Huawei to deliver FusionSolar solutions in Saudi Arabia for

Aug 21, 2024 · As of now, Saudi Arabia is partnering up with Huawei for its FusionSolar solutions. Inputs reveal the Red Sea Project will build a photovoltaic-energy storage microgrid. This

Huawei Photovoltaic Panel Price Key Factors and Market

Summary: Understanding Huawei photovoltaic panel prices requires analyzing market dynamics, technological advancements, and regional demand. This article breaks down cost drivers,

Unlocking the Potential of the Solar Photovoltaic (PV)

Feb 15, 2025 · rowth in the years to come, the Middle East is accelerating its solar ambitions. From large-scale utility projects to innovative PV technologies and smart grid i. tegration, the

Unlocking the Power of Solar Panels: Your Ultimate Guide

May 27, 2024 · With the sun as an inexhaustible energy source, solar panels offer a smart, eco-friendly way to generate electricity. This cutting-edge solution not only saves you money but

World''s Largest Solar Microgrid coming to Saudi''s Red Sea

Aug 27, 2024 · Saudi Arabia''s Red Sea Project will feature the world''s largest solar microgrid, powered by Huawei''s renewable technology. The microgrid will consist of a 400MW solar PV

MENA Solar and Renewable Energy Report

Sep 5, 2024 · Introduction Renewable energy usage has been growing significantly over the past 12 months. This trend will continue to increase as solar power prices reach grid parity. In 2019,

Residential Smart PV & ESS Solution | FusionSolar Saudi Arabia

FusionSolar provides residential solar solutions for professionals. We can maximize energy production and improve overall energy efficiency. Our monitoring systems ensure that

Middle East: Leading the 5.5G Era and Striding Towards an

Jun 29, 2024 · The advancements in 5G and 5.5G that carriers have made in the Middle East''s Gulf Cooperation Council (GCC) countries have set new benchmarks in scenario-based

Unlocking the Potential of the Solar PV Market

Mar 14, 2025 · The Middle East, benefiting from an 89% drop in solar generation costs since 2010, is on track to reach 40 GW solar capacity in 2024 and 180

Europe considers ban on Chinese solar inverters,

May 13, 2025 · Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions

World''s Top Solar PV Producers Plan to Open Factories in Middle East

The solar PV factories in Middle East are set to transform the energy future of the region. Leading global solar producers have announced plans to build new manufacturing factories in the

Huawei and du Commercially Deploy the First Indoor 5G

Jun 30, 2025 · Huawei, in partnership with du, from the Emirates Integrated Telecommunications Company (EITC), have deployed the first indoor 5G-Advanced Network in the Middle East.

Nastech Solar & Huawei Strengthen Partnership to Expand

Sep 28, 2024 · With strong ties and a focus on growth, Nastech Solar and Huawei are poised to drive the expansion of solar energy in the Middle East, fostering a sustainable and energy

Leading Provider of Innovative Solar Solutions in Saudi

FusionSolar is a leading Saudi Arabia provider of solar solutions, partnering with professional installers, utilities, and other stakeholders to promote sustainable and efficient use of

Middle East''s challenging outlook for PV industry

Nov 3, 2023 · In the short term, PV demand will taper off in Israel and other war-torn regions, while geographical uncertainties deter foreign PV investments. This underscores the need for

6 FAQs about [Huawei photovoltaic panels in the Middle East]

Is Huawei the leading solar inverter vendor in 2022?

Huawei’s dominance in the renewable energy sector is further evidenced by its position as the leading global solar photovoltaic (PV) inverter vendor in 2022, with a 29 percent market share, according to Wood Mackenzie.

Will Huawei fusion solar power Red Sea city's off-grid energy needs?

Huawei’s FusionSolar Smart String Energy Storage Solution will power the Red Sea City’s off-grid, clean energy needs. The Red Sea Project, a key part of SaudiVision2030, is now the world’s largest microgrid with 1.3GWh storage capacity.

Will Saudi Arabia become a solar energy L Ader in the Middle East?

e region’s solar capacity by 2030.Large-scale utility and ofshore innovationsPositioning itself as a solar energy l ader, the Middle East is embarking on various endeavors to advance solar energy. One of the most prominent is the implementation of large-scale utility projects.On this front, Saudi Arabia is leading the charge.

Is the Middle East accelerating its solar ambitions?

ctricity, has emerged as a cornerstone of renewable energy strategies worldwide.With global solar PV capacity surpassing 1,600 GW in 2023 and projections of even greater rowth in the years to come, the Middle East is accelerating its solar ambitions. From large-scale utility projects to innovative PV technologies and smart grid i

Which countries have the largest solar capacity by 2030?

GW by 2030. Solar capacity in the region grew by 23% last year, reaching 32 GW. Saudi Arabia, Türkiye, Egypt, the UAE, Oman, and Morocco are leading the growth, and these countries are p e region’s solar capacity by 2030.Large-scale utility and ofshore innovationsPositioning itself as a solar energy l

What is Huawei fusionsolar smart string energy storage solution (ESS)?

Central to this vision is Huawei’s FusionSolar Smart String Energy Storage Solution (ESS). This solution will enable the Red Sea Project to independently meet its power needs. The microgrid solution addresses the intermittent and fluctuating nature of solar and wind power. It ensures the safe and stable operation of renewable energy systems.

Learn More

- Solar Photovoltaic Panel Prices for Sale in the Middle East

- Middle East photovoltaic energy storage 15kw inverter price

- Middle East Solar PV Panels

- Huawei makes photovoltaic panels in Bulgaria

- Huawei makes photovoltaic panels

- East Asia factory photovoltaic solar panels

- Huawei Southern Europe rooftop photovoltaic panels

- Huawei makes photovoltaic panels in Uganda

- Huawei Solar Photovoltaic Panels Join

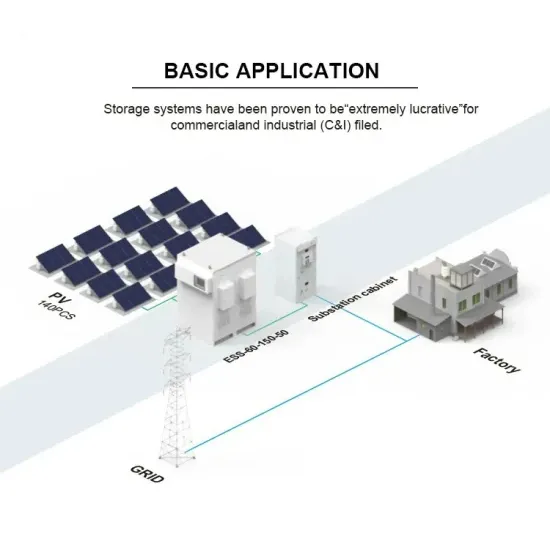

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.