Top 10 Lithium Battery Manufacturers in South Africa

2 days ago · As one of the top 10 lithium battery manufacturers in South Africa, the company''s core market is stationary energy storage systems combined with solar photovoltaics, focusing

South Africa Top-5 Best-Selling Lithium Batteries

Jul 20, 2023 · Discover Redway''s top 5 best-selling lithium batteries in South Africa for 2024. These include the 1 2V 300Ah LiFePO4, 48V 200Ah Lithium,

LiFePO4 Batteries – Lithium Batteries South Africa

The Lithium Iron Phosphate (LiFePO4) battery, also known as LFP (lithium ferrophosphate), represents a breakthrough in energy storage technology. As a member of the lithium-ion

Challenges and Opportunities in South Africa''s

Oct 8, 2024 · Explore the challenges and opportunities in South Africa''s battery sector, with expert insights from IDC on energy solutions, industry growth, and

Freedom Won: Africa''s Largest Lithium Battery Manufacturer

We offer a wide range of leading lithium battery solutions to cover all your needs from our smallest 7Ah 12V gate motor batteries through to our largest 5MWh containerised expandable grid

Hubble Energy | Lithium Battery Solutions In South Africa

From energy storage to smart system design and monitoring, Hubble Energy is proud to provide fully integrated solutions for commercial, industrial, and agricultural operations — while

REGULATORY ASSESSMENT OF BATTERY

May 23, 2023 · EXECUTIVE SUMMARY South Africa is facing a deepening energy crisis. Households and businesses are facing rapidly escalating electricity costs, declining reliability

Sustainable energy storage for solar home systems in rural

Jan 1, 2019 · Photovoltaics (PV) are increasingly important for electrification in rural Sub-Saharan Africa, but what is the best battery technology to use? To explore this question, a small-scale

List of Lithium Battery Manufacturers in South Africa 2025

Jul 15, 2025 · To help, we''ve listed 10 lithium battery manufacturers or suppliers in South Africa. We hope this information helps you find the right solution. 2 How to Choose a Reliable Lithium

Lithium Batteries South Africa

Lithium Batteries South Africa (LBSA) is a leading manufacturer and supplier of high-performance lithium-ion energy storage solutions, engineered specifically for the South African market. We

South Africa''s Leading Lithium Battery Manufacturer

about us IG3N (Pty) Ltd is a manufacturing start-up that assembles LiFePO 4 batteries and is currently the "Premier player" [assembler] in the Lithium Iron storage market in South Africa.

Learn More

- Kitjia energy storage low temperature lithium battery

- Lithium energy storage power price in Johannesburg South Africa

- Huawei s distributed energy storage cabinet in Johannesburg South Africa

- 5 lithium battery packs in Johannesburg South Africa

- Majuro Energy Storage System Lithium Battery

- Which lithium iron phosphate battery energy storage container is better in Oslo

- Baghdad lithium battery energy storage cabinet customization

- Norway Energy Storage Lithium Battery Project

- Canberra lithium battery energy storage cabinet

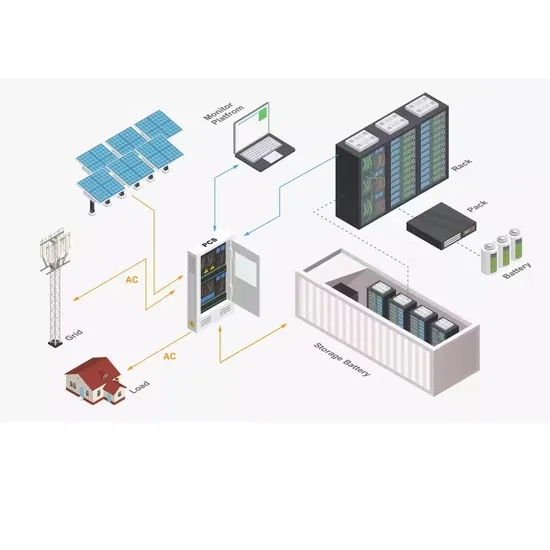

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.