Rising Demand in Micro Inverter Commercial Sector | SabayLok

The commercial micro inverter market is growing rapidly due to rising solar energy adoption, the shift toward decentralized energy systems, and increasing demand for efficient power

Commercial solar inverters for sale

Nov 4, 2024 · Choose commercial solar inverters that suit your needs. Grid-tie, Off-grid inverters from top-selling brands like SolarEdge, SMA America, Fronius - A1 SolarStore

Commercial Single Phase Micro Inverter Market

6 days ago · Commercial single phase micro inverters are increasingly deployed in distributed solar power systems where independent module control improves total energy yield. They

Commercial Micro Inverters Market

May 4, 2025 · The U.S. Department of Energy''s Grid Modernization Initiative allocated $3.5 billion for advanced inverters, with commercial microinverter shipments increasing 27% in program

Commercial Single Phase Micro Inverters

Aug 15, 2025 · Designed to convert DC power from individual solar panels into AC power for commercial energy use, single phase micro inverters eliminate the risk of power loss due to

Micro Inverter Market Size & Share | Industry Report, 2030

Micro Inverter Market Size, Share & Trends Analysis Report By Type (Single-Phase, Three-Phase), By Application (Residential, Commercial), By Region (North America, Europe, Asia

Commercial Micro Inverters Market Size, Future Growth and

The global commercial micro inverters market is projected to reach a valuation of USD 3.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 15.2% from 2025 to 2033.

Global Commercial Micro Inverter Market Size and Forecasts

Apr 25, 2025 · Commercial Micro Inverter Market Market Overview The Commercial Micro Inverter market represents a critical aspect within the broader industry, facilitating a wide array

Commercial Micro Inverters Market Size, Future Growth and

The global commercial micro inverters market is projected to reach a valuation of USD 3.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 15.2% from 2025 to 2033. This

Commercial Micro Inverter Market Size, Share & Growth

Aug 14, 2025 · Micro inverters enable module-level conversion, improving system performance in shaded or partially obstructed installations. It supports flexible system design and allows for

Global Commercial Micro Inverter Market Size and Forecasts

Apr 25, 2025 · By 2030, the Commercial Micro Inverter market will be a cornerstone of global infrastructure, shaping the future of logistics, manufacturing, and urban development.

Enphase Energy Systems for commercial solar | Enphase

2 days ago · IQ9N-3P Microinverter The IQ9N-3P Microinverter takes commercial solar further, with native support for 480 VAC three-phase systems and the same trusted 25-year limited

Commercial Three Phase Micro Inverters

Aug 15, 2025 · With continued advancements in inverter technology, increasing regulatory support for solar adoption, and growing investments in renewable energy infrastructure, the

Commercial On-Grid Micro Inverters

Aug 15, 2025 · What''s Fueling the Growth of the Commercial On-Grid Micro Inverter Market? Identifying Key Expansion Drivers The growth in the commercial on-grid micro inverter market

Commercial Single Phase Micro Inverters

Aug 15, 2025 · The growing adoption of solar energy in commercial spaces has significantly increased the demand for single phase micro inverters, which provide enhanced energy

Micro Inverter in Commercial Solar Projects – Volt Coffer

Nov 13, 2024 · Micro inverter play a pivotal role in enhancing the performance, reliability, and scalability of commercial solar projects. Their ability to maximize energy harvest, improve

6 FAQs about [Commercial Micro Inverter]

What is the global micro inverter market size?

The global micro inverter market size was estimated at USD 4.67 billion in 2024 and is projected to reach USD 17.34 billion by 2030, at a CAGR of 24.58% from 2025 to 2030. The market is experiencing steady growth, driven by the rising adoption of rooftop solar systems and the increasing emphasis on maximizing energy efficiency.

Who are the leading companies in the micro inverter market?

Some key players operating in the market are Enphase, Darfon Electronics Corporation, Deye Inverter, Sparq Systems, Fimer Group, Solis Solar, Tata Power Solar, and others. The following are the leading companies in the micro inverter market. These companies collectively hold the largest market share and dictate industry trends.

Why is the micro inverter market growing?

The market is experiencing steady growth, driven by the rising adoption of rooftop solar systems and the increasing emphasis on maximizing energy efficiency. North America held the largest revenue share of 37.74% in the global micro inverter market. The micro inverter market in the U.S. is experiencing strong momentum.

How big is the 2025 micro inverter market?

At USD 4.17 billion, the 2025 micro inverter market size skews heavily toward this configuration. However, three-phase designs are forecast to expand at 19.1% CAGR, outpacing overall sector growth as CandI rooftops seek module-level monitoring to maximize limited real estate.

What is a micro inverter?

Micro inverters provide individual MPPT, unlocking the full bifacial yield profile and preventing one shaded panel from curtailing an entire string. Leading vendors now market 600 W micro inverters with 97% CEC-weighted efficiency, ensuring conversion losses stay below the incremental energy gain.

What is the market share of micro inverters in 2024?

By phase configuration, single-phase systems led with 72% of micro inverter market share in 2024, whereas three-phase platforms are projected to register the fastest 19.1% CAGR through 2030. By communication technology, wired solutions held 91% revenue share in 2024; wireless platforms are poised for a 20.4% CAGR to 2030.

Learn More

- Micro Small Inverter

- Magadan Micro Inverter Brand

- Micro photovoltaic inverter auxiliary power supply

- Ngerulmud Micro Grid-connected Inverter

- Micro inverter 1 5kw

- Does a commercial 500kwh energy storage cabinet need an inverter

- Syrian photovoltaic micro inverter manufacturers

- Lusaka Industrial and Commercial Photovoltaic Inverter

- Grid-connected micro inverter supplier

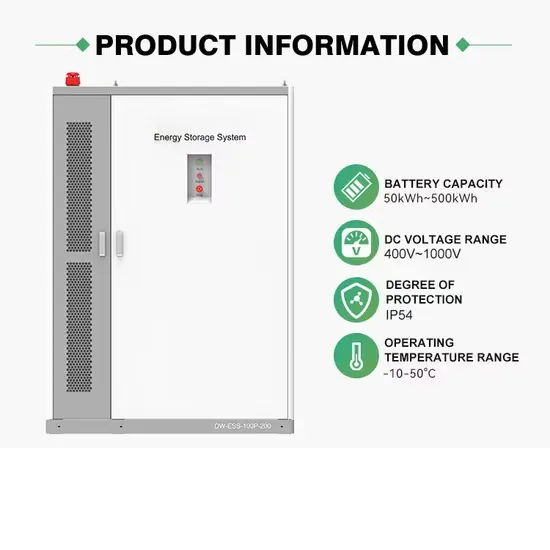

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.