Tesla reveals how much a Model Y or Model 3 cost to make,

Jan 31, 2022 · Tesla''s gross profit margin is one of the highest in the industry, it turns out, as it costs Tesla just US$36,000 on average to build one of its electric vehicles. A healthy 29%

Chinese battery maker CATL reports faster profit growth in

Jul 30, 2025 · Chinese electric vehicle battery giant CATL''s net profit growth picked up in the second quarter, even as it came under pressure from a bruising EV price war in its home

Battery Manufacturing Plant Report 2025: Setup and Cost

The battery project report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed

China''s battery makers report spike in Q1 revenue, profit

Jul 13, 2025 · BEIJING -- China''s major battery manufacturers saw rapid growth in revenue and profit in the first quarter (Q1) of the year, official data showed. Profits of major battery

Battery Gross Profit Increased Nearly Fourfold! REPT

Aug 13, 2025 · As of the end of the reporting period, REPT BATTERO''s total assets amounted to RMB 38,892.5 million, an increase of 0.9% compared to the end of last year; net assets were

Battery giant CATL turns conservative to sustain profits amid

Aug 1, 2024 · The gross profit margin of overseas revenue was 29.65%. CATL''s overseas business currently mainly involves exports, and expanding local production capacity overseas

The average gross profit margin of China''s lithium battery

Lithium battery equipment manufacturing belongs to the non-standard equipment customization industry, which has attracted many enterprises to enter the lithium battery equipment industry

Guide to Investing in the EV Battery Supply Chain

Jun 21, 2024 · Demand for batteries in multiple sectors, including automotive, is creating a significant growth opportunity for companies scaling capabilities across the battery supply

Understanding How to Increase Profitability in Battery

Aug 6, 2025 · Primarily, the revenue in Lithium Ion Battery Production is generated through the sale of battery cells and battery packs to various Original Equipment Manufacturers (OEMs)

Funeng Technology''s gross profit margin in 2024 has

Jan 25, 2025 · The prospect of solid-state battery industrialization is further brighter. In terms of the progress of all-solid-state batteries, the company has made great breakthroughs in sulfide

Historical and prospective lithium-ion battery cost

Jan 15, 2024 · However, a high-volume market for all components of battery cells except cathode active material is assumed [39], meaning that the unit price of all components in a battery cell

BYD Tops Profit Among Chinese Carmakers, Beats Tesla

Jul 17, 2025 · In Q1 2025, BYD led Chinese passenger carmakers with 9.155 billion yuan net profit and a 20.7% gross margin, outpacing Tesla. Geely and SAIC followed with net profits of 5.67

7 KPIs for Optimal Battery Production

Apr 6, 2025 · Understand how gross profit, net profit, and EBITDA serve as cornerstones for assessing your venture''s health. Discover how production costs, economies of scale, and

Industry Report 2025 investment outlook for the lithium battery

Jan 13, 2025 · The industrialization process of solid-state battery technology is accelerating, and it is expected to become one of the key technologies in the field of lithium batteries by 2025. The

Global Battery PACK Industry Research Report, Growth

Chapter 4: Detailed analysis of Battery PACK manufacturers competitive landscape, price, sales, revenue, market share and industry ranking, latest development plan, merger, and acquisition

Battery industry in China

Jul 9, 2025 · As downstream sectors, including consumer electronics and new energy vehicles, have matured, demand for batteries in China has increased dramatically, pushing the industry

Battery Energy Storage System Manufacturing Plant Setup Cost

A battery storage system production plant is a dedicated facility built to manufacture battery modules and packs for energy storage purposes. The plant entails operations such as

6 FAQs about [Gross profit of battery pack factory]

Will the global battery market grow in 2024-2025?

We estimate the global battery market will see 30%-40% annual growth in 2024-2025, mainly supported by our anticipated sales growth of electric vehicles (EVs) in China. Fading EV subsidies in Europe and less aggressive emission standard targets in U.S. could moderate EV sales and battery demand growth in these regions during the period.

What is a battery manufacturing report?

Additionally, it also provides the price analysis of feedstocks used in the manufacturing of battery, along with the industry profit margins. The report also provides detailed information related to the process flow and various unit operations involved in a battery manufacturing plant.

What is the market outlook for rechargeable batteries in the automotive sector?

Additionally, the growing demand for rechargeable batteries, such as starting, lighting, and ignition (SLI) batteries, in the automotive sector is offering a favorable market outlook. The following aspects have been covered in the report on setting up a battery manufacturing plant:

How much power does a battery pack have?

Sources: S&P Global Ratings, S&P Global Mobility. Battery cell with other materials (e.g. LFP): ≥165 Wh/kg; battery pack with other materials: ≥120 Wh/kg. Sources: The Ministry of Industry and Information Technology, China Automotive Battery Innovation Alliance, Gaogong Industry Research Institute, S&P Global Ratings.

What is covered in the report on setting up a battery manufacturing plant?

