2025 Photovoltaic Projects Continue To Develop In Singapore

Feb 8, 2025 · Kinsend''s photovoltaic cooperation projects in Singapore continue to increase, with a high installation rate of rooftop projects, using the space of industrial and commercial roofs to

ASEAN builds photovoltaic panel manufacturers

Using data from the Sustainable Energy Development Authority (SEDA),IRENA noted that foreign direct investment (FDI) has turned Malaysia into a major solar PV manufacturer for export

Southeast Asia Solar Energy Companies

Get access to the business profiles of top 10 Southeast Asia Solar Energy companies, providing in-depth details on their company overview, key products and services, financials, recent

Vietnam is leading Asean growing solar PV market

Aug 17, 2025 · SOUTH-EAST Asia''s cumulative solar photovoltaic (PV) capacity is expected to triple within the next 5 years, with large-scale solar projects dominating installation capacity

Southeast Asian Solar Manufacturers Look Elsewhere To

Dec 18, 2024 · The burden of these tariffs on foreign manufacturers could change the supply chains for solar panels coming to American consumers, and the shape of that industry in the U.S.

China''s Solar Module Shipments Hit 680 GW In 2024, Raising

Mar 13, 2025 · In 2024, Chinese solar PV module manufacturers recorded impressive shipment volumes, with nearly 40 companies shipping over 3 GW each. Combined, these shipments

Theimpactofgreentradebarriers on China s photovoltaic

Oct 8, 2024 · In the context of the global push towards a green economy, this research investigates the impact of green trade barriers on the export trade volume of Chinese

New record-high US solar tariffs leave uneven

Apr 23, 2025 · After a year-long investigation into alleged dumping practices and unfair subsidies in the solar photovoltaic (PV) manufacturing industry, the

(PDF) The impact of green trade barriers on China''s photovoltaic

Oct 8, 2024 · In the context of the global push towards a green economy, this research investigates the impact of green trade barriers on the export trade volume of Chinese

Maximizing solar energy production in ASEAN region

Dec 1, 2023 · A systematic tabulation is presented, organizing the current and potential solar energy installations and outputs of ASEAN countries. The article explores the deployment of

Solar power in ASEAN: A snapshot and outlook of the solar

Jul 14, 2025 · In this article, PF Nexus recognises the top 10 solar developers in Asia who are driving the region''s energy transition. Asia aims to triple its renewable energy capacity by

6 FAQs about [ASEAN high-rise photovoltaic panel manufacturers]

Who is Asian solar?

Asian Solar is one of Southeast Asia’s leading Solar Energy Firms. We are involved in design and installation of solar systems, as well as distributing solar panels from manufacturers in Thailand, China, and throughout Asia. Learn more about what we do Asian Solar has experience with diverse types of clients and installation scales

Where is solar power available in ASEAN?

The current key markets for solar power are Vietnam, Malaysia, Thailand, the Philippines, and Indonesia, which also account for more than 87% of ASEAN’s population. The solar M&A scene is most active in Thailand and Vietnam – the countries with the highest installed capacities in the ASEAN region.

What is the biggest solar PV project in Southeast Asia?

Philippines The biggest operational solar PV project to date in Southeast Asia is the 132.5 MW Cadiz Solar Power Plant located in the province of Negros Occidental in the Philippines. The plant is owned by Helios Solar Energy Corporation and is being operated and maintained by Bouygues Construction.

Why is PV module manufacturing under pressure in Southeast Asia?

Despite strong ambitions, PV module manufacturing in Southeast Asian is currently under pressure. Operational capacities have been significantly reduced or temporarily halted, primarily due to U.S. import tariffs. Once a strategic workaround for Chinese manufacturers aiming to access Western markets, Southeast Asia now faces growing constraints.

What is the Southeast Asia Solar supply chain map?

This edition of the Southeast Asia Solar Supply Chain Map provides a detailed snapshot of current realities and future ambitions, as the region navigates complex trade, investment, and production challenges.

What's new in the 2025 Southeast Asia Solar supply chain map?

The first 2025 edition of the Southeast Asia Solar Supply Chain Map includes significant revisions and additions, driven by valuable market feedback and the region’s evolving geopolitical and industrial dynamics.

Learn More

- Papua New Guinea photovoltaic panel price manufacturers

- Solar polycrystalline silicon photovoltaic panel manufacturers

- Dhaka photovoltaic panel manufacturers

- Tunisia s best photovoltaic panel manufacturers

- Ouagadougou stock photovoltaic panel manufacturers

- High standard photovoltaic panel manufacturers

- African photovoltaic panel processing manufacturers

- Cuban rural photovoltaic panel manufacturers

- How many photovoltaic panel manufacturers are there in Boston

Industrial & Commercial Energy Storage Market Growth

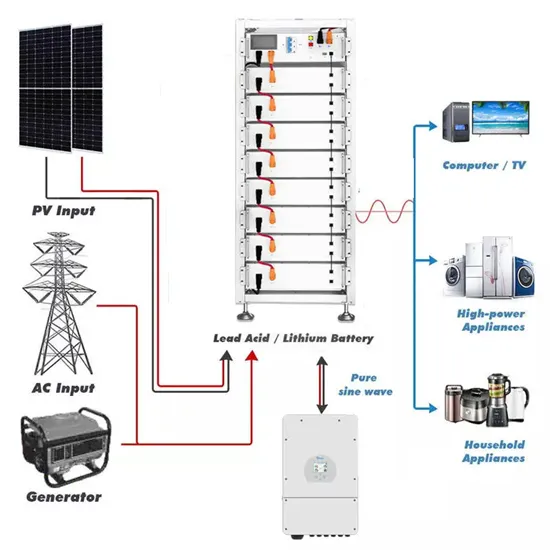

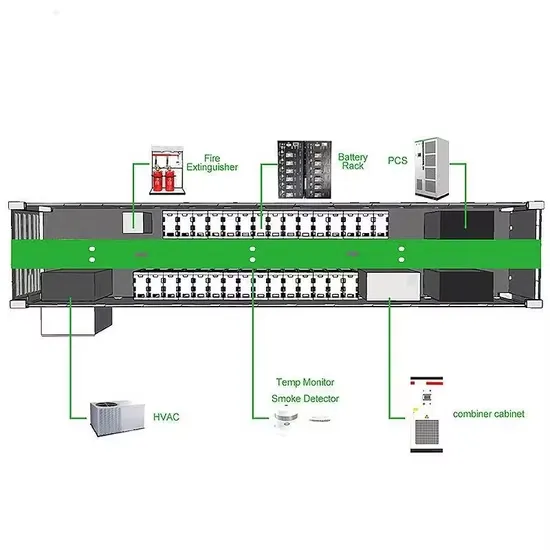

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.