Solar Photovoltaic Glass: Classification and

Jun 26, 2024 · Demand for solar photovoltaic glass has surged with the growing interest in green energy. This article explores ultra-thin, surface-coated, and

Global Photovoltaic Conductive Glass Industry Research

China Photovoltaic Conductive Glass market should grow from US$ million in 2023 to US$ million by 2030, with a CAGR of % for the period of 2024-2030. The United States Photovoltaic

Europe PV Glass (Solar Glass; Solar Photovoltaic Glass)

Aug 5, 2025 · PV Glass (Solar Glass; Solar Photovoltaic Glass) Market The PV Glass (Solar Glass; Solar Photovoltaic Glass) Market is experiencing robust growth, driven by the

Photovoltaic Conductive Glass Market Report | Global

Oct 16, 2024 · Regionally, Asia Pacific is anticipated to dominate the Photovoltaic Conductive Glass Market over the forecast period, owing to the rapid industrialization and urbanization in

Global and China Photovoltaic Glass Industry

Apr 26, 2022 · Global and China Photovoltaic Glass Industry Report, 2019-2025 highlights the following: PV glass industry (definition, classification, industry

Global Photovoltaic Conductive Glass Market Research

The Photovoltaic Conductive Glass market size, estimations, and forecasts are provided in terms of output/shipments (K Tons) and revenue ($ millions), considering 2024 as the base year,

Global Photovoltaic Conductive Glass Supply, Demand and

The European Commission released the Net-Zero Industry Act in 2023. This bill aims to stimulate local manufacturing in Europe, reduce import dependence on China, and ensure that at least

Global Photovoltaic Conductive Glass Market Research

Report Scope The Photovoltaic Conductive Glass market size, estimations, and forecasts are provided in terms of output/shipments (K Tons) and revenue ($ millions), considering 2023 as

Global Photovoltaic Conductive Glass Market 2024 by

According to our (Global Info Research) latest study, the global Photovoltaic Conductive Glass market size was valued at USD million in 2023 and is forecast to a readjusted size of USD

Photovoltaic Conductive Glass Market Size, Competitive

Photovoltaic Conductive Glass Market Key Takeaways Global Market Breakdown by Region (2023): In 2023, North America led the Photovoltaic Conductive Glass market with a 35%

Global Conductive Glass Substrate Market Research Report

Jun 18, 2025 · The global Conductive Glass Substrate market continues to demonstrate robust growth, with its valuation expected to reach US$ 1.8 billion in 2024. According to detailed

Photovoltaic Conductive Glass Market Report | Global

The global market size of the Photovoltaic Conductive Glass Market is projected to witness significant growth, rising from USD 3.5 billion in 2023 to an estimated USD 8.1 billion by 2032,

Photovoltaic Conductive Glass Market 2025: Key

May 29, 2025 · The Global Photovoltaic Conductive Glass Market Report 📊 is seeing strong growth 📈 because of better technology 💡 and more demand in

Global Photovoltaic Conductive Glass Market Research

The global market for Photovoltaic Conductive Glass was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during

Global Photovoltaic Conductive Glass Market Report, History

There are many coating materials and processes for transparent conductive oxides, which are continuously screened through scientific research, mainly including ITO coated glass, SnO2

Global Photovoltaic Conductive Glass Market 2023 by

According to our (Global Info Research) latest study, the global Photovoltaic Conductive Glass market size was valued at USD million in 2022 and is forecast to a readjusted size of USD

China-Europe Photovoltaic Glass Trends Trade Insights and

China currently produces over 75% of the world''s PV glass, while Europe leads in solar adoption targets – aiming for 45% renewable energy by 2030. This complementary relationship drives

Global Photovoltaic Conductive Glass Market 2023 by

This report profiles key players in the global Photovoltaic Conductive Glass market based on the following parameters - company overview, production, value, price, gross margin, product

Photovoltaic Conductive Glass Market Size, Competitive

Discover comprehensive analysis on the Photovoltaic Conductive Glass Market, expected to grow from USD 3.5 billion in 2024 to USD 10.2 billion by 2033 at a CAGR of 12.5%. Uncover critical

Global and China Photovoltaic Glass

May 21, 2019 · Abstract In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total.

