Export of Household Energy Storage Batteries: The Silent

Jul 8, 2025 · The export of household energy storage batteries has become the unsung hero of global energy transition, with China''s 2024 Q1-Q5 exports surging 50.1% year-on-year to

2021 2024 FOUR YEAR REVIEW SUPPLY CHAINS FOR

Dec 19, 2024 · Introduction Advanced batteries are a critical technology needed for a resilient, affordable, and secure future energy system. As vital components of electric vehicles,

China dominates global trade of battery minerals

May 21, 2025 · After production, raw battery minerals are shipped globally to be used as feedstock for refining. China accounted for 46% of the world''s raw battery mineral import trade

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Energy storage battery exports in the first five months of

Jul 19, 2024 · The outpacing growth of energy storage battery exports over power batteries in the first five months of this year is not surprising. A closer look reveals that the slowing year-on

China dominates global trade of battery minerals

May 21, 2025 · China imported almost 12 million short tons of raw and processed battery minerals, accounting for 44% of interregional trade, and exported almost 11 million short tons

and Non-Export Controls III. Requirements for Limited-

Mar 28, 2022 · Energy storage export and import can provide beneficial services to the end-use customer as well as the electric grid. These capabilities can, for example, balance power flows

Energy Storage Exports: Powering the Global Transition to Clean Energy

Why Energy Storage Exports Matter Now Ever wondered why your phone battery dies right before that important call? Now imagine scaling that frustration to national power grids. As countries

National Blueprint for Lithium Batteries 2021-2030

Jul 1, 2024 · Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid

Analysis of lithium battery export data in overseas markets in

According to the report released by the China Chemical and Physical Power Industry Association, as of November 2024, China''s lithium-ion battery exports reached 3.563 billion, a year-on-year

Report-Battery-energy-storage

Sep 8, 2021 · In order to deploy renewables and to release their potential for ensuring a stable and secure energy supply, Europe needs to work to overcome the intrinsic limits of

China s new battery energy storage exports

Jan 31, 2025 · China''s energy storage battery exports have been growing significantly. In 2021, China exported 3.427 billion lithium-ion batteries, with an export value of US$28.423 billion.

China''s lithium-ion battery exports totaled US$43.687 billion

Oct 22, 2024 · From January to September 2024, Fujian Province is still the largest source of China''s lithium-ion battery exports, with an export value of US$11.85 billion, a year-on-year

How is the export market of energy storage batteries?

Jan 15, 2024 · The export market of energy storage batteries is experiencing exponential growth, driven by factors such as increasing demand for renewable energy, advancements in

6 FAQs about [Export value of energy storage batteries]

Is battery storage an export opportunity in India?

India’s Central Electricity Authority has modelled a need for 27GW/108GWh of battery storage by 2030 to meet national goals of adding 500GW of renewable energy capacity from solar and wind, while battery storage could be an export opportunity as well.

How much battery material does China Import & Export?

China imported almost 12 million short tons of raw and processed battery minerals, accounting for 44% of interregional trade, and exported almost 11 million short tons of battery materials, packs, and components, or 58% of interregional trade in 2023, according to regional UN Comtrade data.

Will a battery storage system affect export payments?

This means the government pays you the same amount – 50% of your generation reading – regardless of how much you generate. Therefore, your export payments won’t be affected by installing a battery storage system. Something to bear in mind is that the smart meter rollout – expected to be completed by 2020 – might well affect the export tariff.

What are the economics of battery energy storage?

The Economics of Battery Energy Storage, a recent RMI analysis, showed that battery storage systems can provide up to thirteen distinct electricity services to the grid. However, some of these services are hindered by regulatory barriers and cannot compete directly with conventional investments in wires and generators.

Which country exports the most battery cells in the world?

China accounted for 74% of the world’s battery pack and component exports in 2023. That same year, China controlled nearly 85% of the world’s battery cell production capacity by monetary value. Data source: United Nations Statistics Division, UN Comtrade Note: Excludes trade within regions.

Which country imports the most battery minerals?

China imported 20% of the world’s processed battery minerals in 2023, made up of mainly cobalt from Africa. That same year, China exported 58% of the world’s processed battery minerals, mainly synthetic graphite to the rest of Asia and Oceania.

