New Energy Storage Technologies Empower Energy

Aug 3, 2025 · KPMG China and the Electric Transportation & Energy Storage Association of the China Electricity Council (''CEC'') released the New Energy Storage Technologies Empower

EPRI Energy Systems and Climate Analysis Group

ESCA storage research focuses on use of storage for energy arbitrage, capacity value, and for spinning or non-spinning reserves, and considers the feedback efects of increasing storage

Energy Storage Applications and Value Stacknig

Apr 11, 2022 · Energy storage is capable of providing a wide array of grid services Regulatory structure is still evolving for many applications Different technologies for energy versus power

Unlocking the Hidden Value of Energy Storage Products:

With modern energy storage product value propositions, this isn''t science fiction. The global energy storage market is projected to hit $546 billion by 2035 (BloombergNEF), but most

How is the value of energy storage products calculated?

Jan 17, 2024 · To determine the value of energy storage products, several key factors are assessed: 1. System Characteristics, 2. Market Dynamics, 3. Economic Benefits, 4.

BlueVault™ energy storage solutions

6 days ago · BlueVault™ energy storage solutions are an advanced lithium-ion battery-based solution, suited for both all-electric and hybrid energy-storage applications. BlueVault™ is

Sungrow''s Perspective on Value Evolution of Solar + Energy Storage

Jun 24, 2025 · As solar and energy storage scale rapidly, Sungrow argues that industry competitiveness will hinge not on cost-per-watt, but on system integration, platformization, and

Electric Cars, Solar & Clean Energy | Tesla

Dec 6, 2024 · Tesla is committed to creating a sustainable future through solar energy, battery technology, and electric vehicles, impacting products, people,

The value of storage in electricity generation: A qualitative

Dec 1, 2020 · Electricity storage (ES) is a technology that can complement variable renewable generation in the widely sought low-carbon future. Given the several unique features of ES, it

Unlocking the Energy Storage Product Value: Innovations,

May 10, 2022 · Let''s cut to the chase: energy storage product value isn''t just industry jargon—it''s the secret sauce powering everything from your neighbor''s solar-powered Tesla Powerwall to

Energy Storage System Value Analysis and Value Recovery

Oct 24, 2021 · Under the background of a new power system with new energy as the main body, energy storage has the characteristics of fast response, time decoupling, etc., whi

Energy Storage Valuation: A Review of Use Cases and

Jun 24, 2022 · Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its

Battery Energy Storage Systems

Dec 1, 2023 · Battery Energy Storage System (BESS) is becoming a key technology to support the energy transition. Therefore, choosing the right System Integrator able to seamlessly

EXPLORING THE VALUE OF ELECTRICITY STORAGE: A

1 day ago · This report highlights international exhibits of worldwide cases where the value of energy storage is demonstrated and storage assets are properly integrated into the energy

6 FAQs about [Energy storage product value]

Do energy storage systems provide value to the energy system?

In general, energy storage systems can provide value to the energy system by reducing its total system cost; and reducing risk for any investment and operation. This paper discusses total system cost reduction in an idealised model without considering risks.

How do you value energy storage?

Valuing energy storage is often a complex endeavor that must consider different polices, market structures, incentives, and value streams, which can vary significantly across locations. In addition, the economic benefits of an ESS highly depend on its operational characteristics and physical capabilities.

Are energy storage technologies valuable?

Regardless of the low or high LCOS indication, the ‘variable EP scenario’ shows that all included energy storage technologies are valuable. As noted earlier, we define a technology as valuable if it reduces the total system costs. This is the case if a technology is part of an optimised energy system.

What is the value of a storage service?

Value represents the monetary remuneration storage would receive if it is deployed: the value can be tied immediately to the service, or a model can be built to understand how the market value of the service is affected when storage enters the energy mix.

How many benefits can energy storage provide?

How many benefits can be delivered by energy storage depends, among others, on how future technology will be designed. Consequently, research and development (R&D) must evaluate the techno-economic design of energy storage systems to be most beneficial. A traditional technology evaluation approach is to reduce the cost of its devices [ 4 ].

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Learn More

- Kosovo energy storage product production company

- Lesotho Energy Storage Product Quote

- Energy storage ems system product introduction

- Export value of energy storage batteries

- Energy storage product battery cell profit model

- Energy storage battery product direction

- Outdoor energy storage product design

- Energy storage product export data

- Investment value of New Zealand energy storage power station

Industrial & Commercial Energy Storage Market Growth

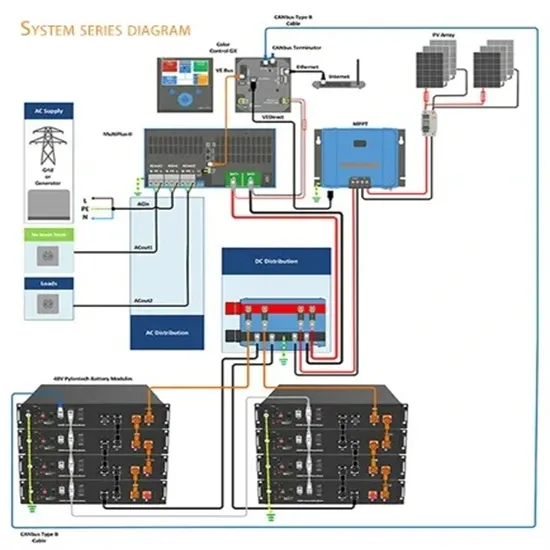

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

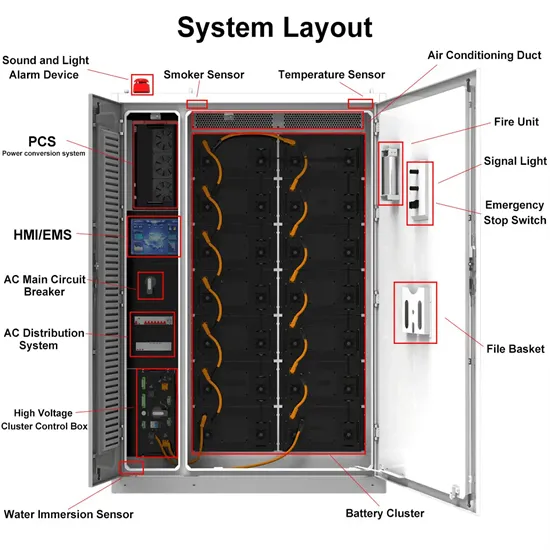

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.