MEA Advanced Battery Energy Storage System Market Size,

5 days ago · The Middle East and Africa Advanced Battery Energy Storage System Market is projected to grow from USD 249.46 million in 2023 to an estimated USD 471.80 million by

Battery Energy Storage Systems: A Key Driver for

Mar 8, 2025 · Functioning like large-scale batteries, BESS stores surplus power during periods of high generation and releases it when production dips. A

Can Battery Energy Storage Systems help power the future

Aug 15, 2025 · Mining across Africa: A strong history Mining plays a significant role in many African countries, with some nations showing potential that is not yet fully tapped. A snapshot

Closing the Loop on Energy Access in Africa

Mar 22, 2023 · Energy storage, particularly batteries, will be critical in supporting Africa''s progress to full energy access by 2030, enabling off-grid and on-grid electrification. This increasing

Middle East and Africa Battery Energy Storage System

The Middle East and Africa Battery Energy Storage System market was valued at USD 16.35 Billion in 2024 and is expected to reach USD 56.83 Billion by 2032, growing at a CAGR of

Leveraging Battery Energy Storage Systems (BESS) in shaping Africa

Jan 10, 2025 · Battery Energy Storage Systems (BESS) have emerged as a pivotal solution, storing excess solar energy generated during the day for use at night or during periods of high

East Africa Energy Cooperation Summit: Overview, Schedule,

Dec 9, 2024 · The East Africa Energy Cooperation Summit is a significant platform dedicated to driving energy development in the region through cross-border collaboration. With a clear

Middle East Energy | Press Release | Battery and

5 days ago · Middle East Energy, 2025 is making a transformative move to drive sustainable transport in the Middle East and Africa by introducing a dedicated

Energy Storage: The key to energy access in East Africa

Apr 6, 2020 · On the commercial and industrial front, Battery Energy Storage System (BESS) technologies have made headway, especially in both Front Of The Meter (FOTM) and Behind

Battery storage market and value chain assessment in South Africa

3 days ago · Customized Energy Solutions (CES) for the World Bank. It is analyzed that the South African battery storage market can be expected to grow from 270 MWh in 2020 to 9,700 .

Can Battery Energy Storage Systems Help Power the Future

Aug 18, 2025 · Mining remains a cornerstone of economic output across many Sub-Saharan African nations, often contributing a substantial share of Gross Domestic Product (GDP). As

Energy storage battery air transport in cairo

Overview of Energy Storage Technologies Besides Batteries This chapter provides an overview of energy storage technologies besides what is commonly referred to as batteries, namely,

Electrochemical energy conversion and Storage Systems: A

Mar 1, 2025 · The increasing demand for energy in Africa poses challenges in terms of sustainability, affordability, and accessibility. Although Africa is rich in renewable resources,

CAN ENERGY STORAGE AND CONVERSION TECHNOLOGIES

Can battery energy storage be used in off-grid applications? In off-grid applications, ES can be used to balance the generation and consumption, to prevent frequency and voltage deviations.

6 FAQs about [East Africa energy storage battery air transport]

Why is Africa a good place for battery production?

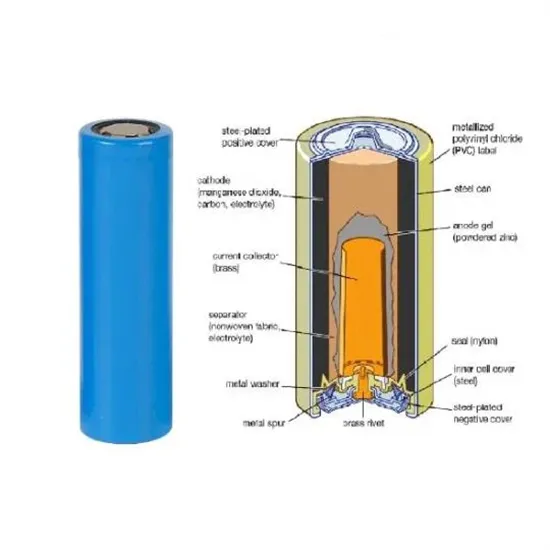

Each system can contribute uniquely to Africa's diverse energy storage needs. Africa's potential for local battery manufacturing is substantial due to its natural resource wealth and available labour force. The continent is rich in minerals such as lithium, cobalt, and graphite, essential components for battery production.

Why are lithium ion batteries popular in Africa?

Lithium-ion batteries are prevalent due to their high energy density and decreasing costs. Flow batteries offer longer discharge times suitable for larger-scale applications, while lead-acid batteries remain widely used due to their low cost and established technology. Each system can contribute uniquely to Africa's diverse energy storage needs.

What is a battery energy storage system?

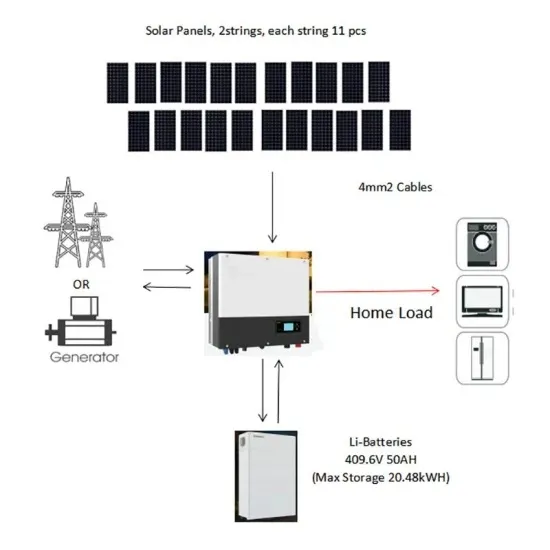

Battery Energy Storage Systems (BESS) have emerged as a pivotal solution, storing excess solar energy generated during the day for use at night or during periods of high demand. Storage batteries can also be integrated with existing grid power to stabilise use between peak and off-peak usage.

Why should African countries develop local supply chains for battery production?

The continent is rich in minerals such as lithium, cobalt, and graphite, essential components for battery production. By developing local supply chains for battery manufacturing, African countries can meet their energy storage needs while creating jobs and stimulating economic growth in related sectors.

Are energy storage boom times extending to Africa?

Boom times for energy storage have extended to the continent of Africa, with a 10-fold increase in installed storage supporting grids and renewable energy penetration.

Does Scatec have a solar-plus-storage site in South Africa?

Scatec’s Kenhardt solar-plus-storage site in South Africa (above), which went online at the end of 2023. Image: Scatec. Africa’s energy storage market has seen a boom since 2017, having risen from just 31MWh to 1,600MWh in 2024, according to trade body AFSIA Solar’s latest report.

Learn More

- How much does it cost to transport lithium battery energy storage cabinets by air

- Ecuador energy storage battery air transport power requirements

- East Africa Energy Storage Power Generation

- Where are the mobile energy storage sites in East Africa

- Energy storage low temperature lithium battery in Johannesburg South Africa

- Energy storage battery prices in the Middle East

- Which energy storage battery is best in East Timor

- East Asia aluminum acid energy storage battery brand

- East Africa Energy Storage Container Power Station Customization

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.