Photovoltaic Conductive Glass Market | Size, Share, Price,

Photovoltaic Conductive Glass Market Size, Capacity, Demand & Supply 2024 The global Photovoltaic Conductive Glass market was valued at US$ million in 2023 and is projected to

Photovoltaic Conductive Glass 2025-2033 Market Analysis:

Mar 18, 2025 · The global photovoltaic (PV) conductive glass market is experiencing robust growth, driven by the increasing demand for solar energy and the continuous advancements in

2024年全球光伏级导电玻璃行业总体规模、主要企业国内外

Photovoltaic Conductive Glass Report 2024, Global Revenue, Key Companies Market Share & Rank 报告编码: qyr2401191125016 服务方式: 电子版或纸质版 电话咨询: +86-181 2742 1474 出

5 FAQs about [China-Europe Photovoltaic Conductive Glass]

Can a photovoltaic system be installed in a European location?

"If I want to install a photovoltaic system in a European location with average irradiation values, I have a great influence on its climate friendliness with the choice of my PV modules," explains Dr. Holger Neuhaus, Head of Department for Module Technology at Fraunhofer ISE.

Why do we need a PV production chain in Europe?

"Due to the significantly lower CO2 emissions during production and the further strong increase in demand for more climate-friendly PV modules worldwide, it is now a matter of establishing the PV production chain in Europe quickly and with a great deal of commitment," concludes Prof. Andreas Bett, Institute Director at Fraunhofer ISE.

Do glass-glass solar panels reduce emissions?

In the process, they also found that glass-glass modules enable an additional emissions reduction ranging between 7.5 to 12.5 percent compared to PV modules with backsheet films, regardless of their production location.

Are glass-glass PV modules a good choice?

Glass-glass PV modules (b) do not require an aluminum frame and therefore have a lower carbon footprint than PV modules with backsheet (a). Although photovoltaic modules convert sunlight into electricity without producing emissions, PV-generated solar energy does produce CO2 emissions during production, transport and at the end of module life.

Do silicon photovoltaic modules produce less CO2?

In a new study, researchers at the Fraunhofer ISE have calculated that silicon photovoltaic modules manufactured in the European Union produce 40 percent less CO2 than modules manufactured in China.

Learn More

- French photovoltaic conductive glass

- The difference between ito conductive glass and photovoltaic glass

- Maputo Photovoltaic Conductive Glass

- Photovoltaic glass solar power generation

- Huawei photovoltaic module ultra-hard glass

- Which company has photovoltaic glass in Comoros

- Photovoltaic glass curtain wall function

- Is photovoltaic power generation made of glass

- Solar photovoltaic transparent glass

Industrial & Commercial Energy Storage Market Growth

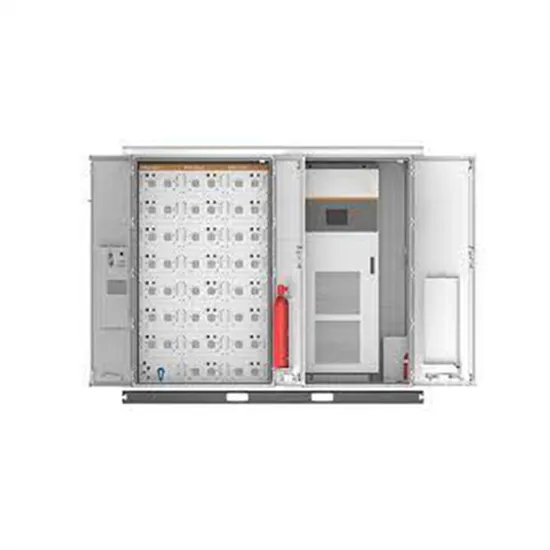

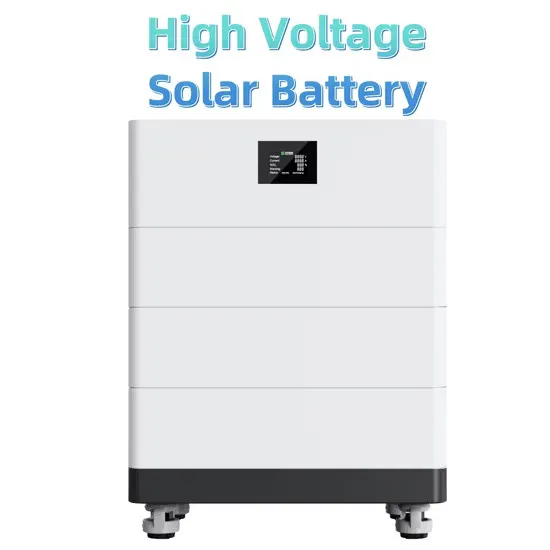

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.