Ambitious 5G base station plan for 2025

Dec 28, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

5G Outdoor Macro Base Station Market 2025: Strategic

May 25, 2025 · 5G Outdoor Macro Base Station Market Revenue was valued at USD 12.56 Billion in 2024 and is estimated to reach USD 32.78 Billion by 2033, growing at a CAGR of 11% from

Unity™ Outdoor Integrated Base Station 5W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station leverages the NXP LX2160A platform, featuring low power consumption, easy customization, and high integration

Unity™ 4+5G Outdoor Integrated Base Station

May 9, 2025 · SageRAN Unity™ 4+5G Outdoor Integrated Base Station is a highly efficient 4+5G base station designed for outdoor use. It features an integrated 4 and 5G BBU and RRU, and

Shanghai to set up nearly 10,000 new 5G-A base stations this

Feb 7, 2025 · Shanghai will establish up to 10,000 new 5G-A base stations this year, routing more than 70 percent of the city''s internet traffic through 5G network, helping Shanghai maintain its

Unity™ Outdoor Integrated Base Station 2W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station leverages the NXP LX2160A platform, featuring low power consumption, easy customization, and high integration

Shanghai Has Built Over 72,000 5G Macro Base Stations

Jul 3, 2023 · Shanghai has accumulated over 72,000 outdoor 5G base stations and 310,000 indoor small stations, promoted about 900 "dual-gigabit" innovative applications, and created

5G Outdoor Macro Base Station Market Analysis (2032)

Jun 21, 2024 · 5G Outdoor Macro Base Station Market Size was estimated at 7.11 (USD Billion) in 2023. The 5G Outdoor Macro Base Station Market Industry is expected to grow from 8.49

Telecom Battery Backup System | Sunwoda Energy

A telecom battery backup system is a comprehensive portfolio of energy storage batteries used as backup power for base stations to ensure a reliable and stable power supply. As we are

Ambitious 5G base station plan for 2025

The move comes as the country charted its vision for industrial growth during a two-day work conference of the Ministry of Industry and Information Technology. With 4.19 million 5G base

6 FAQs about [5g outdoor base station company]

What is a 5G small cell base station?

5G Small Cell indoor and outdoor 'all-in-one' radio access for private 5G wireless networks. 5G Small Cell Base Stations (Micro Cell, Femtocell) offer advanced features and “stand alone” capability for private networks.

How big is the 5G base station market?

5G Base Station Market size was valued at USD 11.20 Billion in 2021 and is projected to reach USD 194.26 Billion by 2030, growing at a CAGR of 37.3% from 2022 to 2030. Because of the increased need for high-speed data with low latency, the 5G base station market is likely to develop significantly throughout the forecast period.

Where is the first 5G base station made?

Back in July of last year, Verizon received the first U.S. manufactured 5G base station from a facility in Texas. Pictured is Verizon's CTO Kyle Malady holding some of the hardware. Image used courtesy of Ericsson

Who are the major players in the 5G base station market?

The major players in the market are Airspan Network, Cisco Systems Inc., Ericsson, Huawei technologies co. Ltd., Qualcomm Technologies, Inc., Samsung, Marvell, NEC Corporation, Nokia Corporation, and ZTE corporation amongst others are a few major companies operating in the 5G Base Station Market.

How far can a 5G base station go?

Each 5G base station has a range of between 800–1000 feet, or 0.15–0.19 miles. It makes up for its limited range by surpassing 4G in other key areas: data transfer speeds (bandwidth), latency, and capacity. Whereas 4G promised peak speeds of 1 Gbps, 5G’s max speed is set at 20 Gbps.

How many 5G base stations would a cell phone tower support?

Hundreds of 5G base stations will need to be installed to cover the area of a single cell phone tower. Even if just 100 base stations were required, 5G’s would support at least 25,000 devices to 4G’s 100. 5G smartphones are being released all the time.

Learn More

- 5g base station construction communication company

- Yemen Communications Company 5G Base Station Bidding

- 5g small base station power supply supporting company

- Hybrid Energy 5G Base Station Outdoor Power Station Procurement

- Outdoor 5G base station within the 5th ring of Muscat

- Antananarivo Communication 5G Base Station Project Bidding Project

- Communications 5g base station construction in the third quarter

- 5g base station single-mode communication

- Swiss 5G communication base station wind and solar complementary project

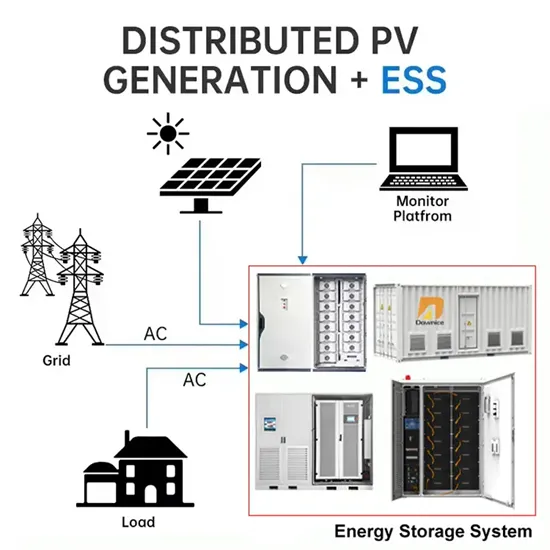

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.