West african energy storage grid-connected enterprises

South Africa''''s power utility Eskom has reiterated that the Interim Grid Capacity Allocation (IGCA) Rules are necessary, given the urgent need for the connection of new generation capacity to

An overview of the African energy sector: Now and the

Aug 20, 2024 · Introduction Energy & Utilities is pleased to present this 2-part report on the dynamic power sectors of Africa. It combines a useful overview of key sectors with close looks

East Africa: Regional Energy Outlook | SpringerLink

Apr 4, 2019 · Irrespective of energy resources endowment and RE potential, as of today all EA-7 countries (i.e. with the exception of South Africa) share a

Op-Ed: Energy storage is the key to energy access in East

Jan 20, 2025 · The Solar Africa Solar Outlook 2025 details that energy storage has become a critical complement to variable renewable energy (VRE)

Reviewing the Energy Security Challenges and Risks in the

Oct 11, 2024 · In efforts to achieve energy security and electrification targets by 2030 onwards, countries of the Eastern African Power Pool (EAPP) are expanding cross-border

Reviewing the Energy Security Challenges and Risks in the

Oct 11, 2024 · In efforts to achieve energy security and electrification targets by 2030 onwards, countries of the Eastern African Power Pool (EAPP) are expanding cross-border electricity

New Energy Opportunities and Investment Surge in African

Nov 11, 2024 · The Africa Energy Indaba is Africa''s premier energy conference dedicated to driving energy investment, trade, and innovation across the continent. Held annually, the event

Resilience of the Eastern African electricity sector to

Jan 17, 2019 · Hydropower generation in the Nile River Basin is vulnerable to climatic changes. Here, the authors assess infrastructure resilience of the Eastern African power pool (EAPP) to

The State of African Energy 2022

Feb 8, 2023 · Against this backdrop, the State of African Energy 2022 report assesses the energy value chain encompassing upstream, midstream and downstream investment needs,

Middle East and Africa Outlook Report 2022

Aug 20, 2024 · Power generation across the Middle East and North Africa (Mena) has doubled in the past 15 years, from around 842TWh in 2005 to 1,635TWh by 2020, according to data

Planning and prospects for renewable power Eastern and Southern Africa

This report, the fifth in the series Planning and prospects for the renewable power: Africa, assesses prospects for the power sector in countries from the two power pools through to

Africa''s growing energy storage capacity is key to energy self

Mar 18, 2025 · In 2025, South Africa leads the continent in terms of battery storage capacity as it sees the second year of its Battery Energy Storage Independent Power Producer Procurement

Middle East Energy | Market Outlook Report 2024

6 days ago · The " Middle East and North Africa 2024 Energy Industry Outlook " powered by Middle East Energy, offers a comprehensive analysis of the energy landscape in one of the

Six solar battery projects paving the way in Africa

Jan 31, 2024 · The demand for battery energy storage is experiencing a significant increase, driven in large part by the growing demand for solar energy and the ever-increasing need for

Energy Storage: The key to energy access in East Africa

Apr 6, 2020 · Pumped hydro dams are prominently used as energy storage in East Africa, but that is changing with the increase in renewable energy and battery energy storage systems. The

6 FAQs about [East Africa Energy Storage Power Generation]

What is the future of energy storage in South Africa?

This is according to a new report by the World Bank which says that over the next five years SA is expected to show rapid growth in energy storage demand. The rise in demand will come from the transformation of the energy system to include more renewables and developing demand in the electric vehicle (EV) sector...

What are the most popular solar-plus-storage developments in Africa?

As noted by AFSIA Solar, one of the most notable solar-plus-storage developments in Africa is Norway-based independent power producer (IPP) Scatec’s 225MW/1,140MWh Kenhardt project in South Africa. The site started operation in late 2023 (pictured above).

Does Scatec have a solar-plus-storage site in South Africa?

Scatec’s Kenhardt solar-plus-storage site in South Africa (above), which went online at the end of 2023. Image: Scatec. Africa’s energy storage market has seen a boom since 2017, having risen from just 31MWh to 1,600MWh in 2024, according to trade body AFSIA Solar’s latest report.

Is solar PV a focal energy resource for Africa?

