Degradation of transparent conductive oxides: Interfacial

Dec 1, 2015 · Transparent conductive oxides (TCOs) are a known failure mode in a variety of thin film photovoltaic (PV) devices, through mechanisms such as resistiv

Global Photovoltaic Conductive Glass Market Growth 2023

LPI (LP Information)'' newest research report, the "Photovoltaic Conductive Glass Industry Forecast" looks at past sales and reviews total world Photovoltaic Conductive Glass sales in

Photovoltaic Conductive Glass Market, Report Size, Worth

Report Scope The Photovoltaic Conductive Glass market size, estimations, and forecasts are provided in terms of output/shipments (K Tons) and revenue ($ millions), considering 2023 as

Physical Properties and Applications of FTO Conductive Glass

In the photovoltaic field, FTO coated glass is widely used as a transparent conductive electrode in perovskite solar cells and CIGS thin-film cells. Its high light transmittance and low resistivity

Solar: end-of-life panels revalued in the glass industry

Oct 16, 2024 · For the head of the Isère start-up, glass from photovoltaic panels is nevertheless an interesting source of recycled glass. In France alone, it is estimated that around 250,000

Global Photovoltaic Conductive Glass Market Research

The Photovoltaic Conductive Glass market size, estimations, and forecasts are provided in terms of output/shipments (K Tons) and revenue ($ millions), considering 2024 as the base year,

France Photovoltaic Ultra Clear Embossed Glass Market 2025

Jun 20, 2025 · 📅 France Photovoltaic Ultra Clear Embossed Glass Forecasts (2026–2033) 🌍 France and Regional Market Size Projections 📈 Segment-wise Growth Rates (CAGR) 📉...

Photovoltaic Conductive Glass Market Size, Predictions:

Apr 27, 2024 · The photovoltaic conductive glass market is highly competitive with a number of key players vying for market share. These players are constantly engaging in research and

Transparent photovoltaic film: a solar innovation

Transparent photovoltaic film is an innovative technology that generatessolar energy while retaining the material''s transparency and lightness. This could lead to innovative applications

Global Photovoltaic Conductive Glass Supply, Demand and

The global Photovoltaic Conductive Glass market size is expected to reach $ million by 2030, rising at a market growth of % CAGR during the forecast period (2024-2030).

Photovoltaic Conductive Glass Market Size | Competitive

Aug 6, 2024 · 🌐 Photovoltaic Conductive Glass Market Research Report [2024-2031]: Size, Analysis, and Outlook Insights 🌐 Exciting opportunities are on the horizon for businesses and

France Solar Photovoltaic Glass Market (2024-2030) | Trends,

Market Forecast By Application (Residential, Non-Residential, Utility), By Type (AR Coated Solar PV Glass, Tempered Solar PV Glass, TCO Coated Solar PV Glass, Others), By End-User

Global Photovoltaic Conductive Glass Market 2023 by

Global Photovoltaic Conductive Glass market size and forecasts, by Type and by Application, in consumption value ($ Million), sales quantity (K Tons), and average selling prices (US$/Ton),

Global Photovoltaic Conductive Glass Market 2023 by

This report profiles key players in the global Photovoltaic Conductive Glass market based on the following parameters - company overview, production, value, price, gross margin, product

Global Photovoltaic Conductive Glass Market Report, History

There are many coating materials and processes for transparent conductive oxides, which are continuously screened through scientific research, mainly including ITO coated glass, SnO2

Global Photovoltaic Conductive Glass Market Research

The global market for Photovoltaic Conductive Glass was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during

Photovoltaic Conductive Glass 2025-2033 Market Analysis:

Mar 18, 2025 · The global photovoltaic (PV) conductive glass market is experiencing robust growth, driven by the increasing demand for solar energy and the continuous advancements in

Global Photovoltaic Conductive Glass Market 2023 by

According to our (Global Info Research) latest study, the global Photovoltaic Conductive Glass market size was valued at USD million in 2022 and is forecast to a readjusted size of USD

Global Photovoltaic Conductive Glass Industry Research

The global key manufacturers of Photovoltaic Conductive Glass include Yaohua Pilkington Glass Group (AGC), NSG, Xinyi Glass, Xiuqiang Glass, SYP Group, Solaronix, Daming, Nippon

Global Photovoltaic Conductive Glass Market Research

There are many coating materials and processes for transparent conductive oxides, which are continuously screened through scientific research, mainly including ITO coated glass, SnO2

Global Photovoltaic Conductive Glass Market Research

Report Scope The Photovoltaic Conductive Glass market size, estimations, and forecasts are provided in terms of output/shipments (K Tons) and revenue ($ millions), considering 2023 as

Worldwide Photovoltaic Conductive Glass Market Research

The photovoltaic conductive glass market is experiencing robust growth, driven by several key factors that are reshaping the solar energy landscape. One significant driver is the increasing

