Five Asian countries now at the top of global solar power

Beijing, 4 July – Asian countries now make up five of the top ten solar-powered economies thanks to a decade of growth that has enabled a number of Asia''s biggest economies to significantly

Largest Solar Power Stations in South Africa | Photovoltaic

Here is a list of the largest South Africa PV stations and solar farms. Get to know the projects'' power generation capacities in MWp or MWAC, annual power output in GWh, state of location

Southeast Asia''s Power Sector: Challenges and opportunities

Mar 3, 2025 · Southeast Asia''s transition to clean energy presents vast economic opportunities, particularly in the manufacturing of renewable energy components. The region is already a

A Race to the Top: Southeast Asia 2024

Dec 21, 2023 · The region currently has 28 gigawatt (GW) of large utility-scale2 solar and wind power in operation — accounting for 9% of total electrical capacity in the region. ASEAN would

Decarbonising Southeast Asia through solar and

May 25, 2024 · In 2023, around 84 per cent of new global electricity capacity was solar and wind power, with all other technologies — coal, gas, nuclear,

Spatial integration framework of solar, wind, and hydropower energy

Jan 7, 2023 · This study aims to create the first spatial model of its kind in Southeast Asia to develop multi-renewable energy from solar, wind, and hydropower, further broken down into

Power plants map of Queensland

4 days ago · Existing power stations include information about fuel type, size (MW), ownership, commissioned date and data source. For remote/isolated areas, only major generating

Solar and wind power plants in Southeast Asia

How many solar power plants are there in Southeast Asia? Figure 8 A shows the distribution of solar,wind,and hydropower plants in Southeast Asia and their generating capacity. There are

Southeast Asia Energy Outlook 2024 – Analysis

Oct 22, 2024 · It explores what the outcomes of the COP 28 meeting in Dubai (2023) mean for Southeast Asia, notably regarding the global targets to triple renewable capacity by 2030,

Beyond tripling: Keeping ASEAN''s solar & wind

Nov 16, 2023 · Beyond tripling: Keeping ASEAN''s solar & wind momentum Southeast Asian nations require stronger policy support to stimulate solar and

Clean Energy and Decarbonization in Southeast Asia:

May 1, 2023 · Southeast Asian governments have ambitious carbon neutrality pledges, but rising energy demand, large financing needs, and barriers to private sector investment are some of

Renewable energy in Southeast Asia: Policies and recommendations

Jun 20, 2019 · Southeast Asian countries stand at a crossroads concerning their shared energy future and heavily rely on fossil fuels for transport and electricity. Within Asia, especially India

BESS the Linchpin for Asia''s Renewable Energy

Feb 11, 2025 · Making wind, offshore wind, solar, and other clean energy sources reliable has become a priority. Ultimately, BESS integration is the only way for

South East Asia: The coming solar-storage revolution

May 19, 2023 · Why gas-fired power stations should integrate storage However, any headlong dash towards a clean energy economy in South East Asia is certain to present major

Southeast Asia''s Energy Transition: Policy and

Jan 25, 2025 · While bioenergy, hydropower, utility solar, and wind energy are all projected to remain relatively stagnant, there is significant growth in distributed

Southeast Asia Renewable Energy''s Untapped Power

Mar 22, 2025 · Southeast Asia''s solar photovoltaic (PV) capacity could generate over 45,000 terawatt-hours (TWh) annually—far exceeding the region''s current total electricity generation

Where Can Wind Turbines Be Found In South Australia

Jul 2, 2025 · How Many Wind Turbines Are There In SA? As of 2022, South Australia operates 16 wind farms with a combined capacity of approximately 2, 139 MW. Globally, figures from the

Decarbonising Southeast Asia through solar and

May 25, 2024 · In 2023, around 84 per cent of new global electricity generation capacity was from solar and wind power. The increasing affordability of solar,

6 FAQs about [How many wind solar and energy storage power stations are there in Southeast Asia]

How much solar & wind energy is in Southeast Asia?

New analysis by the International Energy Agency (IEA) indicates that the share of solar and wind energy in the power generation mix in Southeast Asian countries must reach approximately 23% by 2030 to align with the 2050 Net Zero Emission (NZE) scenario. Combined solar and wind generation in ASEAN grew from 4.2 TWh to 50 TWh between 2015 and 2022.

