A Three-Phase Grid-Connected Micro-Inverter for AC

Nov 16, 2017 · Because of these advantages, the PV micro-inverters have attracted an increasing attention and became competitive alternatives to the centralized and string inverters for PV

Micro inverters vs. String inverters : Which Is

Jun 28, 2024 · Solar String Inverters (String Inverter) and Micro Inverters (Micro Inverter) are two common inverter types used in solar PV systems, which are

Types of solar inverters: microinverters vs string

4 days ago · As we mentioned in the previous section, solar panels need inverters to convert sunlight into usable electricity (DC to AC). There are two common

What is the Solar Central Inverter? | inverter

Mar 26, 2020 · All DC terminals from solar panels will be gathered in combiner box input and the output will go to the central solar inverter, so its one inverter

Comparing Central vs String Inverters for Utility

May 14, 2024 · There are three primary tiers of PV inverters: microinverters, string inverters, and central inverters. Since microinverters are not rated for utility

Solar panel micro Inverters: Everything you need

Apr 22, 2024 · While they''re connected to each solar panel like a micro inverter, they don''t convert DC to AC. Instead, they "optimize" the DC power before

Types, advantages and disadvantages of

Sep 18, 2023 · Disadvantages of microinverters: 1. The unit cost of the system is obviously much higher than that of centralized inverters and string inverters. 2.

Microinverters vs String Inverters

Oct 12, 2024 · Micro-Inverter: Each solar panel is equipped with its own micro-inverter, allowing for flexible installation and adaptation to different environments. Traditional String Inverter:

Microinverters vs. String Inverters

Jun 26, 2025 · String Inverters: Centralized Power Conversion String inverters, also known as central inverters, connect multiple solar panels in a series (or "string") to a single inverter,

Microinverters vs. string inverters: Which is right

Aug 26, 2024 · There are a few different types of solar inverters: String inverters, microinverters, and optimized string inverters (power optimizers + string

Difference between String Inverter and Micro

Jun 18, 2022 · String inverters belong to the category of "centralized" inverters, which means they are installed separately from solar photovoltaic arrays. All

Microinverters vs String Inverters

Oct 12, 2024 · Micro-Inverter: A small inverter typically installed on the back of each solar panel, converting direct current (DC) to alternating current (AC) at the panel level, suitable for

Central Inverter vs String Inverter: What''s the Best?

Nov 17, 2023 · In this blog, I have given a detailed study of the central inverter vs string inverter and it is true that the higher MPPT density of the string inverters

6 FAQs about [Micro inverter centralized string]

What is a microinverter & a string inverter?

Microinverters and other module-level power electronics can be found on residential rooftops as well as commercial systems. Central inverters are installed in large commercial and utility-scale systems. String inverters are designed for all system sizes. Central inverters are large — in the 1-5 MW range per unit.

Are string inverters better than microinverters?

String inverters have the benefit of being a short-term cheaper solution due to the less equipment requirement as compared to microinverters. Microinverters are costly in comparison to string inverters. Generally, string inverters have a warranty period between 8 to12 years, whereas microinverters have a warranty of up to 25-years.

Should I expand my solar system with microinverters?

Expanding a solar system with microinverters is significantly easier and more convenient compared to a traditional string inverter system. With microinverters, there’s no need to upsize or replace a centralized string inverter when increasing your system’s capacity.

Are central inverters better than string inverter?

Fewer equipment areas: Developers will inherently need fewer central inverters than string inverters for the same overall project capacity, leaving more space for the PV array and less for inverters and balance of system components. Lower perceived risk: Central inverters are more mature than string inverters.

How do microinverters work?

Installed on the back of each panel, they do the DC to AC conversion right at the panel, and then send the AC to your main electrical panel to distribute to your house. Unlike string inverters, microinverters operate independently of one another.

What is a central inverter?

The inputs to central inverters are most often combined dc circuits from many (or all) strings in the array that feed a small number of integrated MPPTs. The likelihood of encountering a central inverter on a project increases with project size and age. Utility-scale projects above ~10 MW are the most common application today.

Learn More

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

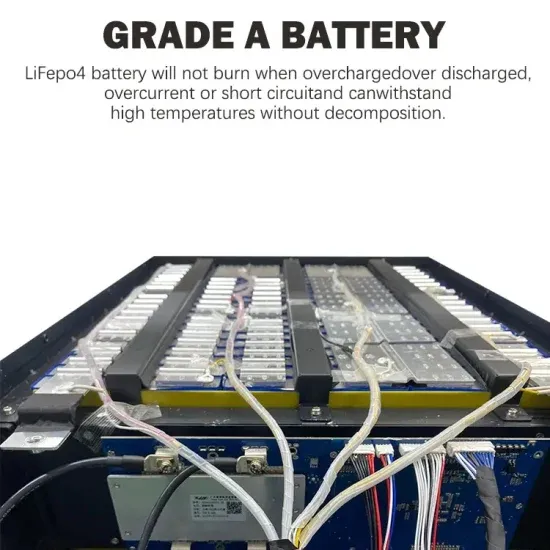

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.