Top 11 Solar Panel Manufacturers in China : 2025 Industry

Nov 30, 2024 · In this article, we will explore the key manufacturing hubs that fuel China''s solar industry, highlight the top 11 solar panel manufacturers in China, and provide an overview of

PV Module Testing Machines | Solar Equipment | Horad

Jan 16, 2025 · Horad, as a specialist manufacturer of intelligent PV panel production line, is committed to providing complete PV module manufacturing solutions for global customers

Solar panel manufacturers in the United States

Jun 2, 2025 · A current list of U.S. solar panel manufacturers that produce solar panels for the traditional American residential, commercial and utility-scale

Solar Panel Manufacturing Process: Step-by-Step Guide

Apr 12, 2025 · Complete solar panel manufacturing process – from raw materials to a fully functional solar panel. Learn how solar panels are made in a solar manufacturing plant,

6 FAQs about [Photovoltaic panel assembly equipment manufacturers]

What makes China's solar panel manufacturing industry unique?

In conclusion, China’s solar panel manufacturing industry stands at the forefront of global renewable energy efforts, offering a vast array of high-quality products from leading manufacturers like Primroot.com, Jinko Solar, Trina Solar, and LONGi Green Energy.

Where are solar panels made in China?

Jiangsu Province is renowned as one of China’s largest solar panel manufacturing hubs. Located on the east coast, it has the advantage of being near ports, which facilitates the ease of exporting solar panels. The province hosts a multitude of solar panel manufacturers in China, including Trina Solar, one of the world’s largest.

Who is Supo solar panel manufacturer?

Powered by dyyseo.com SUPO is a top brand solar panel manufacturing equipment manufacturer from China,export fully automatic solar panel production line,solar panel making machine,solar cell tabber stringer,laminator,testing machine and tunrkey line solution,best factory layout plan.

Do you offer a complete set of PV machines?

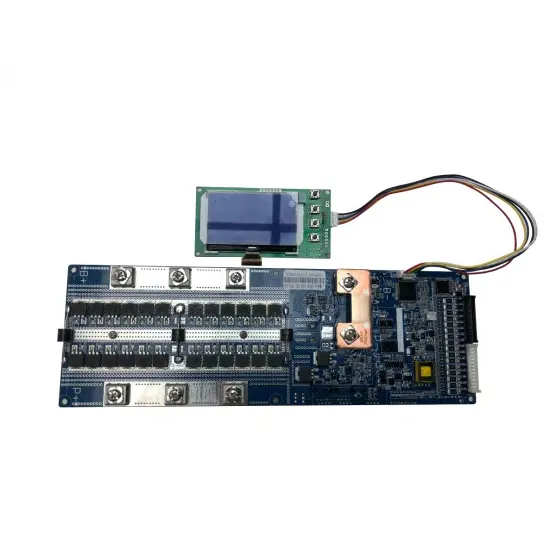

We offer a complete set of PV machines covering all solar manufacturing processes. We offer complete solar panel production lines for global customers to manufacture photovoltaic modules based on their specific requirements.

What is the market share of solar testing machine?

More than 70% of the market share on solar testing machine and 1 Year Warranty for all the supplied machines. Suposolar is a group company have been engaged in solar PV module manufacturing solutions for more than 15 years focus on serving small and medium factories in PV Industry.

Why is China the world's leading producer of solar panels?

China is the global powerhouse in solar panel manufacturing, driving the industry with unparalleled production capabilities and cutting-edge technological advancements. As the world’s leading producer, China commands over 95% of the global market for key components such as polysilicon, ingots, and wafers, essential for solar panel production.

Learn More

- Photovoltaic panel assembly manufacturers

- Smart photovoltaic panel equipment manufacturers

- Colombian flexible photovoltaic panel manufacturers direct sales

- ASEAN high-rise photovoltaic panel manufacturers

- High standard photovoltaic panel manufacturers

- Spanish rural photovoltaic panel manufacturers

- Villa photovoltaic panel equipment manufacturer

- Serbia photovoltaic energy storage equipment manufacturers

- Are there any photovoltaic panel manufacturers in Astana

Industrial & Commercial Energy Storage Market Growth

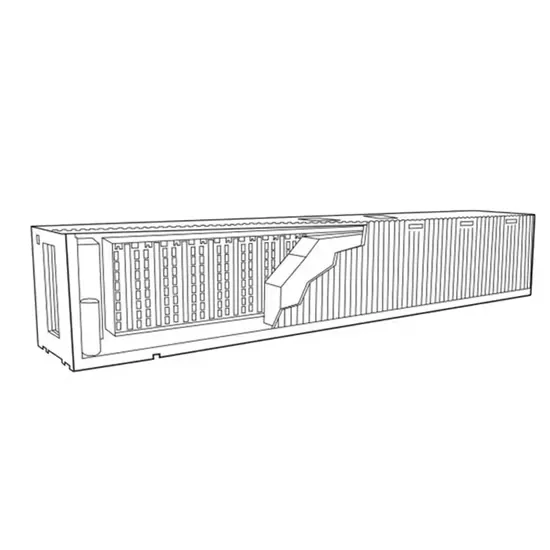

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.