Middle East: Solar Investment Opportunities

Nov 16, 2021 · In this report we are proud to present our findings on solar investment opportunities in the Middle East and North Africa. It covers markets in Egypt, Jordan, Oman,

Middle East & Africa Solar Photovoltaic (PV) Market

As prices continue to fall, it becomes increasingly cost-effective for homeowners and businesses to install rooftop solar panels or other small-scale installations, as well as larger solar power

Middle-East Solar Power Market Size | Mordor

Jun 27, 2025 · Solar Power Market in Middle East Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Middle East Solar Power Market is

Economic viability of rooftop photovoltaic systems in the middle east

Dec 1, 2020 · Solar Incentive Programs (SIPs), covering 50% of the total cost can be assumed in the Middle East and Northern Africa. The economic model results demonstrating the payback

Middle East and Africa solar PV system pricing 2020

Aug 25, 2020 · This report covers solar PV system costs for utility-scale systems in 18 major Middle East and Africa markets. It includes detailed breakdowns for system costs in Jordan

Middle East Solar PV Panels Market (2020-2026)

Middle East Solar Panel outlook report provides an unbiased and detailed analysis of ongoing Middle East Solar PV panels market trends, opportunities/high growth areas and market

The Future Of Rooftop Solar In The Middle East

Mar 3, 2021 · Rooftop solar PV panels are common in a number of countries, but are only now gaining real popularity in the Middle East. Despite the sunny climes, there are still a number of

Solar photovoltaics manufacturing attraction in the Middle East

Jun 2, 2025 · As global demand for renewable energy accelerates, the Middle East is positioning itself as a competitive hub for solar photovoltaics (PV) manufacturing. This paper explores the

Unlocking the Potential of the Solar Photovoltaic (PV)

Feb 15, 2025 · rowth in the years to come, the Middle East is accelerating its solar ambitions. From large-scale utility projects to innovative PV technologies and smart grid i tegration, the

Solar Panels for Sale: High-Quality Photovoltaic Panels in Spain

The most powerful PV panels on the market had prices ranging from 260 to 441 euros per solar panel in 2020. The average price for installing panels in private homes in Spain varies from

With record low cost, Saudi Arabia leads Middle

Jun 5, 2024 · According to a recent report, Saudi Arabia has achieved a world-record low levelized cost of electricity for solar photovoltaics, reaching USD

Buy Solar Panels Online | Muzuri Solar

Our competitive prices make us the cheapest option for solar panels in the Middle East, ensuring that you get the best value for your money. For the best quality and most cost-effective solar

Middle East & Africa Solar Pv Panels Market Size & Outlook

The solar pv panels market in Middle East & Africa is expected to reach a projected revenue of US$ 5,724.2 million by 2030. A compound annual growth rate of 3.3% is expected of Middle

The Middle East Is Bracing for a Solar Energy Boom

Jan 26, 2025 · Solar PV is expected to contribute over half of the Middle East''s power supply by 2050, driven by increasing power demand and government initiatives to diversify energy sources.

Strategic considerations for deployment of solar

Jun 1, 2013 · The strategic rationale for adoption of solar energy, particularly solar photovoltaics (PV), in the Middle East and North Africa (MENA) is considered here through analysis of a

Middle East and Africa Photovoltaic Market – Growth

The Middle East & Africa Photovoltaic Market size is projected to reach approximately $XX billion by the end of 2024 with a CAGR of close to XX% from $XX billion in 2017 during the forecast

World''s Top Solar PV Producers Plan to Open Factories in Middle East

The solar PV factories in Middle East are set to transform the energy future of the region. Leading global solar producers have announced plans to build new manufacturing factories in the

Solar System Installers in Middle East | PV Companies List

List of Middle Eastern solar panel installers - showing companies in Middle East that undertake solar panel installation, including rooftop and standalone solar systems.

The Middle East''s Solar Shift: From Oil to Energy

Mar 17, 2025 · The Middle East, long defined by its oil wealth, is now emerging as a global leader in solar power. Once considered an afterthought in a region

6 FAQs about [Solar Photovoltaic Panel Prices for Sale in the Middle East]

How big is the Middle East & Africa solar photovoltaic (PV) market?

The Middle East & Africa solar photovoltaic (PV) market size was valued at USD 5.00 billion in 2022. The market is projected to grow from USD 6.93 billion in 2023 to USD 37.71 billion by 2030, exhibiting a CAGR of 27.4% during the forecast period. Solar panels form the heart of any solar energy system.

Which country has the most solar installations in the Middle East?

Amongst all the countries in the Middle East region, the United Arab Emirates holds the maximum installations and PV projects in the pipeline for solar PV installation. Rapidly growing renewable deployment coupled with encouraging initiatives by the national administration is set to boost the setup of new solar units in the country.

What is the competitive landscape of solar photovoltaic market?

The competitive landscape of this market depicts a market share dominated by solar photovoltaic manufacturers which hold a superior position in the global market. The competitive landscape which has well-established supply chains with preference from customers dominated the market in the Middle East too.

Is the Middle East accelerating its solar ambitions?

ctricity, has emerged as a cornerstone of renewable energy strategies worldwide.With global solar PV capacity surpassing 1,600 GW in 2023 and projections of even greater rowth in the years to come, the Middle East is accelerating its solar ambitions. From large-scale utility projects to innovative PV technologies and smart grid i

Is Saudi Arabia advancing solar energy in the Middle East?

ader, the Middle East is embarking on various endeavors to advance solar energy. One of the most prominent is the implementation of large-scale utility projects.On this front, Saudi Arabia is leading the charge. Under its National Renewable Energy Programme, it aims to tender 20 GW annually. The country’s

How much is Oman's solar energy project worth?

March 2023 - Oman awarded over USD 700 million contracts for solar energy projects. Oman Power and Water Procurement Company (OPWP) is set to award solar energy projects worth more than USD 770 million to international investors after securing approvals from the Authority for Public Services Regulation (APSR).

Learn More

- Middle East soft solar photovoltaic panel manufacturers export

- Photovoltaic solar panel prices in Kathmandu

- Photovoltaic solar panel prices in Oman

- 12v2a20w solar photovoltaic panel

- Guinea photovoltaic panel prices

- 100w outdoor solar panel photovoltaic panel

- A solar photovoltaic panel costs 49 yuan

- Tcl photovoltaic technology solar panel size

- Solar photovoltaic energy storage cabinets for sale in Ghana

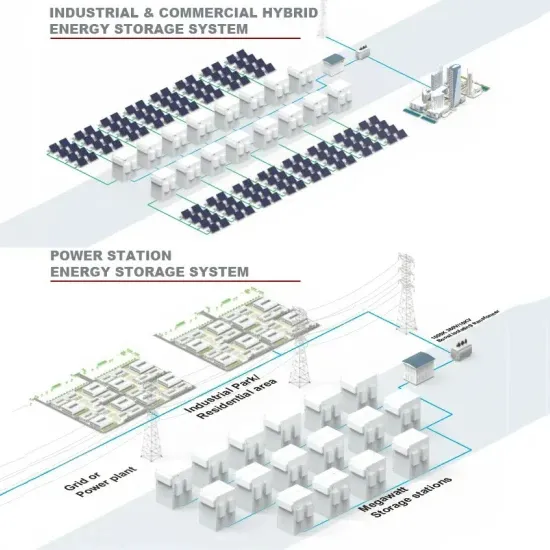

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.