The following aspects have been covered in the report on setting up a battery manufacturing plant: The report provides insights into the landscape of the battery industry at the global level. The report also provides a segment-wise and region-wise breakup of the global battery industry.

How will China's crowded market affect the battery industry?

China's crowded market has weakened pricing power in the industry. Weaker players have less competitive product offerings and could lose volume and face weaker profitability over the next one to two years. Excess battery supply and further free operating cash outflows for many players will elevate their debt leverage.

Learn More

- Micronesia lithium battery pack factory

- Export lithium iron phosphate battery pack factory

- Albania Battery PACK Factory

- Vietnam battery pack factory

- Belarus Gomel Energy Storage Battery Pack Factory

- Costa Rica regular lithium battery pack factory price

- Brazil lithium battery pack factory

- Factory produces 36v lithium battery pack

- Prague Battery Pack Factory

Industrial & Commercial Energy Storage Market Growth

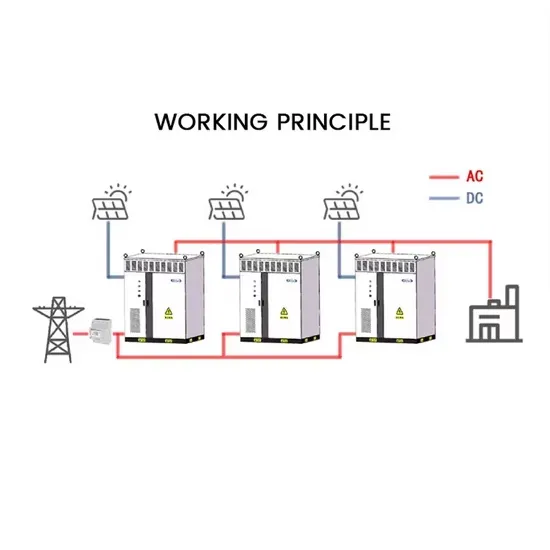

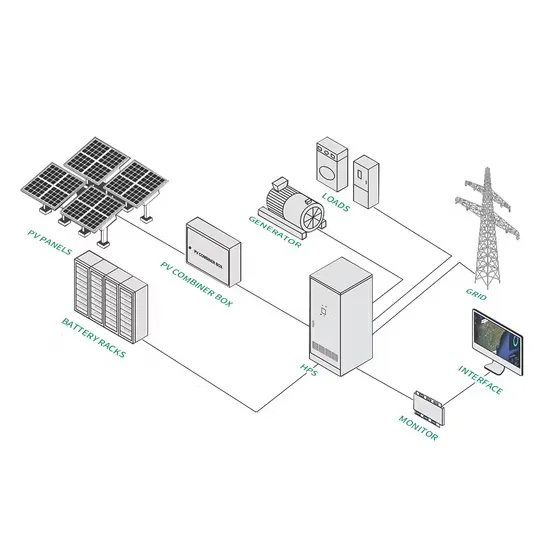

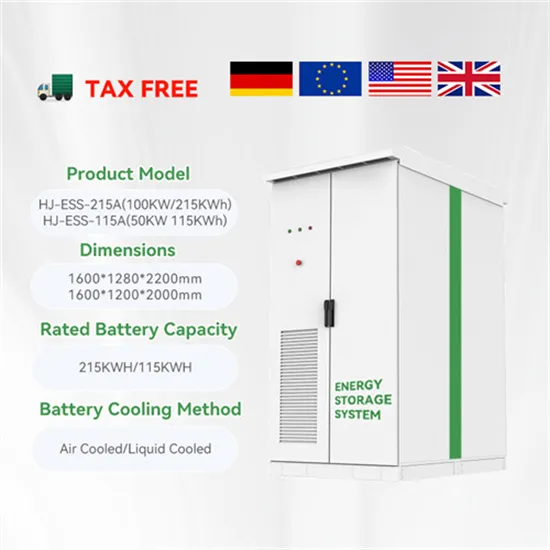

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

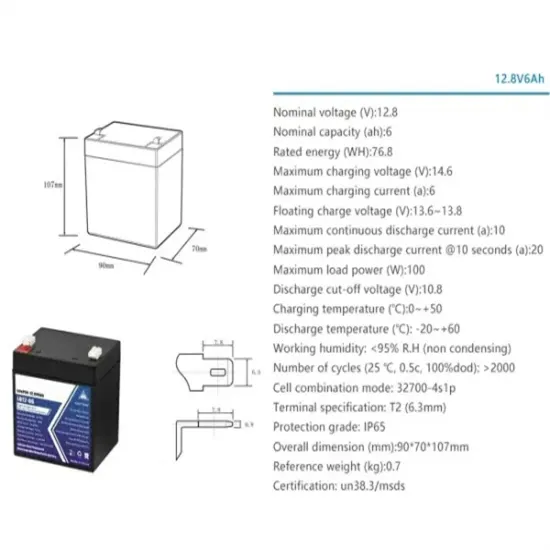

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.