The business model of 5G base station energy storage

The literature [2] addresses the capacity planning problem of 5G base station energy storage system, considers the energy sharing among base station microgrids, and determines the

Look Before You Leap: Secure Connection Bootstrapping

Jun 5, 2025 · The communication overheads and computational delays of these signature schemes and authentication protocols will be further aggravated in 5G networks since 5G

Integrated Urban Development and Resilience Project for

Jun 25, 2023 · Reference — Integrated Urban Development and Resilience Project for Greater Antananarivo: Acquisition d''Équipements de Communication pour la Commune Urbaine

Antananarivo, Madagascar Partner city Status of the

May 30, 2025 · In addition to these plans, the city is engaged in various ambitious projects. These include an electric cable transport initiative, the development of an urban train network, the

China Mobile Aggregates 480,000 5G Base Stations in

China Mobile Procurement and Bidding Network recently released a single-source procurement announcement for 2024-2025 5G wireless main equipment (2.6GHz/4.9GHz, 700MHz). The

5G-Advanced ORAN mMIMO Base Station | IIITB COMET

COMET Foundation, in collaboration with various IITs, is spearheading the development of advanced 5G technologies. This includes the creation of a 32TR n78 massive MIMO O-RU

Securing 5G Non-Public Networks Against Fake Base

Oct 2, 2010 · ABSTRACT Various industries have adopted 5G Non-Public Networks to take advantage of improved connectivity while remaining separate from public networks. As these

Installation Criteria for a 5G Technology Cellular Base Station

PDF | On Jul 31, 2022, Wilmer Vergaray Mendez and others published Installation Criteria for a 5G Technology Cellular Base Station Modernization | Find, read and cite all the research you

5G Base Station Energy Storage Bidding: What You Need to

Jun 29, 2021 · With over 816,000 5G基站 (5G base stations) expected in China by 2025 [3], the energy storage market has become a battlefield of innovation and cutthroat pricing. Just last

CHINT won the bid for China Mobile 5G base station project

Jun 20, 2020 · In the just-concluded project of China Mobile''s centralized procurement of AC distribution boxes for base stations from 2020 to 2021, CHINT T&D won the bid for nearly

5G base-station antenna array | NTU Singapore

Jul 7, 2023 · Bachelor of Engineering (Electrical and Electronic Engineering)Please use this identifier to cite or link to this item: https://hdl.handle /10356/150114

5G Communication Base Stations Participating in Demand

Aug 20, 2021 · The literature [10] sorts out the key technologies necessary for 5G base stations to participate in demand response, foresees the application scenarios for 5G base stations to

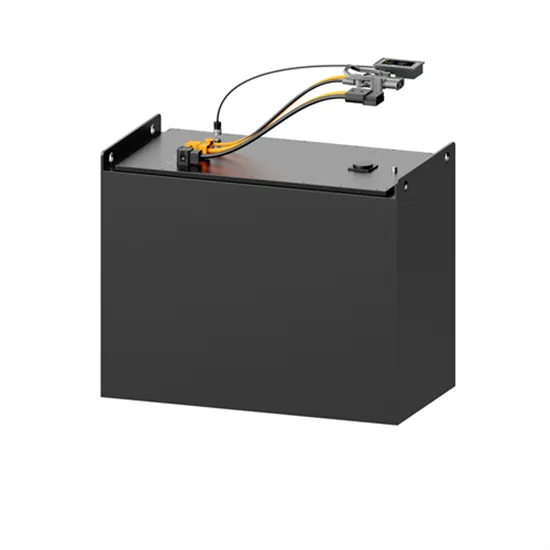

TOPBAND win the bid for 2020 5G Communication Base Station LiFePO4

Apr 15, 2020 · TOPBAND win the bid for 2020 5G Communication base station LiFePO4 Battery Procurement Project hold by CHINA TOWER, Anhui branch. Topband mainly focus on Smart

Antananarivo battery project bidding

New Projects on the Horizon One notable project under development is the "Antananarivo Energy Storage Facility," located near the capital city of Antananarivo. This facility, developed in

antananarivo energy storage project bidding

New Projects on the Horizon One notable project under development is the "Antananarivo Energy Storage Facility," located near the capital city of Antananarivo. This facility, developed in

Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

PG-Charter-5G-NR-Base-station.pdf

Feb 6, 2019 · The 5G NR base station platform will have the flexibility to support all classes of 5G use cases defined by 3GPP. The Project Group will consider 5G NR technology to select

Antananarivo air energy storage project bidding

Antananarivo air energy storage project bidding New Projects on the Horizon One notable project under development is the "Antananarivo Energy Storage Facility," located near the

Antananarivo energy storage project bidding

Brazil launching auction for battery storage projects in 2025 Since Chile passed a major energy storage bill, gigawatts of energy storage co-located with solar PV are being built in the country.

4 FAQs about [Antananarivo Communication 5G Base Station Project Bidding Project]

How many 5G base stations does China Mobile Need?

The CBN/China Mobile tender requests bids for 480,397 5G macro base stations in the 700 MHz band which is roughly equivalent to the number of 2.6 GHz base stations already deployed by China Mobile. Based on past big 3 (China Mobile, China Telecom, China Unicom) tender results, Huawei and ZTE are expected to win approximately 85% of the business.

Why is CBN cooperating with China Mobile on 5G?

Founded in 2014, Beijing-based CBN is the most recently established, so lacks users and infrastructure, which is partly why it is cooperating with China Mobile on 5G. Concurrently, a bidding announcement for the centralized procurement of multi-band (including 700MHz) antenna products was also issued. This project is a centralized bidding project.

Who will win China 5G contract?

Based on past big 3 (China Mobile, China Telecom, China Unicom) tender results, Huawei and ZTE are expected to win approximately 85% of the business. That would leave only 15% for Ericsson or other well known 5G base station vendor, but probably NOT Nokia which was shut out of the last China 5G contract awards.

How many base stations will CBN & China Mobile deploy this year?

CBN and China Mobile are reportedly promising to deploy 400,000 base stations this year. Robert Clark of Light Reading wrote, “That seems unlikely – it took the incumbent operators nearly two years to reach that mark – but it seems certain that CBN will offer its first commercial services late this year or early 2022.

Learn More

- Timor-Leste 5G communication base station hybrid energy construction project bidding

- Uzbekistan 5g communication base station wind power construction project

- Namibia Communication Network 5G Base Station Upgrade Project

- Bidding for West Asia Communication Base Station Inverter Grid Connection Construction Project

- Seychelles 5G communication base station uninterrupted power supply construction project

- Samoa communication base station inverter grid-connected construction project bidding

- Paramaribo communication base station battery project bidding

- South Tarawa Communication 5G Base Station Construction Project

- Swiss 5G communication base station wind and solar complementary project

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.