CATL invertirá 5,000 mdd en planta para fabricar

Jul 18, 2022 · Ciudad Juarez y Saltillo son las ciudades a las que CATL ''puso el ojo'' para para instalar una planta en México para abastecer a Tesla.

First Lithium Battery Factory in Mexico: BMW''s Bold Move

Oct 30, 2024 · In a bold move towards sustainable transportation, BMW Mexico has unveiled plans to commence high-voltage battery production for electric vehicles at their San Luis

Sonora to Build a Lithium Battery Manufacturing Plant

Nov 4, 2022 · The government of Sonora is looking to attract more clean energy-related factories like another battery factory and a spare parts factory for electric vehicles. Villa''s statement

Mexico Lithium-ion Battery Import Research Report

Dublin, Jan. 31, 2025 (GLOBE NEWSWIRE) -- The "Mexico Lithium-ion Battery Import Research Report 2025-2034" has been added to ResearchAndMarkets ''s offering. The demand for

Lithium Ion Battery Pack Suppliers from Mexico

Jun 18, 2025 · Find Economical Suppliers of Lithium Ion Battery Pack: 19 Manufacturers in Mexico based on Export data till Jun-25: Pricing, Qty, Buyers & Contacts.

Batteries for EV Audi – Assembly plant to be

Dec 4, 2024 · The German car manufacturer Audi has started building the first assembly hall for batteries for electric cars at its San José Chiapa plant in the

CATL Looks To Mexico For Battery Factories To Supply Tesla

Reports also suggest that CATL could choose to manufacture the battery cells in Mexico, and then move them to Kentucky to put them into battery packs for Tesla and Ford.

Where the BMW Group will make its next

Jul 19, 2024 · Neue Klasse in Mexico from 2027. At San Luis Potosí in Mexico, additional production capacity is being established for series production of the

Inventus Power Facility Spotlight: Tijuana, Mexico

Oct 4, 2023 · Inventus Power''s Tijuana facility in Mexico offers proximity, fast delivery, and state-of-the-art technology for battery pack manufacturing. Learn

6 FAQs about [Battery pack factory in Mexico]

Who makes the best batteries in Mexico?

This manufacturer also produces batteries for consumer electronics and energy storage devices. Panasonic has grown to become one of the largest battery manufacturers in the world and is among the top 10 battery manufacturers in Mexico.

Who makes LTH batteries in Mexico?

LTH is a well-known battery manufacturer in Mexico that is part of Johnson Controls (now Clarios), which is owned by Grupo Industrial Bamer. LTH is one of the world’s leading manufacturers of energy storage technology from Latin America, has production facilities in Mexico, and also known as one of the top 10 battery manufacturers in Mexico.

Will BMW build a battery plant in Mexico?

BMW is set to launch Mexico’s first lithium battery production facility for electric vehicles at its expanded San Luis Potosí plant in 2025. With an $800 million investment, BMW aims to boost sustainability, reduce CO₂ emissions by 80% per vehicle, and integrate high-voltage battery manufacturing for an electric vehicle line by 2027.

When will a new battery plant be built in Mexico?

The plant will primarily supply the micro-electromobility sector. The amount of the investment has not been announced. The Spanish company will plan to produce its first batteries in Mexico in February or March of next year. (Endurance Motive)

Does Mexico have a battery industry?

Mexico’s battery industry continues to grow rapidly, with leading manufacturers providing energy storage solutions for a variety of sectors, including automotive, industrial, and renewable energy sectors in Mexico.

Is there a demand for lithium batteries in Mexico?

Puebla’s Volkswagen manufacturing plant, which has been in operation for over 55 years. (Volkswagen México) Endurance Motive has also met with other potential customers, including the Mexican Association of the Photovoltaic Industry, which confirmed that there is increasing demand for lithium batteries in Mexico.

Learn More

- Albania lithium battery PACK factory

- Albania Battery PACK Factory

- Dushanbe professional lithium battery pack factory price

- Gross profit of battery pack factory

- Costa Rica regular lithium battery pack factory price

- Belarus Gomel Energy Storage Battery Pack Factory

- Factory produces 36v lithium battery pack

- Battery pack factory construction plan

- Prague Battery Pack Factory

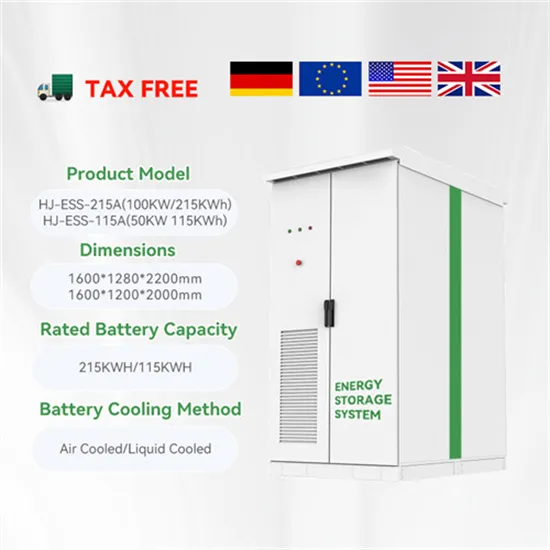

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.