Photovoltaic Conductive Glass Market Size, Competitive

Discover comprehensive analysis on the Photovoltaic Conductive Glass Market, expected to grow from USD 3.5 billion in 2024 to USD 10.2 billion by 2033 at a CAGR of 12.5%. Uncover critical

Learn More

- The difference between ito conductive glass and photovoltaic glass

- Malaysia Photovoltaic Conductive Glass

- China-Europe Photovoltaic Conductive Glass

- External glass curtain wall photovoltaic power generation

- Photovoltaic power generation transparent glass

- Prague 300W photovoltaic glass price

- Huawei London Photovoltaic Glass

- 9BB high efficiency photovoltaic double glass module

- EU photovoltaic glass demand

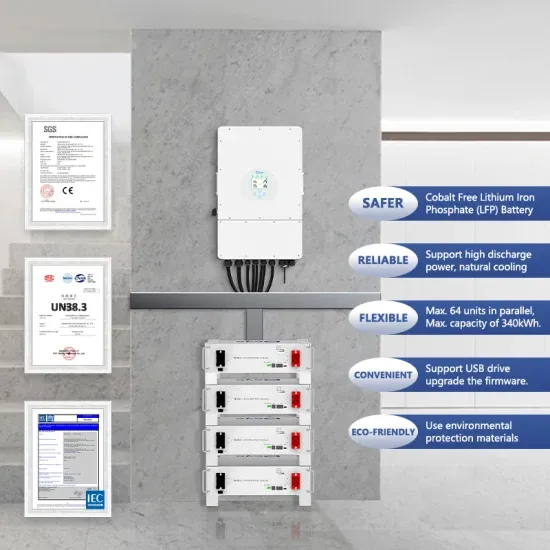

Industrial & Commercial Energy Storage Market Growth

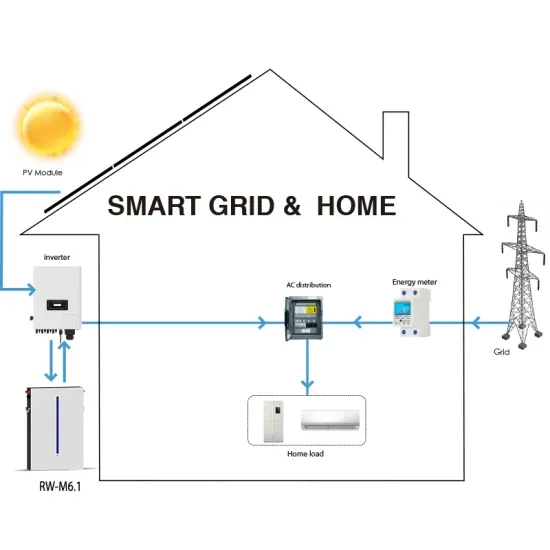

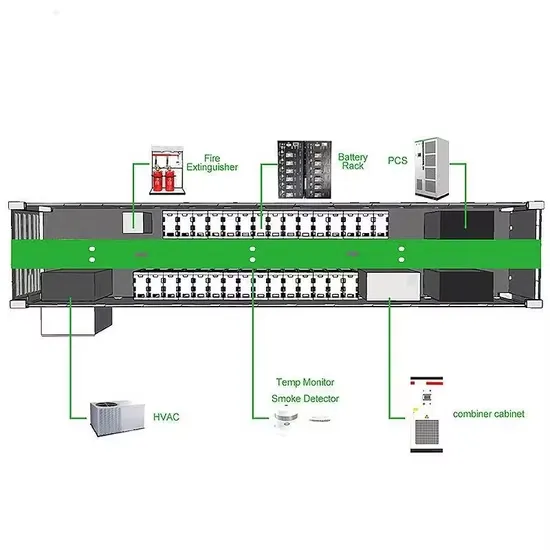

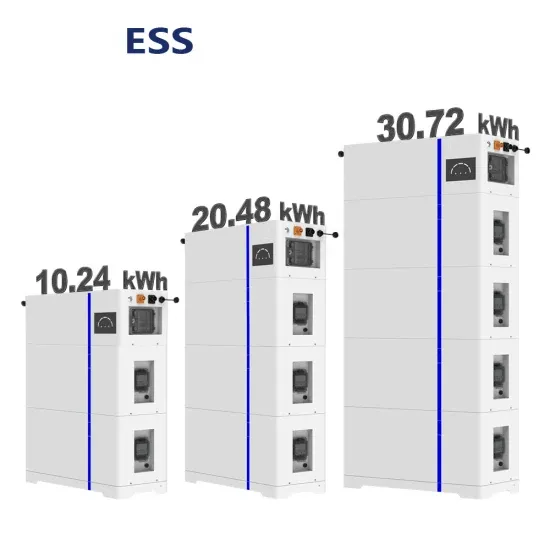

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.