Southeast Asian solar AD/CVD investigation

Apr 15, 2025 · The U.S. International Trade Commission (ITC) will hold a public hearing later today to gather insights into whether the domestic solar industry

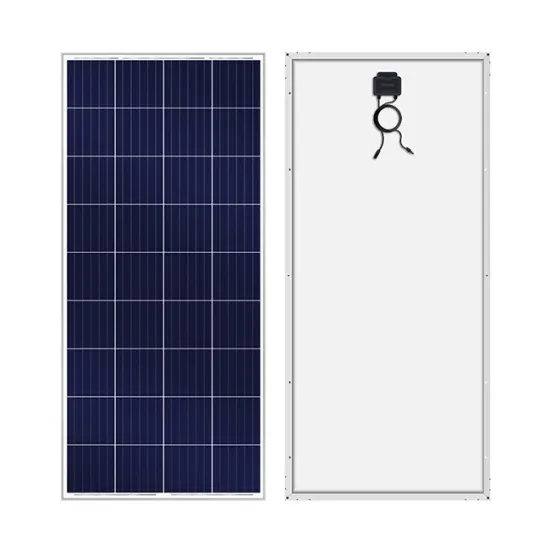

East Asia Photovoltaic Panel Professional Manufacturer

Why East Asia Dominates Global Solar Panel Production Did you know that 3 out of 5 solar panels installed worldwide come from East Asia? Countries like China, South Korea, and

Sinovoltaics Southeast Asia SEA Solar Energy Supply Chain

This edition of the Southeast Asia Solar Supply Chain Map provides a detailed snapshot of current realities and future ambitions, as the region navigates complex trade, investment, and

Top 50 Solar Plants in Asia: The lands of rising solar

May 9, 2024 · From the perspective of photovoltaic industry capacity, Southeast Asia is undoubtedly the largest production region outside of China. As of the

Untapped Potential: Scaling solar PV and battery

Oct 9, 2023 · Southeast Asia is a solar PV manufacturing hub with 2 per cent – 3 per cent of the world''s polysilicon and wafer capacity and 9 per cent–10 per cent of the world''s cells and

Leaving Southeast Asia, where should Chinese photovoltaic

Jul 4, 2024 · Chinese photovoltaic enterprises have successively "gone to Southeast Asia", and the leading enterprises have integrated production capacity from silicon wafers to modules.

Solarvest Adopts First Solar Technology To Optimize Their

Jul 21, 2022 · First Solar, Inc. will supply Solarvest Holdings Berhad, a clean energy specialist and turnkey engineering, procurement, construction and commissioning service provider in South

Southeast Asia''s Solar Industry Development

Feb 28, 2025 · The solar industry''s growth in Southeast Asia unveils a massive, latent market for pallets, particularly photovoltaic pallets. These non-standard

6 FAQs about [East Asia factory photovoltaic solar panels]

What is the Southeast Asia Solar supply chain map?

This edition of the Southeast Asia Solar Supply Chain Map provides a detailed snapshot of current realities and future ambitions, as the region navigates complex trade, investment, and production challenges.

Are solar panels made in Malaysia?

Most of these solar panels are manufactured for export to the US, with Malaysia’s installed solar capacity at only 4.2GW. From January to September 2024, Malaysia, which is a major hub for solar panel manufacturing in South-east Asia, exported nearly US$1.8 billion (S$2.4 billion) worth of solar panels.

Why is PV module manufacturing under pressure in Southeast Asia?

Despite strong ambitions, PV module manufacturing in Southeast Asian is currently under pressure. Operational capacities have been significantly reduced or temporarily halted, primarily due to U.S. import tariffs. Once a strategic workaround for Chinese manufacturers aiming to access Western markets, Southeast Asia now faces growing constraints.

Who makes the most solar panels in the world?

The remaining production capacity is taken up by the US’ largest solar manufacturer First Solar and South Korea’s biggest solar producer Hanwha Qcells. Most of these solar panels are manufactured for export to the US, with Malaysia’s installed solar capacity at only 4.2GW.

What's new in the 2025 Southeast Asia Solar supply chain map?

The first 2025 edition of the Southeast Asia Solar Supply Chain Map includes significant revisions and additions, driven by valuable market feedback and the region’s evolving geopolitical and industrial dynamics.

Are other countries blooming with solar power?

It is not nearly as immediately apparent that other countries in Asia are also blooming with solar power. Given the recent commitments at COP21 and ASEAN Ministerial summits, positive investment climate and huge hunger for power, Asia has witnessed the commissioning of an abundance of utility-scale solar plants.

Learn More

- East Asia makes solar photovoltaic panels

- Photovoltaic solar panels at Guinea-Bissau factory

- Asmara factory solar photovoltaic panels

- The lifespan of solar photovoltaic panels

- 24V photovoltaic solar panels

- New solar photovoltaic panels 3000 watts

- Kyiv photovoltaic panels wholesale factory direct sales

- New house solar photovoltaic panels for home use

- Where to buy 250w solar photovoltaic panels

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.