Sun Power Ethiopia | Leading Renewable Energy Solutions

Explore Sun Power Ethiopia, your trusted renewable energy and consulting company. Offering solar solutions, battery storage, and efficient water pumping systems. Get a free consultation

Ethiopia to Exploit Full Potential of Solar Energy

Sep 17, 2024 · Ethiopia is increasingly identifying the urgent need to transition from traditional energy sources to more sustainable alternatives. Among

Ethiopian Energy Outlook 2025

Jun 4, 2025 · 1. Executive Summary Ethiopia''s energy policy plays a crucial role in shaping the country''s economy and the well-being of its population. This second Ethiopian Energy Outlook

The Status of Solar Energy Utilization and Development in Ethiopia

Jul 24, 2023 · The analysis result of this research shows that increasing the participation of photovoltaic energy in the renewable energy market requires raising awareness regarding its

Ethiopia Dire Dawa Emerging Hub for Photovoltaic Glass

Summary: Discover how Dire Dawa is transforming into a strategic center for photovoltaic glass production in Ethiopia''s renewable energy push. This article explores market opportunities,

Juniper glass factory opens

Dec 23, 2019 · Juniper container glass plant is open for business. The new entrant to the Ethiopian market can make 200 million glass bottles a year for the national and regional

Ethiopia Solar PV Glass Market (2024-2030) | Competitive

3.5 Ethiopia Solar PV Glass Market Revenues & Volume Share, By Application, 2020 & 2030F 6.1.2 Ethiopia Solar PV Glass Market Revenues & Volume, By Application, 2020- 2030F

photovoltaic curtain wall Companies serving Ethiopia

Onyx Solar is the world''s leading manufacturer of transparent photovoltaic (PV) glass for buildings. Onyx Solar uses PV Glass as a material for building purposes as well as an

ACE TAF ETHIOPIA Customs Handbook Final | PDF | Photovoltaic

Mar 7, 2025 · The Ethiopia Customs Handbook for stand-alone solar products and components outlines the amended tariff structure effective June 2022, aimed at enhancing electricity

ISA and Ethiopia Sign Agreements to Accelerate Solar Park

Jun 25, 2022 · The International Solar Alliance (ISA) and Government of Ethiopia have signed multiple agreements to accelerate solarisation in Ethiopia through solar parks and solar pump

Ethiopia Solar Glass Market (2025-2031) | Trends, Outlook

Market Forecast By Type (Tempered Solar Glass, Low Iron Solar Glass, BIPV Solar Glass, Coated Solar Glass), By Coating Technology (Anti Reflective, Self Cleaning, Thermal

Solar Panels Suppliers Serving Ethiopia

Colour treated glass for photovoltaic (PV) and thermal panel applications involves the application of highly efficient and environmentally friendly nanotechnology surface treatments optimized

Ethiopia Photovoltaic Market (2025-2031) | Size & Companies

Historical Data and Forecast of Ethiopia Photovoltaic Market Revenues & Volume By Half-Cell PV Modules for the Period 2021-2031 Ethiopia Photovoltaic Import Export Trade Statistics

Ethiopia Solar Photovoltaic (PV) Market Size Zooming 3.6X

Aug 11, 2025 · During the forecast period between 2025 and 2031, BlueWeave expects Ethiopia Solar Photovoltaic (PV) Market size to boom at a robust CAGR of 20.09%, reaching a value of

6 FAQs about [Ethiopia Photovoltaic Glass]

Are solar PV Grid-connected power plants possible in Ethiopia?

As far as the author knowledge is concerned, only a recent state-sponsored pre-feasibility study on solar energy potential of Ethiopia suggested four sites for solar PV grid-connected power plants .

What is the history of solar PV systems in Ethiopia?

In the next section, brief overview of previous studies and historical background of PV systems in Ethiopia is included. The first standalone solar PV system in Ethiopia was introduced in the mid of 1980s to a remote village located in the central part of the country .

How much does a solar PV system cost in Ethiopia?

Another recent study in Nigeria analyzed the technical and economic performance of an 80 kW solar PV grid connected system (contributing 40.4%) in combination with a 100 kW power from the grid and showed that the LCOE was about $0.103/kWh . Looking at such cases, the proposed system cost in Ethiopia falls within the range of LCOE in the region.

Is solar photovoltaic water pumping system feasible in Ethiopia?

Study site In this research, the feasibility of solar photovoltaic water pumping system was studied selecting one potential site from three administrative regions of Ethiopia. The regions selected are Amhara, Oromia and Tigray regions.

Can solar power transform Ethiopia's energy landscape?

Among these, solar energy emerges as a beacon of hope, poised to transform Ethiopia's energy landscape and drive socioeconomic development. Significantly, the country has relied heavily on hydropower, which accounts for more than 90% of its electricity generation.

Why is solar energy important in Ethiopia?

By improving energy access, solar energy can stimulate local economies, enhance educational opportunities, and improve healthcare services, thereby contributing to overall development. Moreover, the transition to solar energy aligns with Ethiopia's ambitious climate goals.

Learn More

- What is required for photovoltaic glass processing

- Which is better the battery cell or the photovoltaic glass

- London New Energy Building Photovoltaic Glass Component Wholesale

- Paris photovoltaic glass model

- Photovoltaic conversion efficiency of cadmium telluride glass

- U-shaped glass u-shaped photovoltaic

- The difference between ito conductive glass and photovoltaic glass

- Photovoltaic glass technical transformation project

- Photovoltaic silicon glass

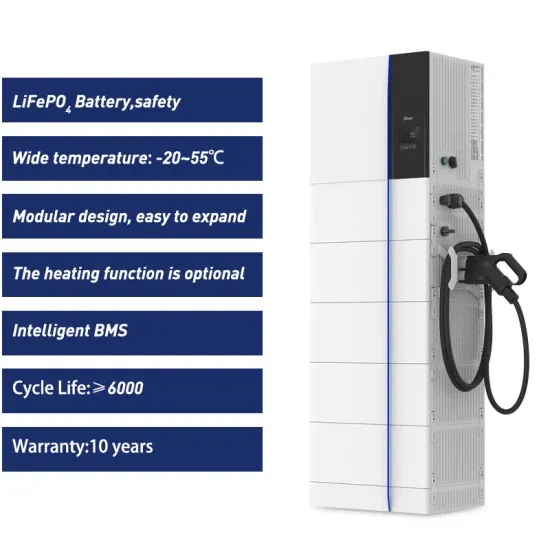

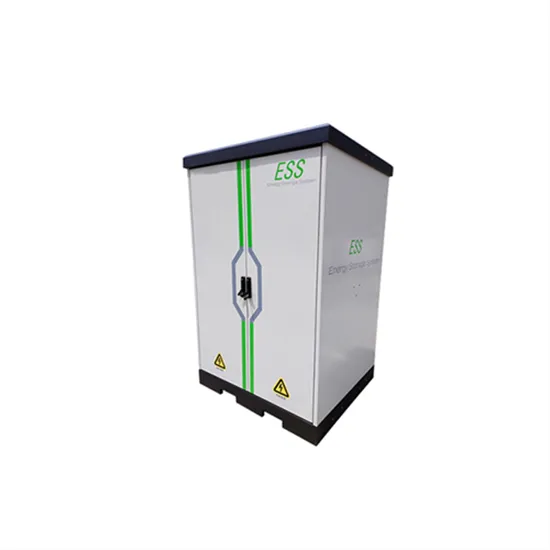

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.