules

- Solar PV Panel Costs in Malabo

Industrial & Commercial Energy Storage Market Growth

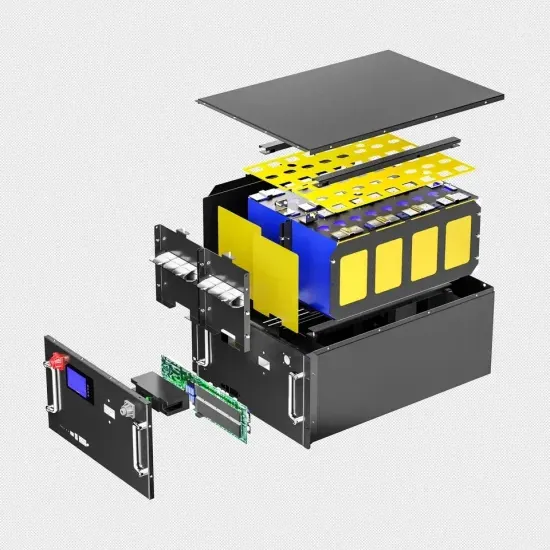

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.