China home to 4.25 million 5G base stations

Jan 22, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday. More than

A Compact Dual Broadband Shared-Aperture Antenna Array for 5G Base

Dec 17, 2022 · A compact dual broadband dual-polarized shared-aperture antenna array is proposed for base station applications. The shared-aperture antenna array consists of a dipole

A super base station based centralized network architecture for 5G

Apr 1, 2015 · In future 5G mobile communication systems, a number of promising techniques have been proposed to support a three orders of magnitude higher network load compared to what

5G Base Station Chips: Driving Future Connectivity by 2025

Nov 27, 2024 · As 5G networks become the backbone of modern communication, 5G base station chips are emerging as a cornerstone of this transformation. With projections showing

5G Network Evolution and Dual-mode 5G Base Station

Dec 14, 2020 · The fifth generation (5G) networks can provide lower latency, higher capacity and will be commercialized on a large scale worldwide. In order to efficiently dep

Key technologies for 5G co-construction and shared base station

Oct 22, 2021 · 5G network consumes huge investment cost, including 5G network construction, 5G network operation and maintenance etc. Therefore, China Unicom and China Telecom

A Low-Profile Triple-Band Shared-Aperture Antenna Array for 5G Base

Dec 29, 2021 · In this article, a triple-band shared-aperture dual-polarized antenna array is proposed for fifth generation (5G) base station applications. The shared-aperture

5G RAN Architecture: Nodes and Components

Jan 24, 2023 · Discover 5G RAN and vRAN architecture, its nodes & components, and how they work together to revolutionize high-speed, low-latency wireless communication.

Ambitious 5G base station plan for 2025

Dec 28, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

Which RF Technologies Are Shaping 5G Base Stations?

Apr 24, 2025 · 5G base stations are the backbone of the 5G network, transmitting and receiving radio signals across various frequency bands to provide connectivity to mobile devices.

China has more than 3.8 million 5G base stations

Jun 28, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

A Novel Sub-6 GHz and Millimeter Wave Shared

Sep 23, 2023 · Index Terms—base station antenna, 5G antenna, shared-aperture, dual-band antenna. I. INTRODUCTION The development of the 5G era poses enormous challenges to

5G NR Base Stations Classes

Dec 28, 2023 · 5G New Radio (NR) defines various classes of base stations to cater to different deployment scenarios and requirements. These classes enable operators to optimize their

6 FAQs about [Are 5G base station communications shared ]

What is a 5G base station?

In Summary, The 5g Base Station is a Critical Element of the 5g Wireless Network, Serving As the Between User Devices and the Core Network. IT Incorporate Advanced Technologies Like Massive Mimo, BeamForming, and Adaptive Modulation to Provide High-Performance, Low-Latency, and Reliable Communication Services Across various uses.

What is 5G network sharing?

Through 5G Network Sharing, operators make annual savings and are reducing greenhouse gas emissions by millions of tons per year. Network sharing is also providing users with ubiquitous connectivity and high-quality services.

What is the automatic data configuration model of 5G co-construction and shared base stations?

This paper focuses on the automatic data configuration model of 5G co-construction and shared base stations. By interacting with the core network and wireless network, this model can identify and match different 5G network modes such as SA and NSA (including dual-anchor scenarios and single-anchor scenarios).

What are the advantages of a 5G base station?

Massive MIMO: The use of a large number of antennas allows the base station to serve multiple users simultaneously by forming multiple beams and spatially multiplexing signals. Modulation Techniques: 5G base stations support advanced modulation schemes, such as 256-QAM (Quadrature Amplitude Modulation), to achieve higher data rates.

Does 5G support indirect network sharing?

The 5G System may support Indirect Network Sharing deployment between the hosting operator (i.e. shared network operator) and participating operator, in which the RAN is shared.

What frequency bands do 5G base stations use?

Utilization of Frequency Spectrum: 5g Base Stations Operate in specific Frequency Bands Allocated for 5G Communication. These bands include Sub-6 GHz Frequencies for Broader Coverage and Millimeter-Wave (Mmwave) Frequencies for Higher Data Rates.

Learn More

- Bandar Seri Begawan Communications upgrades 5g base station

- Somaliland Communications 5g base station universal

- Avaru Communications earliest 5g base station deployment

- Cairo Communications 5g base station bidding

- Yemen Communications Company 5G Base Station Bidding

- Communications 5g base station construction in the third quarter

- Beirut Communications 5G Base Station Efficiency

- Mali Communications sets up 5g base station

- Vaduz Communications Civilian 5G Base Station Installation Progress

Industrial & Commercial Energy Storage Market Growth

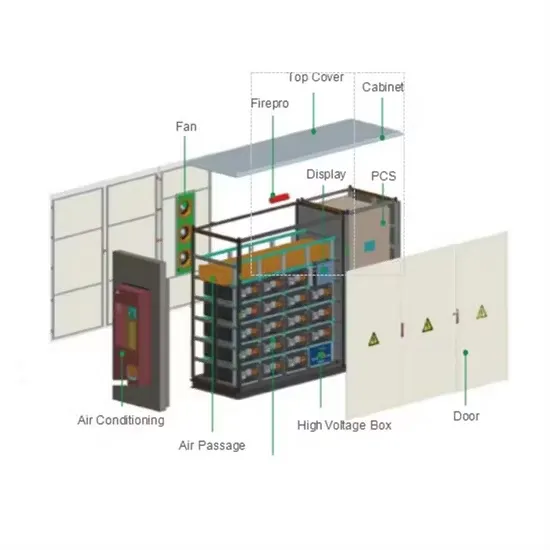

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.