Lithium for All | Huawei Digital Power

Lithium for All Simple Intelligent Efficient Safe Scenarios Lead-Acid Battery to Lithium Battery An energy storage system with higher energy density is needed in the 5G era. Intelligent lithium

Battery for Communication Base Stations Growth

May 13, 2025 · The market is segmented by battery type (lead-acid, lithium-ion, and others), with lithium-ion batteries dominating due to their superior performance characteristics. Application

Lithium Storage Base Station Batteries | HuiJue Group E-Site

As 5G deployment accelerates, over 60% of operational costs for mobile operators now stem from powering remote base stations. Yet conventional lead-acid solutions barely achieve 70%

Why Lithium Batteries for Base Stations? | HuiJue Group E-Site

Crumbling Infrastructure Meets Modern Demands Traditional lead-acid batteries—still powering 68% of global base stations—struggle with three critical flaws. First, their 500-800 cycle

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In the future, especially after the 5G upgrade, lithium battery companies will no longer simply focus on communication base stations, but on how the communication network

Strategic Vision for Battery for Communication Base Stations

Apr 26, 2025 · The global market for batteries in communication base stations is experiencing robust growth, driven by the expanding 5G network infrastructure and increasing demand for

Nobel prize honors lithium batteries, and Huawei is prepared

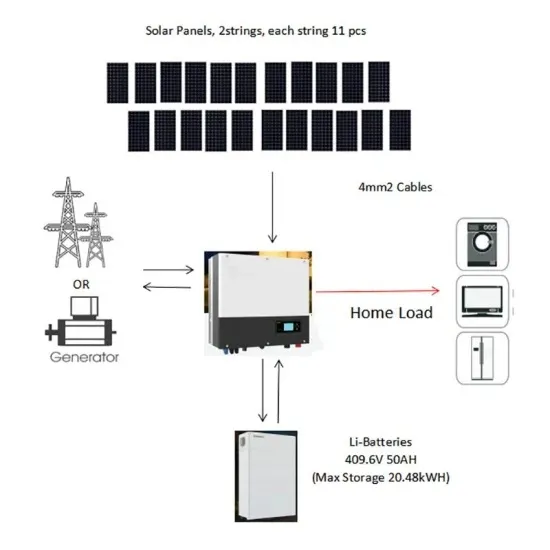

Replacing lead-acid batteries with energy storage lithium batteries for household solar energy, uninterrupted backup power supply, communication, base stations, etc

Lithium Storage Base Station Batteries | HuiJue Group E-Site

Why Traditional Telecom Infrastructure Is Failing the Energy Transition Can lithium storage base station batteries solve the $15 billion annual energy waste in global telecom networks? As 5G

Battery for Communication Base Stations Market

Renewable Energy Integration Pressures Solar-powered base stations require advanced batteries to manage intermittent supply. Vodafone''s Turkish network uses lithium batteries with 95%

With The Advent Of The 5G Era The Competition For Lithium Batteries

Jul 15, 2025 · In addition to lead-acid giants focusing on the lithium battery market, communication equipment suppliers such as ZTE and Huawei also covet this "baby market."

Battery for Communication Base Stations Market

The Battery for Communication Base Stations market can be segmented by battery type, including lithium-ion, lead acid, nickel cadmium, and others. Among these, lithium-ion batteries

Battery for Communication Base Stations Market | Size

One of the key trends shaping the communication base station battery market is the shift towards lithium-ion batteries from traditional lead-acid batteries. Lithium-ion batteries offer higher

Battery for Communication Base Stations Market''s

Apr 23, 2025 · The global market for batteries in communication base stations is experiencing robust growth, projected to reach $1692 million in 2025 and maintain a Compound Annual

Ranking of companies using batteries for communication base stations

In the past, the backup power storage of communication base stations was mainly lead-acid batteries, but lead-acid battery products polluted the environment, and were bulky and low in

Communication Base Station Battery Disposal | HuiJue Group

The Silent Crisis in 5G Expansion As global 5G infrastructure grows by 19% annually, communication base station battery disposal emerges as a critical yet overlooked challenge.

Lithium Battery Application in Data Centers White Paper

In 2009, Huawei began large-scale use of lithium batteries in communications base stations. Since 2016, the electric vehicle market, which uses lithium batteries, has been growing

3 FAQs about [Huawei makes lead-acid batteries for communication base stations]

What is Huawei boostli battery?

Smart uses Huawei's BoostLi intelligent telecom lithium battery – as a replacement to traditional lead-acid batteries. With a proposition of being "Simple", "Intelligent" and "Green", BoostLi helps Smart mitigate power shortage challenges . 2.1 Reliable Power Backup

What is Huawei boostli?

Figure 1: Rooftop Site A with Lead-acid Batteries 2. Solution and Benefits Smart uses Huawei's BoostLi intelligent telecom lithium battery – as a replacement to traditional lead-acid batteries. With a proposition of being "Simple", "Intelligent" and "Green", BoostLi helps Smart mitigate power shortage challenges .

Are boostli batteries better than lead-acid batteries?

BoostLi batteries have better adaptability to poor power grid situations by maintaining better SOH and backup time compared to lead-acid batteries. The solution significantly improves network availability.

Learn More

- Do lead-acid batteries for communication base stations need to be publicized

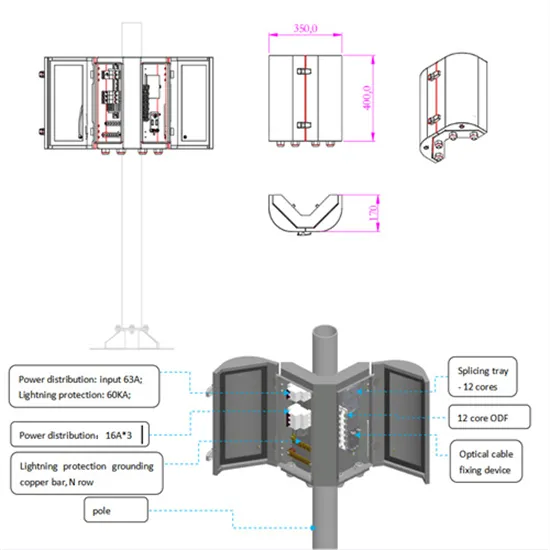

- Lead-acid batteries and optical fibers for communication base stations

- Manufacturing lead-acid batteries for communication base stations

- Why does Huawei want to build supercapacitors for communication base stations

- How often should the batteries of communication base stations be maintained

- Replacement of batteries for communication base stations

- What types of batteries are there for communication base stations

- What are the manufacturers of lithium-ion batteries for Berlin communication base stations

- Old-style energy storage batteries for communication base stations

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.