How many wind and solar projects are there in ASEAN?

There is currently a total of 222GW of announced, pre-construction and construction-stage utility-scale wind and solar capacity in ASEAN countries, according to GEM’s research. More than 185GW of this pipeline of projects is in the Philippines and Vietnam, meaning they account for more than 80% of prospective capacity in the region.

Which country produces the most solar power in ASEAN?

Thailand is one of the largest producers of utility-scale solar and wind power in ASEAN, with over 3 GW of renewable capacity. Two-thirds of this capacity comes from onshore wind power. Thailand’s national energy targets include 10 GW of solar and 4 GW of wind in operation by 2030 and net zero emissions goals for 2065.

How much solar power does ASEAN have?

The global average, barring China, is over twice that of ASEAN countries, at 7% prospective capacity under construction. ASEAN countries have over 28 GW of operating utility-scale solar and wind capacity and a 20% increase in operating capacity since January 2023 and make up 9% of ASEAN countries’ total electrical capacity.

How much solar power does the ASEAN region have in 2022?

The ASEAN region has 27 GW of solar and 6.8 GW of wind installed capacity in 2022, representing less than 1% of the approximately 30,523 GW of solar and 1,383 GW of wind theoretical potential estimated by the National Renewable Energy Laboratory (NREL).

Will Southeast Asia meet the combined wind and solar share target?

For this report, we calculate capacity additions required in Southeast Asia to meet the combined wind and solar share target of 23% by 2030, set out in the IEA NZE scenario. We estimate the required electricity generation by 2030, using ASEAN Centre for Energy (ACE) average annual electricity growth rate projection of 5.8%.

Learn More

- How many wind and solar energy storage power stations are there in Sweden

- Advantages and disadvantages of wind solar and energy storage power stations

- Advantages of wind and solar energy storage power stations

- Classification of wind solar and energy storage power stations

- Price of wind solar and energy storage power generation system in Brno Czech Republic

- How many energy storage power stations have been built in Poland

- Service life of wind and solar energy storage power station

- Wind and solar energy storage power generation

- Bissau wind solar and energy storage integrated power base

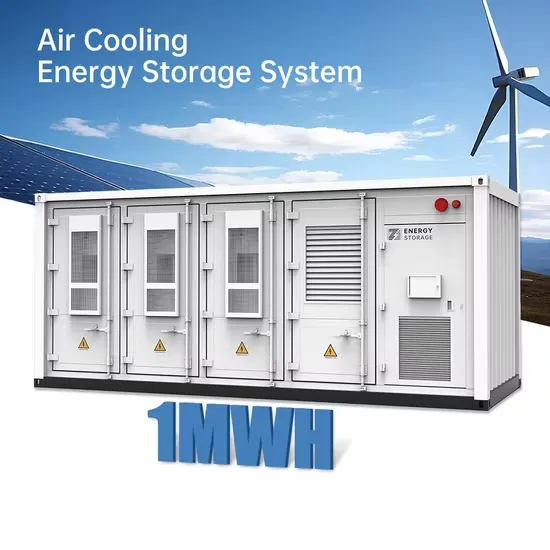

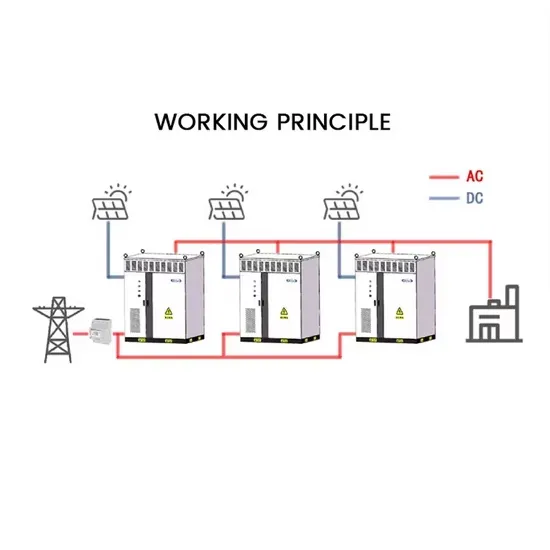

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.