Learn More

- Vienna Photovoltaic Energy Storage Company Export

- Yerevan sells energy storage batteries

- Prices of household energy storage batteries in Egypt

- Introduction to EK Energy Storage Batteries in South America

- How much is the price of energy storage batteries in India

- What was the price of energy storage cabinet batteries in the past

- Is it necessary to have energy storage batteries when off-grid

- Bulgaria invests billions in energy storage batteries

- Do we need batteries for energy storage

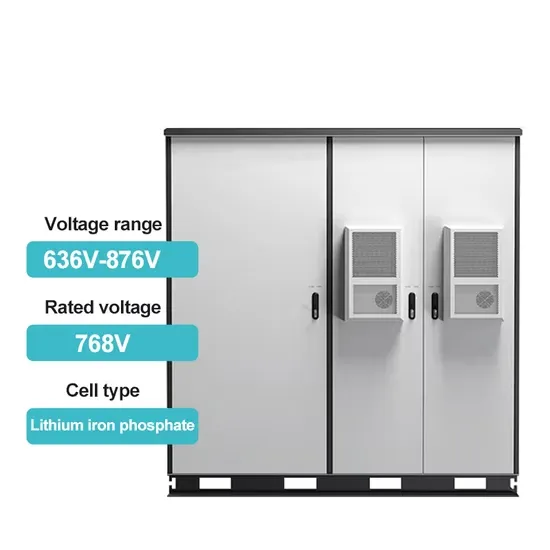

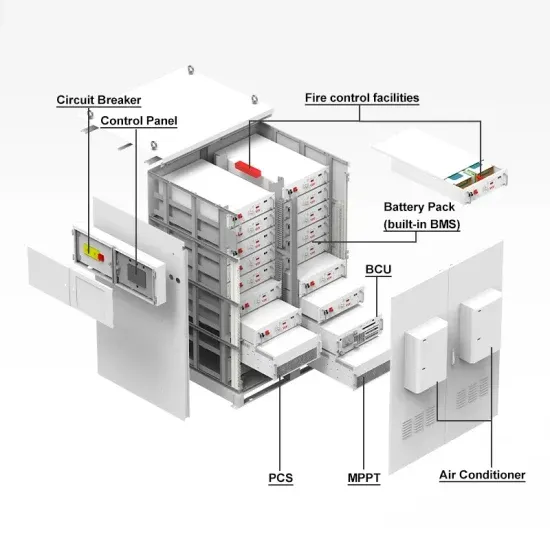

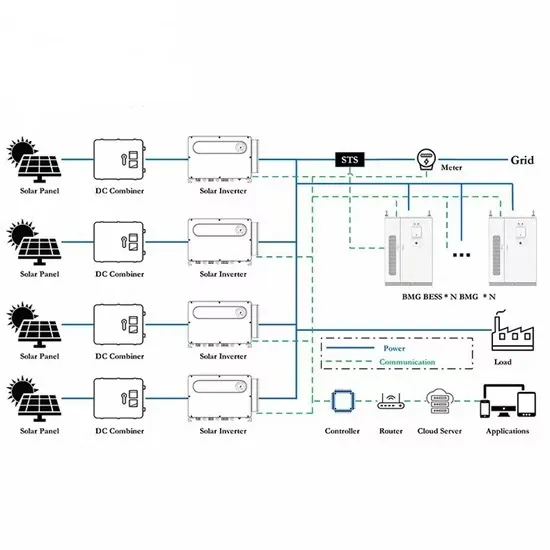

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

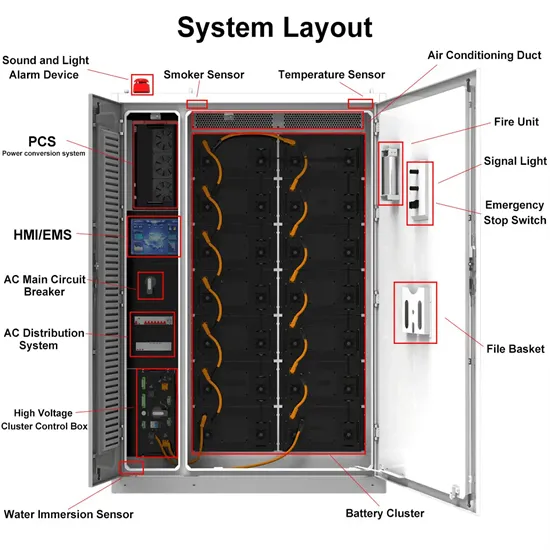

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.