Solar PV, which, as reported by our colleagues at PV Tech in their write-up of the AFSIA report, reached 19.2GW in 2024, increasing by 2.5GW on 2023 levels, is becoming the focal energy generation resource for Africa.

How has energy storage changed in 2022?

This has resulted in an increase in energy storage levels in recent years. In 2022, the continent had around 50MWh of energy storage capacity installed. Since then, energy storage capacity tripled in 2023 and then experienced another 10-fold increase in 2024. Image: AFSIA Solar.

Will Africa's development pipeline slow down?

Image: AFSIA Solar. According to AFSIA Solar, this upward trajectory is not expected to slow down in the near future either. The trade body has identified a development pipeline exceeding 18GWh across Africa.

Learn More

- East Africa wind and solar energy storage power generation

- East Africa Photovoltaic Energy Storage Power Generation Project

- East Africa Energy Storage Container Power Station Customization

- East Africa Energy Storage Power Project

- China-Europe Energy Storage Power Generation Project

- Photovoltaic power generation to energy storage cabinet

- Paramaribo Photovoltaic Energy Storage Power Generation Project

- Cadmium telluride power generation glass energy storage

- Africa Energy Storage Power Direct Sales

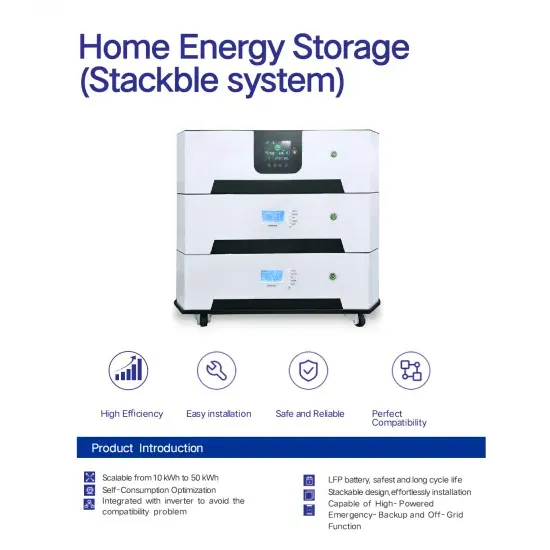

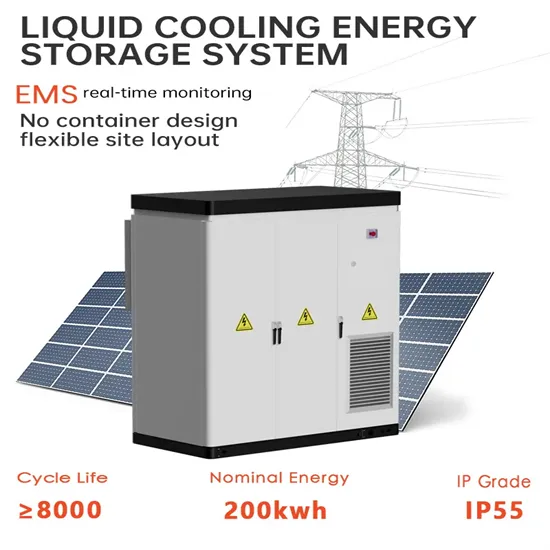

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

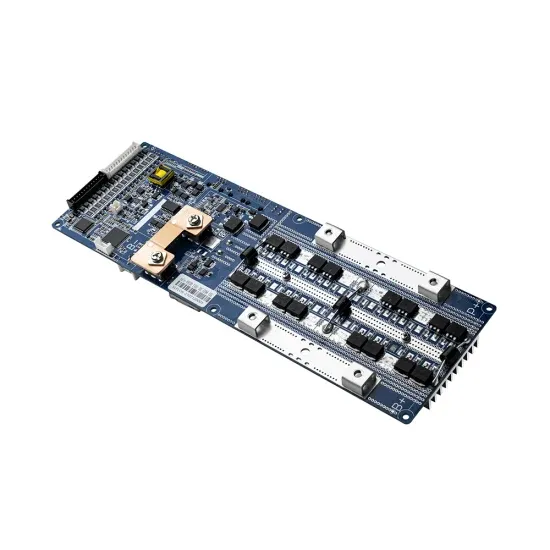

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.