Spanish photovoltaic modules and power generation projects

What is PV moduletech Europe 2025? PV ModuleTech Europe 2025 is a two-day conference that tackles these challenges directly, with an agenda that addresses all aspects of module

Top 24 Photovoltaic Equipment Producers Worldwide

2 days ago · The photovoltaic equipment manufacturing industry is a growing field with a pivotal role in our switch to renewable energy. The industry consists of companies that engineer,

Spain Photovoltaic Panel, Spanish Photovoltaic Panel Manufacturers

Made in Spain Photovoltaic Panel Directory - Offering Wholesale Spanish Photovoltaic Panel from Spain Photovoltaic Panel Manufacturers, Suppliers and Distributors at TradeKey

Photovoltaic panels Spain | B2B companies and suppliers

Vico Export Solar Energy is a wholesale distributor and importer of photovoltaic solar panels, operating in the photovoltaic sector since 2009. We work worldwide with the aim of providing

Top Solar Panel Manufacturing Companies in Spain

Identify and compare relevant B2B manufacturers, suppliers and retailers. Max. The company is a leader in Spain in solar panel installations for photovoltaic self-consumption in businesses,

What Can Photovoltaic Solar Energy Do in Spanish Rural Areas?

May 27, 2025 · Photovoltaic solar energy directly transforms sunlight into electricity using a technology based on the photovoltaic effect that is achieved through the installation of panels

Top 100 Solar Power Companies in Spain (2025) | ensun

EiDF SOLAR is the leading company in Spain for solar panel installations focused on photovoltaic self-consumption for businesses, boasting over 3,000 satisfied clients and a decade of

Performance evaluation of large solar photovoltaic power plants in Spain

Mar 1, 2019 · The pace of installation of renewable energy-based power plants continues to increase. Solar photovoltaic (PV) power is leading this trend, motivated both by improved solar

Top Solar Panel Manufacturers Suppliers in Spain

Jun 4, 2025 · At EXIOM SOLUTION we manufacture the most efficient photovoltaic panels on the market; we design and produce the structure for its support; We assemble solar parks on

Top 9 Spanish Solar Panel Manufacturers : 2024 Guide

Aug 14, 2025 · The solar industry in Spain is thriving, with many companies producing high-quality solar panels and inverters. Here, we are going to take an in-depth look at the top 9 Spanish

Agri-PV solutions for the Spanish solar power market

Aug 18, 2025 · Because Spain is the EU''s fourth-largest agricultural producer, we have a perfect opportunity to integrate farming with PV projects. Agri-PV can increase a farm''s economic

SUNO® | Solar panels designed in Spain

SUNO® challenges the solar energy industry in an unprecedented way with a range of solar panels designed in Spain that offers solutions for photovoltaic installations of any size and

Top 100 Solar Panel Companies in Spain (2025) | ensun

EiDF SOLAR is the leading company in Spain for solar panel installations focused on photovoltaic self-consumption for businesses, boasting over 3,000 satisfied clients and a decade of

6 FAQs about [Spanish rural photovoltaic panel manufacturers]

Are tamesol solar panels made in Spain?

Product Range and Advantage: Tamesol offers a variety of solar panels made in Spain, ranging from monocrystalline to polycrystalline. Their solar panels are known for high efficiency, durability, and optimal performance even in low light conditions.

Are solar energy solutions a viable option in Spain?

Here’s why solar energy solutions are an appealing proposition in Spain: The Abundant Sunlight: Spain is blessed with ample sunshine, averaging over 2,500 sunlight hours each year. Utilizing solar panels under such optimal conditions maximizes energy production, thereby significantly reducing electricity bills.

What certifications do solar panels have in Spain?

Another important certification is the IEC 61730 which deals with the safety of the panel. It ensures the solar panel has been tested for mechanical stress and safety from fire hazards. Additionally, Spain also follows the UNE 206007 IN standard specifically for self-consumption photovoltaic systems.

Who makes atersa solar panels?

Location and History: Atersa, based in Valencia, has been involved in the solar industry since 1981, making it one of the most experienced solar panel manufacturers in Spain. Product Range and Advantage: Atersa offers a wide range of solar panels, including monocrystalline, polycrystalline, and BIPV panels.

Are solar panels safe in Spain?

In Spain, solar panels are subject to various certifications to ensure their efficiency and safety. One such certification is the IEC 61215, which certifies that the solar panels have undergone testing for performance under different climate conditions like rain, high temperature, and high humidity.

Why should you invest in solar panels in Spain?

Testimonials from diverse locales in Spain reflect the company’s capacity to deliver excellence, ensuring each solar panel—whether in Altea or La Nucia—functions as a tiny powerhouse, contributing to a global green grid.

Learn More

- Cuban rural photovoltaic panel manufacturers

- Naypyidaw photovoltaic panel manufacturers

- Are there any photovoltaic panel manufacturers in Uzbekistan

- ASEAN high-rise photovoltaic panel manufacturers

- Are there photovoltaic panel manufacturers in Angola

- Norwegian photovoltaic panel manufacturers

- Bangladesh photovoltaic solar panel manufacturers

- Photovoltaic panel wholesale manufacturers direct sales 1 kWh electricity subsidy

- Bearing photovoltaic panel manufacturers

Industrial & Commercial Energy Storage Market Growth

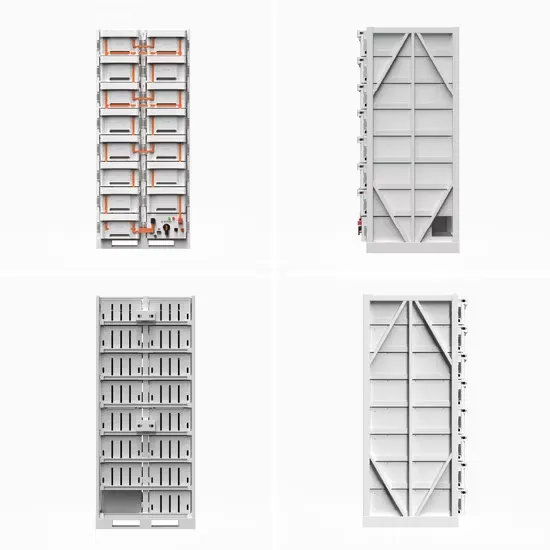

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.